Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 11, 2014

Developing Utica Shale dry gas hinges upon the repeatability of recent well results

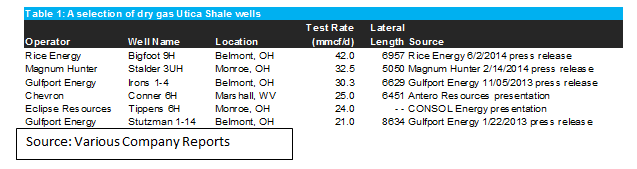

Recent Utica dry gas drilling shows very impressive results and dramatic improvements in initial production rates, with new tests as high as 42 MMcf/d. Recent results are likely generating healthy returns as a $14 million well only needs an initial production rate of 15 MMcf/d to generate a 10% internal rate of return. In the dry gas Utica, several operators have recently reported a dramatic improvement in initial production rates (see table below). The Bigfoot 9H well, Rice Energy's first successful Utica Shale dry gas well, captured an impressive initial production rate of 42 million cubic feet per day (MMcf/d). The well was drilled to a total vertical depth of 9,300 feet, had a lateral length of nearly 7,000 feet, and was completed with 40 fracturing stages using a plug and perforate system. Earlier in 2014, Magnum Hunter reported its first successful dry gas Utica Shale well, Stalder 3UH, which had an initial production rate of 32.5 MMcf/d. These rates are quite remarkable given that less than 10% of the dry gas Utica Shale wells in IHS's well database have an initial production rate greater than 15 MMcf/d.

Similar to other unconventional US plays, operators are attributing these improving well results to drilling longer laterals, reducing the spacing between fracturing stages and landing the well in the optimal zone. Even though these wells represent a small portion of the total number of wells drilled to date, we believe the average initial production rate for the dry gas Utica will improve going forward as operators continue to get a better understanding of the Formation.

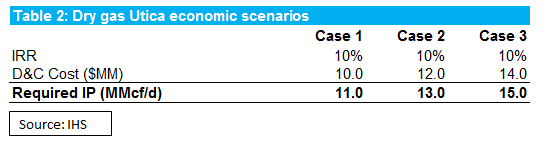

High costs hamper well economic yet recent result provide optimism

We believe the high drilling and completion well costs in the dry gas Utica area, currently in the $14 million range, are a significant obstacle to aggressive exploitation of the play at a gas price under $4/Mcf. Table 2 highlights the required initial production rate needed to earn an internal rate of return of 10% for various well costs based on IHS's early modeling assumptions for a dry gas Utica Shale well. Recent results are likely generating healthy returns as a $14 million well only needs an initial production rate of 15 MMcf/d to generate a 10% internal rate of return. However, drilling and completion costs would need to improve dramatically in order for historical well results to be economic. Well costs in this region are high not only because of the long lateral lengths and large number of fracturing stages but also because of the depth of the formation and the type of casing needed to with stand the high pressures at those depths. With the Marcellus overlapping a significant portion of the Utica dry gas play, we anticipate operators with exposure to both the Marcellus and the Utica to continue to favor drilling the less expensive, more established, and less risky Marcellus. But the likelihood operators will start to develop the dry gas Utica in conjunction with the Marcellus could be decided over the next few quarters if companies can prove recent results are repeatable.

Signpost Wells

A number of critical wills will be drilled in the near future that will provide clues about the future evolution of the Utica dry gas play.

Looking to piggy back off its recent success, Rice Energy and Magnum Hunter plan to drill 14 and 5 wells, respectively, in the dry gas section of the Utica Shale over the remainder of this year. In addition to these wells, several other noteworthy wells are expected to be completed over the next few quarters. CONSOL Energy recently spudded a dry gas Utica Shale well in Monroe County, Ohio. The well is expected to be drilled to a vertical depth of approximately 10,600 feet and have a lateral length of 8,000 feet. We expect the initial test rate of the CONSOL Energy well to further define the sweet spot within the play as it has a similar design as Rice's Bigfoot well and is located between the Bigfoot well and Magnum's Stalder well.

Gastar Exploration's Simms 5-UH well, located in Marshall County, West Virginia, was recently drilled to a vertical depth of 11,410 feet and encountered approximately 92 feet of net pay. The company plans to drill a 4,200 feet lateral leg and complete 23 fracturing stages. Although the lateral length is relatively short it will be interesting to see how the initial production rate from the Simms 5-UH well compares with the Chevron Conner well, also in Marshall County, which tested at 25 MMcf/d.

Range Resources has spudded a dry gas Utica well in the southwestern section of Washington County, Pennsylvania. It is expected to be drilled to a vertical depth of approximately 11,500 feet, have a lateral length of 6,500, and be completed with 32 fracturing stages using reduced cluster spacing. Because this well will be on the eastern portion of the play, success would boost the prospects not only for Range, given its 400,000 net acres prospective for the dry gas Utica, but also for the overall resource potential of the play.

Learn more about IHS Energy Company and Transaction Research.

Posted 11 August 2014

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeveloping-utica-shale-dry-gas-hinges-upon-the-repeatability-of-recent-well-results.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeveloping-utica-shale-dry-gas-hinges-upon-the-repeatability-of-recent-well-results.html&text=Developing+Utica+Shale+dry+gas+hinges+upon+the+repeatability+of+recent+well+results","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeveloping-utica-shale-dry-gas-hinges-upon-the-repeatability-of-recent-well-results.html","enabled":true},{"name":"email","url":"?subject=Developing Utica Shale dry gas hinges upon the repeatability of recent well results&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeveloping-utica-shale-dry-gas-hinges-upon-the-repeatability-of-recent-well-results.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Developing+Utica+Shale+dry+gas+hinges+upon+the+repeatability+of+recent+well+results http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeveloping-utica-shale-dry-gas-hinges-upon-the-repeatability-of-recent-well-results.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}