Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 15, 2023

Europe is better equipped to handle a recurrence of last summer’s heat wave, but remains sensitive to changes in gas supply

We all remember last summer's energy crisis as electricity and gas prices soared with the heat wave and Russia-Ukraine war testing Europe's security of supply. As we enter the summer of 2023, what can we say will happen to electricity prices this year?

Summary: Through all uncertainties, S&P Global Commodity Insights believes the upside for electricity prices and power sector gas demand this summer is relatively muted.

First, what happened last summer? Extraordinarily high temperatures lifted power demand from air conditioning and fans while droughts reduced hydroelectric generation to historic lows. Nuclear generation also dropped with cooling water restrictions curtailing production. Last summer was also notably affected by high gas prices due to the Russia-Ukraine war. However, with gas supply looking stable this year, we see the primary source of price upside to be from a recurrence of heat wave conditions.

To test the impact of another heat wave in S-23, we have lifted our demand view across continental Europe by an average of 3% (up to 8GW in June) to increase electricity demand from air conditioning and fans. We have also lowered our EU10 hydro view by on average 3.2 GW, weighted to June and August, but our view remains above last year's lows given hydro stocks are healthier than in 2022. High temperatures will also affect nuclear generation, particularly in markets with river-cooled reactors, we have tested a lowered nuclear forecast by up to 3GW.

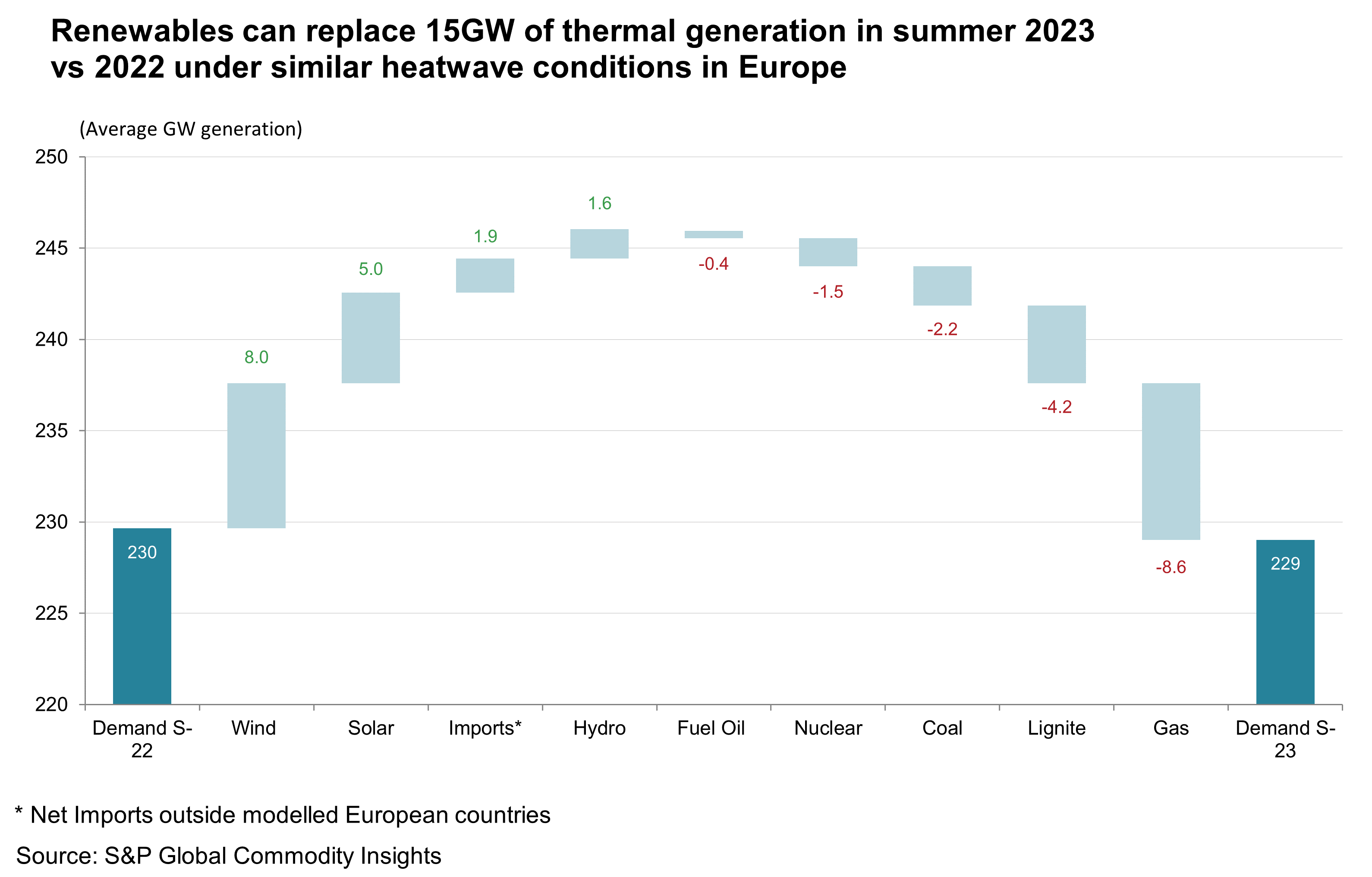

The good news is that S&P Global Commodity Insights' modelling shows Europe is better equipped to handle a recurrence of last summer's heat wave. The biggest reason is wind and solar installations (which increase in capacity summer on summer by 21 GW) lowering the thermal gap and improving Europe's cushion of non-gas supply (see chart below). We forecast baseload prices across Europe will lift less than €12/MWh, remaining significantly lower than prices last summer, when some countries saw day-ahead prices over €400/MWh.

While baseload prices rise across all the countries we model, the impact varies depending on region. Gas-heavy markets like Great Britain and Italy are affected the least with the countries increasing gas generation by an average of 1.6 GW and 2.8 GW respectively in the summer. France and Switzerland, on the other hand, strongly pull back on exports to compensate for lower nuclear and see a steeper price rise of €10.1/MWh and €8.5/MWh over S-23, with France shifting to an import position in July and August.

We project that, under heat wave conditions, France-Great Britain flows will reverse, and Great Britain will revert to exporting to France, as last summer. France-Switzerland flows also reverse in Q3-23, with minor exports from Switzerland of 240MW, in line with last summer. But notably different from last summer's position is Germany which remains a net importer, though it sees a marked pull-back on flows vs our base case. Germany's exit from nuclear on April 15 and S-23 fuel switch dynamics favoring 55%-efficient gas units over 40%-efficient hard coal plants in the merit order, combined with strong solar capacity growth in 2022 in Germany and surrounding markets mean that Germany retains a net import position in our scenario although imports fall by ~2 GW in Jun-23 to Sep-23 vs our base case. In S-22, all-time low French nuclear generation, drought conditions and fuel switch prices in favor of German hard coal dispatch supported German exports of 1.2 GW on average in Jun-22 to Sep-22.

So, are we out of the woods completely? Not yet. While gas stocks, supported by EU's gas demand reduction policy, are at the top of their 2017-21 range, the geopolitical situation can certainly not be relied upon. Also, EU is now securing LNG competitively leaving a previously isolated market vulnerable to changes in worldwide LNG demand. Risks in supply come from French nuclear which remains (unsurprisingly) uncertain as industrial action and planned maintenance could lower availability.

Learn more about our research and analysis relating to electric power in Europe.

Parth Goel is an electricity analyst at S&P Global Commodity Insights.

Posted 15 May 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2feurope-is-better-equipped-to-handle-a-recurrence-of-last-summer.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2feurope-is-better-equipped-to-handle-a-recurrence-of-last-summer.html&text=Europe+is+better+equipped+to+handle+a+recurrence+of+last+summer%e2%80%99s+heat+wave%2c+but+remains+sensitive+to+changes+in+gas+supply+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2feurope-is-better-equipped-to-handle-a-recurrence-of-last-summer.html","enabled":true},{"name":"email","url":"?subject=Europe is better equipped to handle a recurrence of last summer’s heat wave, but remains sensitive to changes in gas supply | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2feurope-is-better-equipped-to-handle-a-recurrence-of-last-summer.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Europe+is+better+equipped+to+handle+a+recurrence+of+last+summer%e2%80%99s+heat+wave%2c+but+remains+sensitive+to+changes+in+gas+supply+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2feurope-is-better-equipped-to-handle-a-recurrence-of-last-summer.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}