Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 01, 2022

Russia crude oil pipeline capabilities to mainland China—The ESPO crude oil pipeline

Key implications

- In the case of pipeline supply disruption to Europe, Russia needs to look to alternative markets in Asia, given that it has no strategic petroleum reserve (SPR) system.

- Insufficient crude oil pipeline transmission capacity will limit how much additional oil Russia can send to mainland China.

- Mainland China's demand for Russian crude will remain stable since local refineries favor the ESPO blend.

The possibility of a supply disruption to Russian oil owing to the Russian-Ukraine crisis has caused a physical and financial shock to the global crude oil market. Russia is a significant crude oil exporter in the world, although it is the third-largest oil producer after the United States and Saudi Arabia. Preinvasion Russian crude oil exports were approximately 4-5 MMb/d. Currently, Russian crude oil exports have reduced, and further reductions are likely. Understanding the crude oil disposition capacity and capability is important as the situation evolves post-invasion in the global crude oil market. What are the current crude oil pipeline disposition outlets and what are the possible implications from further reductions in Russian crude oil exports?

The disposition of crude oil from Russia has several outlets. A critical outlet for Europe is via the Druzhba pipeline. The Druzhba pipeline delivers crude oil from Russia to Poland and Germany through Belarus, Hungary, Slovakia, and Czech Republic via Ukraine. However, if the situation escalates further and impacts Russian crude oil exports, where can the surplus Russian barrels go? Are there alternative routes that Russia can redirect the pipeline flow to beyond Europe? Is incremental offtake to the east and mainland China an option?

The following map illustrates existing Russian oil related infrastructure, highlighting oil pipelines, refineries, and oil storages that are currently operating. For level setting purposes, Russia has an export capability of 11 MMb/d for crude oil and refined products, and a total operating oil storage capacity of 96.8 MMbbl. The largest crude oil storage is the 10.6 MMbbl Omsk Refinery owned by Gazprom Neft, followed by a 7.3 MMbbl Novorossiysk Marine Terminal, owned by Caspian Pipeline Consortium. However, Russia does not own and operate an SPR. While an SPR enables a country to stock up crude for times of supply shortage, it also can in this circumstance, soak up the immediate surplus. Without SPR, Russia theoretically has less supply flexibility and can only manage downstream consumption decreases by production cuts. Correspondingly, if the Russian crude oil exports are reduced, alternative outlets are minimal to nil in-country.

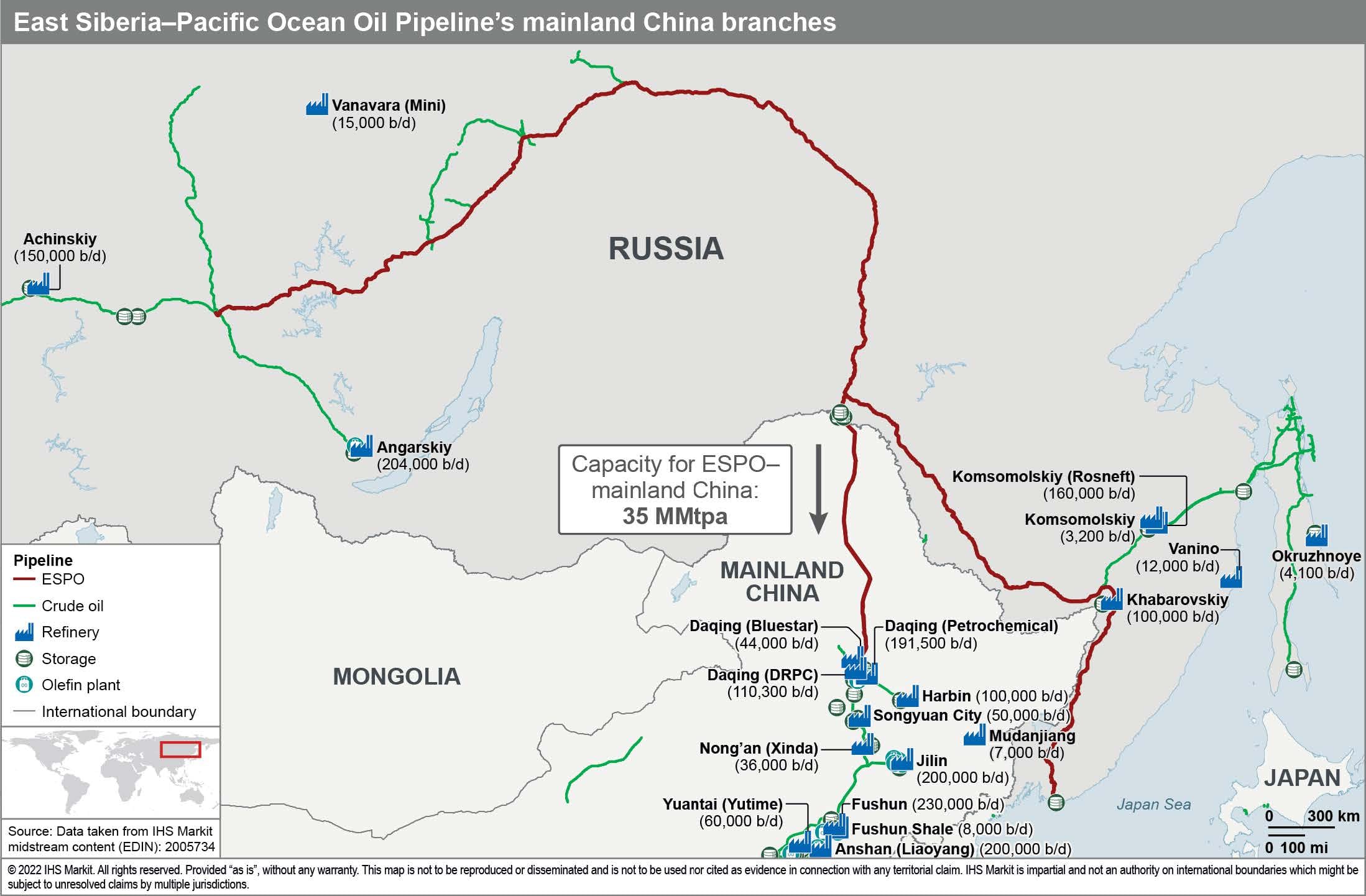

In contrast to Russia's lack of crude oil storage facilities, its neighboring country and biggest oil consumer mainland China has 12 SPR sites in operation totaling 249.7 MMbbl and is contemplating another 5 more going forward. Russia exports nearly 50% of its crude oil and refined products via long-distance pipelines with the balance waterborne liftings and trade. It has the two longest oil pipelines in the world, the Druzhba to the west, and the east, the ESPO oil pipeline. In addition to these major pipelines waterborne crude oil liftings via Very Large Crude Carriers (VLCCs), medium-size Aframax tankers, and other vessel sizes and types provide additional Russian crude oil disposition options. The focus here is on the east side of Russia and the ESPO oil pipeline. The following map shows Russia's pipeline export route to Asia via the ESPO oil pipeline. The 4,857-km ESPO oil pipeline starts from Taishet in eastern Siberia, sending oil to the Pacific Ocean terminal at Kozmino. The ESPO oil pipeline was built and operated by Russian pipeline company Transneft and construction of the pipeline started in 2006 and was completed in 2012.

The ESPO oil pipeline is the key route of Russia oil to reach its key consumers in Asia, including mainland China, Japan, and South Korea. Under the current Russia-Ukraine war situation, Japanese and South Korean companies have backpedaled trading activities with Russia, while mainland China remains to be an outlet for Russian oil.

Deliveries of Russian oil via the ESPO oil pipeline to mainland China started in 2011. Crude oil is injected into the 942-km mainland China branch of the ESPO oil pipeline and further into the Northeastern oil pipeline network. The mainland China branch pipeline was built and is currently operated by the China National Petroleum Corporation (CNPC) with an initial annual transportation capacity of 15 million metric tons (MMt) per year, approximately 0.3 MMb/d1. CNPC launched several projects to lift the capacity to 20 MMt to date. To further strengthen its oil connection with Russia, mainland China built a parallel line in 2018 to receive an additional 15 MMt from Russia each year. The two lines currently have a combined annual capacity of 35 MMt per year (MMt/y), approximately 700,000 b/d.

Crude oil import by ESPO has made Russia the largest oil exporter to mainland China, overtaking Saudi Arabia. In 2021, Asian refineries imported 2.4 MMb/d or about 120 MMt/y of Russian oil via the ESPO oil pipeline and waterborne routes, with over 80% of the oil delivered to mainland China.

Under the current war circumstances, is it possible for Russia to direct more west-word crude to the east? There are likely commercial limitations to delivering incremental crude oil to the east via the ESPO oil pipeline. Russia and Mainland China market participants signed a long-term oil supply contract in 2012 for an estimated annual volume of 15 MMt for the term of 20 years. The commercial negotiations for the supply contract took the two countries 15 years before it finally concluded the commercial negotiations and executed a supply contract in September 2012. The negotiations for additional supplies and a new supply contract are unlikely to be concluded over a short period of time.

Russia, however, has a second route to supply oil to mainland China. Rosneft has signed a 10-year contract with CNPC in February to extend its oil supply through Kazakhstan via the Atasu-Alashankou pipeline. The contract is for a total of 100 MMt of crude over 10 years, or 200,000 b/d. The Atasu-Alashankou pipeline, commissioned in 2006 by Kazakhstan-China Pipeline Company, has a designed capacity of 400,000 b/d. The pipeline has previously been used to transport oil from Russia to mainland China. During 2014-16, 140,000 b/d of Russian crude was sent to mainland China, and also during 2017-21 as 200,000 b/d of Russian crude was sent to mainland China. The Atasu-Alashankou pipeline—despite the existing spare capacity of 200,000 b/d after being assigned for the new Russia-mainland China contract—is not a solution for the standing issue owing to the relatively small designed capacity.

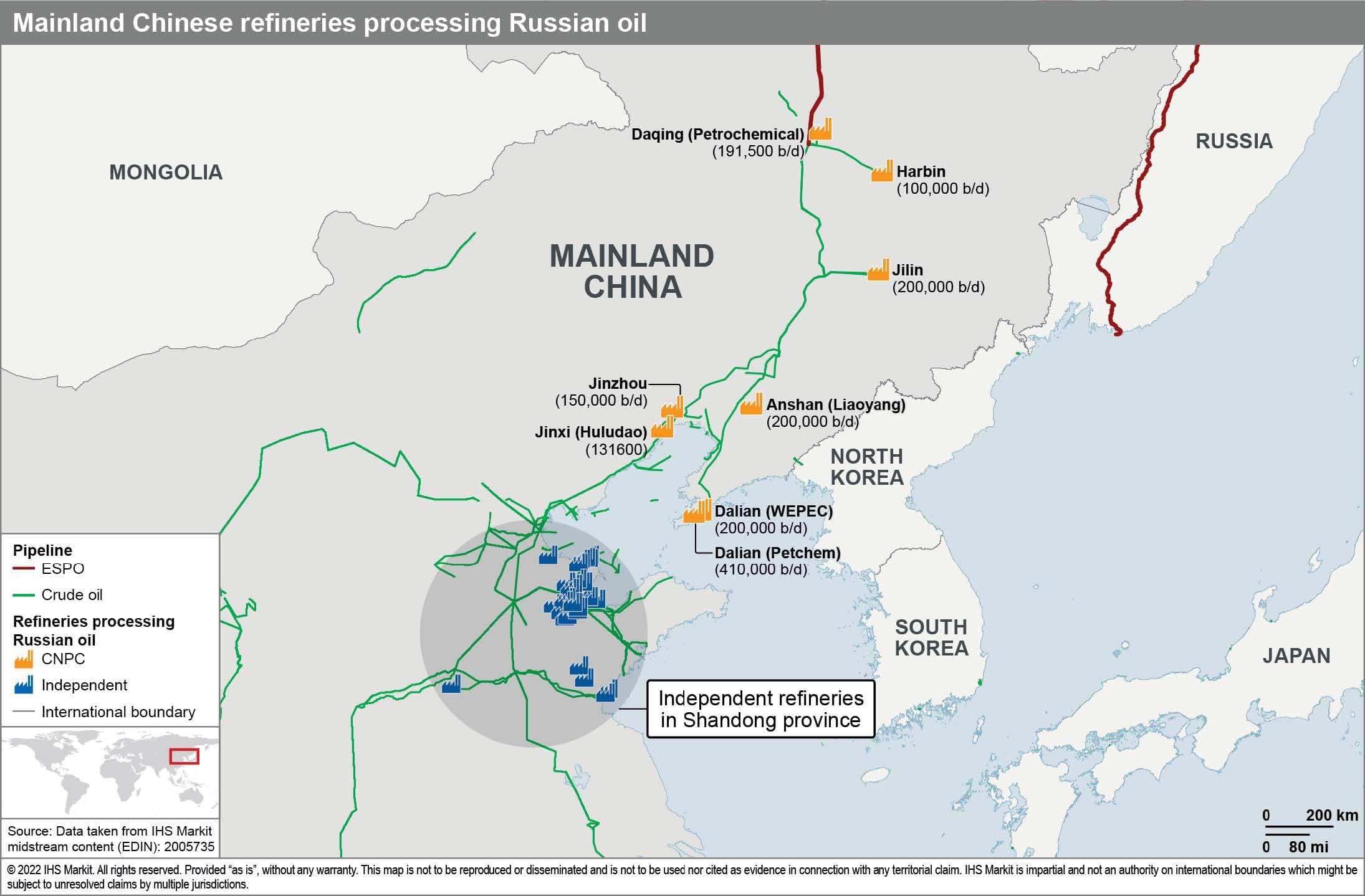

The estimated ESPO oil pipeline capacity for deliveries to mainland China for Russian oil is approximately 35 MMt/y, higher than the 30 MMt/y designated by the supply contract. Assuming the volumes available are more than the pipeline's capacity, mainland China traders have the ability in an unconstrained world to import ESPO blend taking waterborne. The ESPO oil pipeline crude blend is favored by mainland China refineries, particularly refineries in the Northeastern provinces, and the tea-pot refineries in the Shandong province. The following map shows pipeline connections with CNPC refineries and tea-pot refineries in Shandong.

CNPC has recently upgraded its Daqing Petrochemical refinery to process 3.5 MMt/y of Russian Oil. The refinery joined the existing fleet with Dalian Petrochemical, Liaoyang, Jilin, Jinzhou, Jinxi, Harbin, and WEPEC. These refineries process ESPO blend with indigenous oil production, with the ESPO portion ranging at 15-50%.

Mainland China has currently a total of 38 independent or so-called tea-pot refineries with a combined capacity of 2.53 MMb/d, approximately 126 MMt/y. This figure excludes those refineries that have been acquired by large companies such as by ChemChina and Norinco. ESPO is the blend at these refineries, followed by the Urals. IHS Markit research shows ESPO import ranges from 1.5-2.5 MMt per month via ports at the Shandong coast.

In summary, we believe that the ESPO pipeline is a critical route for Russian oil to reach its key consumer, mainland China. However, this pipeline seems to be at its capacity even before the Russia-Ukraine crisis, and it is unlikely for Russia to be able to increase its existing supplies to mainland China via this route. The other pipeline, the Atasu-Alashankou Pipeline, has limited spare capacity. The insufficiency in oil transmission capacity will force Russian barrels to take sea routes to mainland China if Russian ships continue to be diverted from countries that have imposed self-sanctions on Russian crudes. Chinese demand for seaborne Russian crude—particularly the ESPO blend and Urals—will remain stable because these are the preferred grades run by most of the independent/large refineries that are owned and operated by national oil companies.

For more information on S&P Global's Oil Markets, Midstream, and Downstream research and analysis, visit ihsmarkit.com/OMD

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fespo-crude-oil-pipeline.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fespo-crude-oil-pipeline.html&text=Russia+crude+oil+pipeline+capabilities+to+mainland+China%e2%80%94The+ESPO+crude+oil+pipeline+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fespo-crude-oil-pipeline.html","enabled":true},{"name":"email","url":"?subject=Russia crude oil pipeline capabilities to mainland China—The ESPO crude oil pipeline | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fespo-crude-oil-pipeline.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russia+crude+oil+pipeline+capabilities+to+mainland+China%e2%80%94The+ESPO+crude+oil+pipeline+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fespo-crude-oil-pipeline.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}