Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 09, 2021

Fast Transition 2021: What could energy transition look like for the North American natural gas sector?

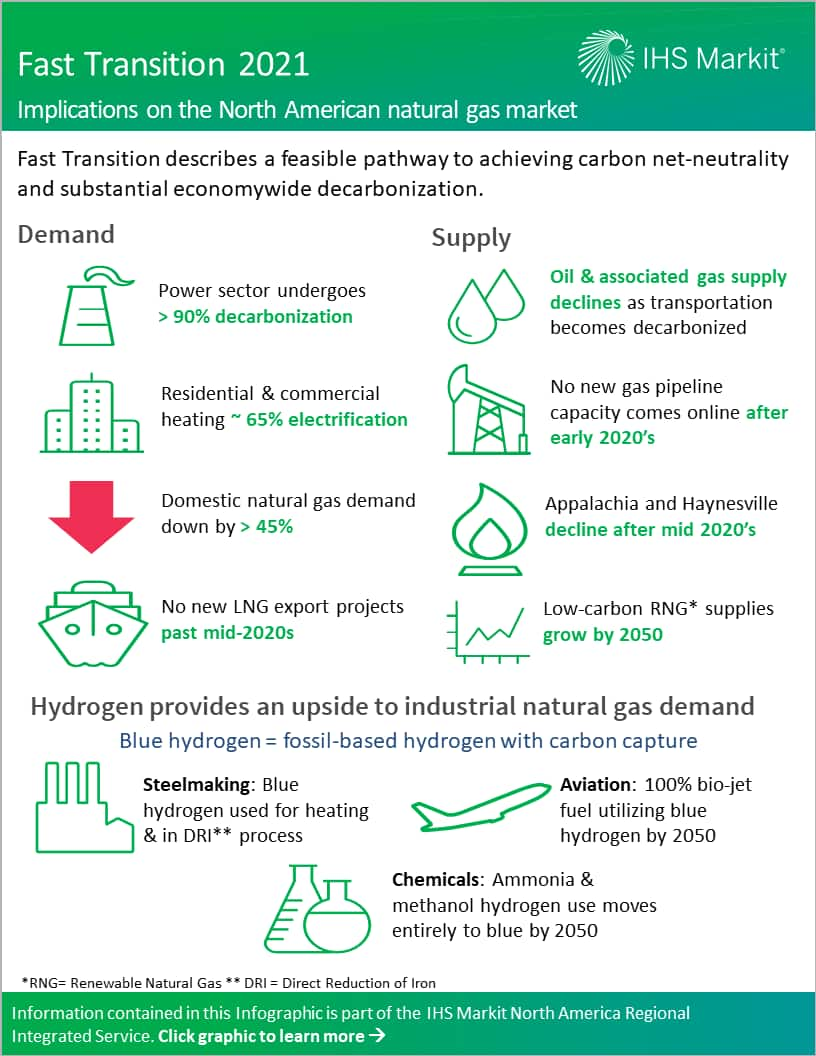

IHS Markit recently released the 2021 Fast Transition Case for natural gas, which demonstrates a pathway to achieve a net zero carbon economy by 2050 and analyzes the potential impact on the North American natural gas market. A low carbon and zero carbon future presents significant difficulties, but also opportunities for the natural gas sector.

Download the Fast Transition Executive Summary.

Fast Transition explores the impact of electrification and efficiency gains in the residential, commercial, and industrial sector and a near-total power sector decarbonization by 2050. The introduction of blue hydrogen (i.e. hydrogen produced from natural gas with carbon capture and sequestration), especially in the industrial sector, as well as stronger development of renewable natural gas supply provide some growth opportunities in otherwise declining demand for fossil fuels.

The natural gas sector is already feeling pressure from decarbonization efforts, with increasing challenges to building new pipeline infrastructure and adapting to increasing regulatory oversight. In Fast Transition 2021, we look at what this energy transition may look like for the natural gas sector.

In Fast Transition, the North American natural gas market starts to decline in the mid-2020s, with total production declining by more than 35 Bcf/d between 2025 and 2050. Owing to strong regulatory pressure, no new gas pipeline capacity comes online after 2022. With lower oil demand due to the electrification of the transportation sector, oil and associated gas production declines through 2050.

Demand for natural gas falls dramatically, with total domestic natural gas demand in 2050 down by more than 48% in US and 46% in Canada from 2019 levels:

Power sector: A near-total power sector decarbonization, over 90% by 2040 and 97% by 2050. The power sector's decarbonization pathway includes the phase out of conventional coal, deployment of carbon capture and sequestration, longer life extensions for nuclear plants and a fifteen-fold growth in solar and wind capacity.

Natural gas cedes baseload generation to renewables and battery use. Much of the conventional natural gas‒fired power assets in the United States and Canada remain online and operate flexibly and at overall low capacity factors, typically under 10% in the late 2040s.

Residential and Commercial: Strong regulatory pressure results in the adoption of electric space and water heating for new built structures. Natural gas and fuel oil used for space and water heating are replaced with electricity in millions of homes and buildings in the second half of the outlook period. Residential and commercial natural gas demand declines by 45% and 46% respectively.

Industrial: Electrification and efficiency gains also lower industrial natural gas demand, but to a lesser extend than in the previous sectors. New avenues for natural gas demand open up, with its increased utilization in the production of blue hydrogen. Fast Transition envisions blue hydrogen adoption in the chemical sector (mainly ammonia and methanol), steel making, and to produce low carbon aviation fuel. Annual blue hydrogen production reaches more than 30 million tons by 2050, utilizing more than half of the industrial natural gas demand.

Renewable Natural Gas (RNG) can be produced by anerobic digestion of biomass in landfills, manure, municipal waste, sewage, and wastewater. In future, commercialization of 'second-generation' technologies such as gasification plus methanation, can unlock vast new quantities of RNG from agricultural residues and woody biomass. In our Fast Transition 2021 outlook, US lower-48 and Canadian RNG is expected to grow to 4.5 Bcf/d and 1.4 Bcf/d respectively by 2050.

Substantial infrastructure investment is required for development of blue hydrogen, RNG supply sources, and in energy end-use applications.

IHS Markit closely monitors the North American energy markets, publishing data, key insights and market analysis. Learn more about our research.

Ankita Vijay, senior analyst on the North America natural gas team, focuses on North American natural gas market modeling using the Gas Pipeline Competition Model (GPCM).

Wolfgang Moehler, director with the Climate and Sustainability team at IHS Markit, has 15 years of progressive experience across the energy value chain and leads the IHS Markit North American natural gas market modeling/analytics.

Posted on 9 June 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffast-transition-2021-what-could-energy-transition-look-like.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffast-transition-2021-what-could-energy-transition-look-like.html&text=Fast+Transition+2021%3a+What+could+energy+transition+look+like+for+the+North+American+natural+gas+sector%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffast-transition-2021-what-could-energy-transition-look-like.html","enabled":true},{"name":"email","url":"?subject=Fast Transition 2021: What could energy transition look like for the North American natural gas sector? | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffast-transition-2021-what-could-energy-transition-look-like.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fast+Transition+2021%3a+What+could+energy+transition+look+like+for+the+North+American+natural+gas+sector%3f+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffast-transition-2021-what-could-energy-transition-look-like.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}