Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 18, 2014

East Texas unconventional acreage values soar - Interest in the East Texas Eagle Ford heats up

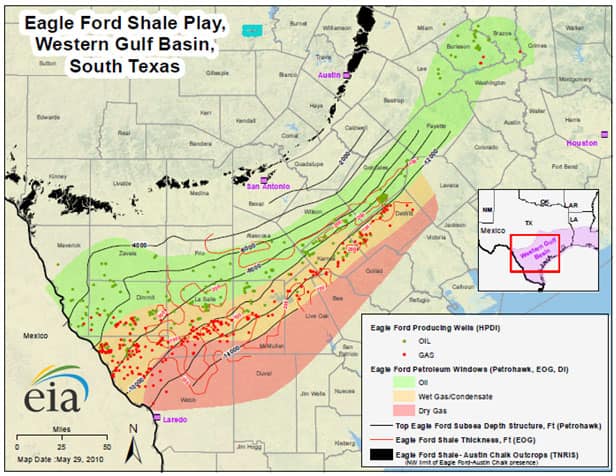

The established Eagle Ford play extends from the Mexico border eastward to Gonzales, Lavaca, and Fayette counties in Texas. Geological maps, however, show that the Eagle Ford formation was deposited over a much larger area. Given the success of the established Eagle Ford play, it is natural to expect the industry to test the ultimate economic limits of the Eagle Ford. Current efforts are focused on extending the play eastward beyond Fayette County, with recent company announcements suggesting a growing confidence that not only is the Eagle Ford prospective in East Texas but in other zones as well. (See previous blog post) "Play Alert: Eagle Ford unconventional oil success extends into eastern Texas in Aguila Vado field", November 12, 2013.

Figure 1 - Eagle Ford Play Map

Multi-zone potential enhances the value of the acreage

Multi-zone potential and existing infrastructure from legacy production should enhance the economic attractiveness of the East Texas unconventional exploration area. Geological maps indicate much of the new eastern Eagle Ford extension area is also prospective for the conventional Woodbine formation. The name "Eaglebine" has been applied by some operators to portions of this area. The area also offers multi-zone conventional opportunities in formations such as the Buda Lime, Georgetown, and Austin Chalk and deep gas potential from the Glen Rose and Bossier formations. Some operators are trying to revitalize these older conventional plays by applying the new unconventional drilling and completion techniques to boost well results with some favorable results being reported from the Woodbine by itself and also the Buda Lime.

Implied M&A deal values double

The most recent transaction in the area was the GE Energy Financial Services and Vess Oil $108 million purchase of 13,000 net acres in Brazos, Madison, and Grimes counties from an EnerVest Ltd affiliate. In our opinion this deal confirms growing interest in the area with an implied acquisition price of $8,308 per acre. This per acre value is two and a half times the $3,325 per acre acquisition price Comstock Resources paid Ursa Resources Group II LLC for 20,000 net acres in the area back in November 2013. The GE-Vess acquired land comes with existing Woodbine production and is also considered to be prospective in the Eagle Ford. We conclude that the multi-zone zone potential played a significant role in supporting the higher acreage valuation. Vess Oil management has stated a desire to continue to expand its holdings in the area.

Recent encouraging well results from the Eagle Ford

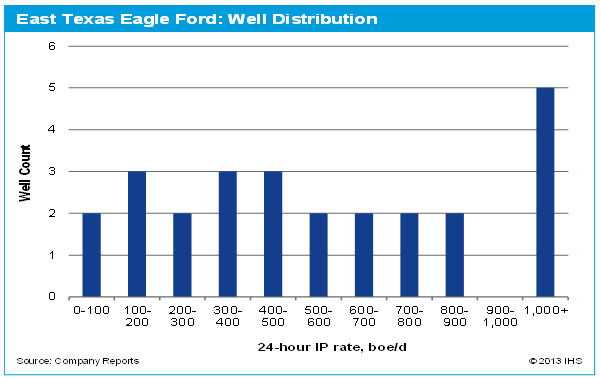

We have collected the initial 24-hour production test data for the East Texas Eagle Ford from recent company reports. Initial production rates from the 26 well sample range from 70 boe/d to 1,285 boe/d. The median well result is about 500 boe/d (85% oil). The oil content of the production also varies from 32- 100%, suggesting the potential of three hydrocarbon windows is similar to the established South Texas Eagle Ford play. The most frequently occurring well result is over 1,000 boe/d, but at this time we consider this interval to be located at the toe of the distribution curve (See Fig. 2 East Texas Eagle Ford Well Distribution).

Wells with initial flow rates 1,000 boe/d or greater wells define the current sweet spot, with Halcon drilling four out of the five top wells, all in Brazos County. The other key 1,000 boe/d initial flow rate test result comes from a well located in eastern Madison County near Houston County. The multi-zone potential makes it challenging for an outsider to verify exactly which zone is being tested, but the improved well performance suggests that East Texas is a rising area of potential and interest.

Figure 2 - East Texas Eagle Ford: Well Distribution

Halcon reallocating investment to East Texas Eagle Ford play

The strong well performance to date is definitive enough for Halcon management to shift some capital investment away from the Utica and Woodbine plays towards the East Texas Eagle Ford play. Halcon refers to its Brazos county project area as "El Halcon". The company owns 265,000 net acres in East Texas, but only 90,000 acres are located in the El Halcon area. Halcon's goal is likely to increase its holdings. The company reports the lateral lengths of its wells have ranged from 7,000 to over 9,000 feet with well drilling and completion costs in the area reported at $7-9 million. Halcon expects to operate an average of 3 to 4 rigs in the El Halcon area during 2014. The company projects estimated ultimate recoveries (EURs) of around 0.55 MMboe per well, which suggests this area offers an attractive implied development cost of around $14.50/boe (implied Finding & Development cost =well cost divided by EUR). Given the high oil content and the relatively low implied development cost, it makes sense for Halcon to increase its capital spending in this area.

What to look for in 2014

We anticipate the well count will continue to rise in the area and look forward to seeing positive well results from both the Eagle Ford and Woodbine plays. We also expect continued efforts to build new opportunities in the conventional targets with our interest mostly focused on the Buda Lime well results. As more well results are announced, look for M&A deal activity in the area to continue to rise.

Posted 18 February 2014

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2feast-texas-unconventional-acreage-values-soar-interest-in-the-east-texas-eagle-ford-heats-up.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2feast-texas-unconventional-acreage-values-soar-interest-in-the-east-texas-eagle-ford-heats-up.html&text=East+Texas+unconventional+acreage+values+soar+-+Interest+in+the+East+Texas+Eagle+Ford+heats+up","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2feast-texas-unconventional-acreage-values-soar-interest-in-the-east-texas-eagle-ford-heats-up.html","enabled":true},{"name":"email","url":"?subject=East Texas unconventional acreage values soar - Interest in the East Texas Eagle Ford heats up&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2feast-texas-unconventional-acreage-values-soar-interest-in-the-east-texas-eagle-ford-heats-up.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=East+Texas+unconventional+acreage+values+soar+-+Interest+in+the+East+Texas+Eagle+Ford+heats+up http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2feast-texas-unconventional-acreage-values-soar-interest-in-the-east-texas-eagle-ford-heats-up.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}