Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 15, 2024

Global corporate clean energy procurement surpasses 50 GW mark again in 2023, setting new record in number of deals

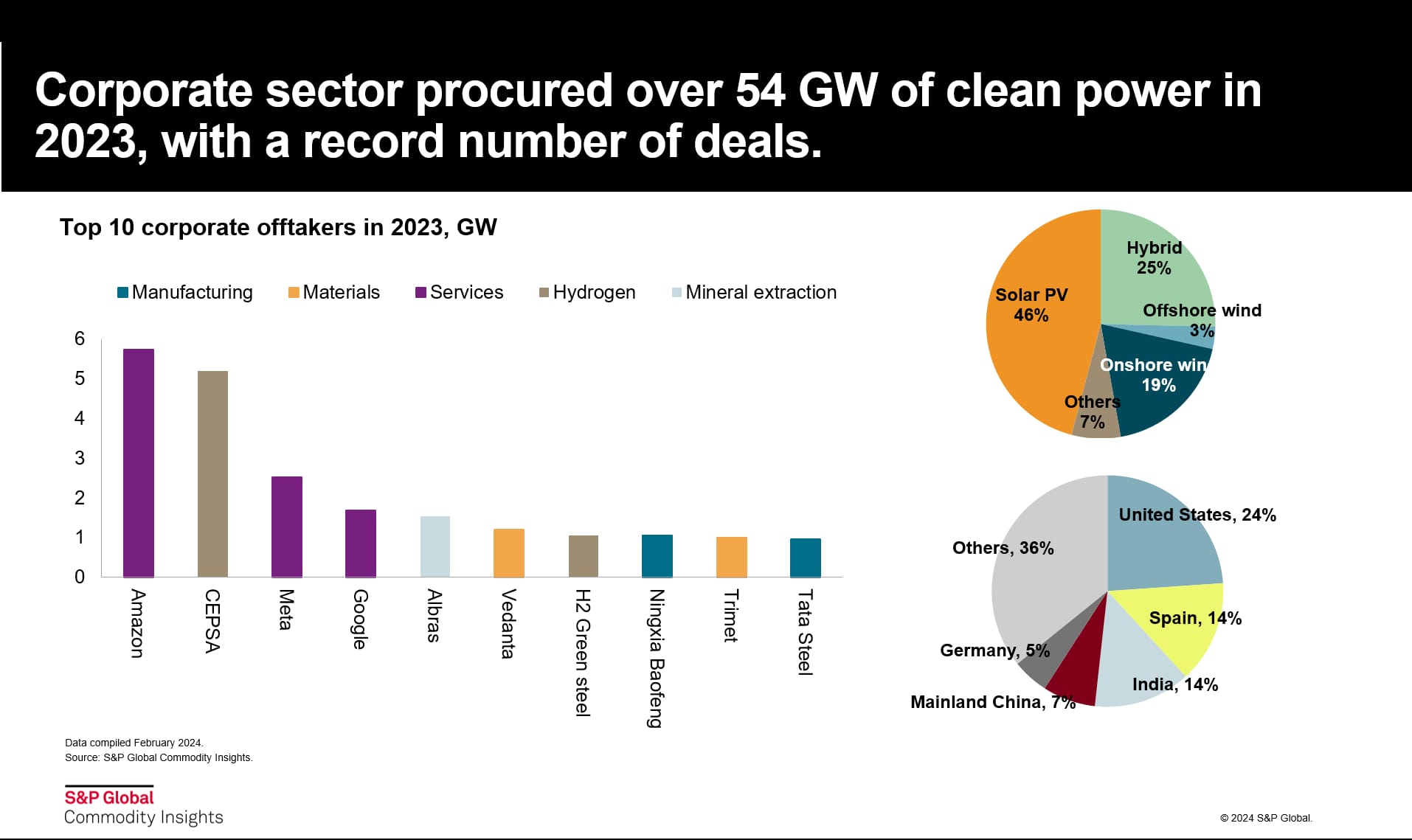

The corporate clean energy procurement (CEP) landscape experienced both triumphs and challenges in 2023 with 55 GW of capacity contracted. A record 2,000 deals were registered, despite a 4% contracting capacity decrease.

Europe is the engine for corporate procurement growth in 2023. Moderating prices for Power Purchase Agreements (PPAs) and strengthened corporate commitments led European corporate procurement markets to grow by 52% and reach an unprecedented 20 GW, making Europe the largest market globally. Spain maintained its position as the principal European PPA market, with rapid growth in Germany and France.

Over the last two years, Asia-Pacific has also emerged as a central location for procurement, establishing itself as the market with the highest number of deals. In 2023, about 80% of CEP deals were contracted in Asia-Pacific. The progress in Asia is driven by policy and market reforms in key markets to allow corporate clean energy procurement.

In 2023, North American markets declined by near 20%, owing to high interest rates, high capital costs and project delays. The procurement market saw the first sign of recovering with a strong uptick in the last quarter of 2023. Looking ahead, easing interest rate prospects, and increasing corporate demand to decarbonize will drive contracting forward.

The hydrogen sector has emerged as the third largest offtake sector in 2023, contracting more than 7 GW in capacity. Most hydrogen associated CEP deals were announced in Europe, owing to the European Union's requirement on renewable hydrogen production. The dominant force in North America is still the services sector, led by the technology giants. Meanwhile, the manufacturing sector comprised over 40% of the Asia-Pacific market.

The United States, Spain, India, and mainland China are the four largest markets for CEP deals in 2023,each surpassing4 GW of contracting volume. They collectively constituted about 60% of the total announcements last year. A remarkable 13 countries achieved the annual 1 GW procurement mark, spanning every global macro region and accounting for over 87% of the total contracted capacity.

S&P Global is tracking more than 70 markets for renewable procurement by more than 2,500 corporations globally. Among the Top 10 corporate offtakers, only three remained the same as last year: Amazon, Meta, and Google. Amazon has been the largest offtaker of renewable energy since 2020, announcing contracts across multiple global geographies. The new leaders in the Top 10 came from a more diversified range of sectors including materials and mineral extraction.

There are key regulatory reforms in several emerging markets. Among these reforms are:

- India revised its renewable purchase obligation (RPO) targets, The target applies to designated consumers including open access commercial and industrial consumers.

- China expanded the coverage of Green Electricity Certificates (GEC) to all types of renewable energy. This GEC coverage update is set to boost tradable GEC issuance.

- South Korea implemented revised guidelines on third-party PPA contract by lowering the barrier for eligible consumers and allowing excess power trading.

- Vietnam is planning for a direct PPA mechanism, granting large electricity consumers the authority to directly purchase power from generators.

- Israel passed a new regulation to allow bilateral power contracts between independent power producers (IPPs) and private customers.

S&P Global Commodity Insights publishes a quarterly report on global corporate clean energy procurement. Read the full report here, Global Corporate Clean Energy Market Briefing - March 2024. For non-clients, to find out more information on our Clean Energy Procurement coverage and the reports like this one featured in this post, please click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-corporate-clean-energy-procurement-surpasses-50-gw-mark.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-corporate-clean-energy-procurement-surpasses-50-gw-mark.html&text=Global+corporate+clean+energy+procurement+surpasses+50+GW+mark+again+in+2023%2c+setting+new+record+in+number+of+deals+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-corporate-clean-energy-procurement-surpasses-50-gw-mark.html","enabled":true},{"name":"email","url":"?subject=Global corporate clean energy procurement surpasses 50 GW mark again in 2023, setting new record in number of deals | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-corporate-clean-energy-procurement-surpasses-50-gw-mark.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+corporate+clean+energy+procurement+surpasses+50+GW+mark+again+in+2023%2c+setting+new+record+in+number+of+deals+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-corporate-clean-energy-procurement-surpasses-50-gw-mark.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}