Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 30, 2018

Deepwater Americas: New offshore timelines & risk driving capital flow & activity levels

Global Exploration Context

When it comes to Global Exploration, new offshore timelines offer optionality and new paradigms for what offshore exploration risk capital means. Instead of only looking at longer cycle projects that are very capital intensive and inflexible (ultra-deep, offshore frontier exploration, and gas fields as examples), there are other options from which to choose. Short-cycle offshore projects (time from discovery to FID is approximately two to three years) and medium-cycle offshore comprising shallow water development such as arrested basins in Mexico and Brazil are also available options. An example of such medium-cycle includes ExxonMobil's activities in the Guyana-Suriname Basin. Essentially, medium-cycle offshore development is not just limited to an asset or a resource type but can also manifest as a company strategy that can enable compressed cycle times.

Arrested Offshore Latin American Basins

Basins in various phases of 'arrest' offer a spectrum of opportunity for frontier early emerging and maturing offshore. Let's take the spectrum of Brazilian Basins as an example. Most of the basins located here, except for the Campos Basin, are considered emerging, in that they have production (no risk in being classified as frontier) but they've been stymied in terms of growth for a variety of above ground reasons. There are also arrested-emerging basins, such as the Sureste Basin in Mexico. Mexico a special case because it's been closed off to foreign investment for such a long period of time, meaning that activity has been stifled (hence arrested), as the country was NOC dominated for a long period of time. The rest of Mexico's basins, however, are under-explored or frontier, meaning there's room available for potential "elephant finds" because exploration historically has been limited for decades.

Exploration & Appraisal Activity Forecasts Progress

in the Deepwater Gulf of Mexico, US

IHS Markit is estimating overall that the Deepwater Gulf of Mexico

(GoM) is going to see an overall decreased level of E&A

activity going forward compared to previous levels. We anticipate a

modest recover in E&A activity for the next ten years,

primarily lead by exploration in the lower Tertiary plays. This is

primarily because of several key reasons, with one being that the

competitive landscape is becoming more and more contracted,

discovery sizes in the prolific Miocene are waning and the

increasing costs of drilling. The key players in the basin (e.g.,

Shell, Anadarko, BP, Chevron) are leading development. But from an

appraisal and exploration point of view, there are few new

entrants, and no new massive play opener discoveries, other than

the Shell Appotamox and the Chevron Ballymore discovery. The

Jurassic Norphlet is an emerging play that one can argue will be a

source of new E&A activity, however, we don't really know what

the extent of this play is just yet, or even if it can accommodate

any other bigger players. What goes along with an increasing

concentration of the competitive landscape is a lack of exploration

risk capital. This coupled with higher well costs and low

producibility means we can't expect the U.S. GoM to attract a lot

of new entrants and thus a higher-level E&A activity going

forward.

Exploration & Appraisal Activity Forecasts Progress

in the Deepwater Gulf of Mexico, Mexico

Mexico's offshore basins, in stark contrast to the U.S. gulf will

see an increase in E&A activity by 50 percent over the next six

years. This is influenced by the increasingly more diverse

competitive landscape, where a number of foreign entities are

coming in and either finding bypassed resource or making new

discoveries and unlocking new formations. It is also influenced by

Mexico offering optionality. If the goal is to take on frontier

offshore exploration, there basins available to do that. Other

options include shallow water (ENI and Talos exhibit what the

potential for running room is in the shallow water with their main

discoveries). This is all contingent upon political situations, and

hopefully there will be a bid round (as planned under the previous

administration) which will offer more shallow water blocks Lastly,

while Pemex continues to dominate as an explorer in Mexico,

international players such as Shell, Repsol, Petrobras, and Total

are projected to lead the deepwater game.

Exploration & Appraisal Activity Forecasts Progress

in Offshore Brazil

Brazil tells a similar story as Mexico, but Brazil is ahead of the

curve as it's been open to foreign investment for a longer period.

The competitive landscape is diversified, and it is not just

Petrobras anymore. There are multiple play types available and

while the presalt will drive a lot of this activity from an

exploration and appraisal point of view, there are also basin

margin wedge plays available, such as what's been found in Guyana

that's also available for exploration. Shallow water exploration is

available also, but with an issue that shallow water exploration in

Brazil is in an environmentally sensitive area and/or permitting

has not been granted. Although this is an added risk element with

Brazil. we expect to see high levels of appraisal and exploration

activity over the next five years.

Further Diversification from NOC-Lead Monopolies will

see Exploration Scope and Activity Levels Increase

Mexico is on the verge of rivalling Brazil offshore in terms of

projected future E&A activity. Even though the Deepwater GoM

will see 25 percent of total E&A wells, it accounts for

approximately 40 percent of total E&A cutbacks. This is because

of the difference in how much it costs to drill a well in the

Deepwater GoM. Underpinning these E&A forecast is how the

competitive landscapes evolve in these different geographies.

If you remove Pemex and Petrobras from the Mexico and Brazil

competitive landscapes, there is a wide diversification of

operators, based on total recoverable 2P resources. Equinor leads

in recoverable reserves and are not just in the Campos or the

Santos, but also the Espirito Santo Basin and the Potiguar Basin.

They are targeting more than presalt, which is an interesting

aspect of the Brazilian offshore and how it's evolved. What we're

expecting from Mexico, if current policies continue the way that

they are as per the energy reform, is for Mexico to take the same

path as Brazil.

What we have in the offshore Americas sector is a real risk

dichotomy. In the Deepwater GOM, your above ground risk is

relatively mitigated, you have a stable political climate from an

investment standpoint as it's a pro-oil administration, however,

the main risk is really resource materiality and challenging

reservoir conditions.

However, the further south you move into Mexico and Brazil, there is political volatility, but basins have running room and exploration acreage in general. The risk in Guyana and Suriname, as early emerging basins, is lack of infrastructure coupled with no active bid rounds; the only way in is through farm-ins. We're dealing with multiple risk types and what you as an investor/ operator chooses will depend on your internal risk tolerances.

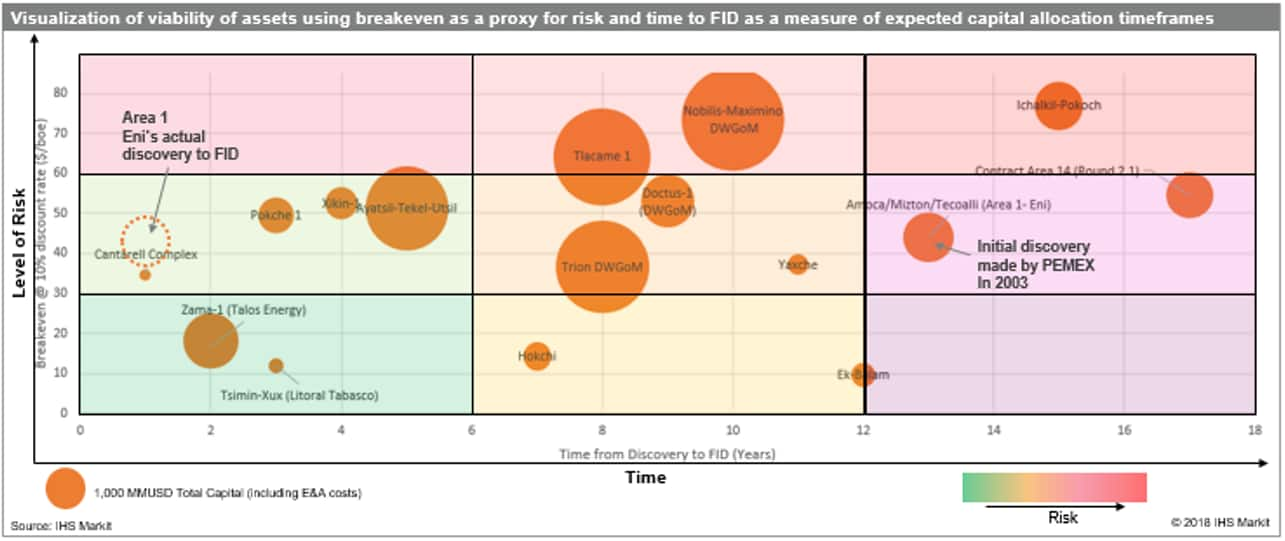

Figure 1: Competition for Risk

Capital

Figure 1: Competition for Risk

Capital

Risks & Portfolio Optionality

If you are portfolio manager looking to either stay, get in or

divest in Latin America (LATAM) offshore or offshore Americas, we

are seeing external factors (e.g., investor pressure to diversify

energy sources, cyclicality in the pricing environment) becoming

more important in your portfolio choices as opposed to internal

factors (e.g., technical capabilities, internal stage gate process

risks).

We can't talk about offshore and not mention cost. The price crash saw a return of pricing power to buyers (operators) as there was not much demand for offshore equipment, and there was a general contraction of the capital intensive offshore environment. What we project going forward is a return of pricing power to the suppliers (service sector). The cost efficiencies that were realized by operators for the last couple years will start to diminish, slowly. Which is something we need to pay attention to when sanctioning offshore projects going forward.

Another external factor is cycle time, or the time from discovery to final investment decision (FID). We see an overall compression of cycle time within the Americas offshore projects; overall the reduction in time to FID is approximately 13 percent in the past 10 years. Brazil has enjoyed the greatest reduction in time to FID by approximately 20 percent over 10 years, due to the diversified competitive landscape and the encouragement of a variety of operators who are more adept at project execution.

In contrast to that is Mexico. They haven't historically seen a lot of compression of cycle time and times taken to project sanctioning, however, that has changed, especially in recent time with ENI and Talos who have taken their FID decisions almost one to two years after making their discoveries.

Deepwater GoM is a different story. We don't see much compression in cycle time, and this is mostly due to how capital intensive a lot of these projects are and its challenging reservoirs (high pressure reservoirs). The Guyana-Suriname Basin, what I like to call the first mover advantage in a basin is an example. Exxon made their discoveries and they are taking their FID decision days rapidly. They can do this because of their execution abilities and because they've picked up prime acreage in this basin. Everyone is now following suit and trying to get a piece of that pie, however whether other operators in this basin can realize this same efficiency is debatable. Subsurface uncertainty notwithstanding the first mover advantage in a basin or country can be employed as a strategy for cycle time compression.

Key Takeaways

- Global deepwater and exploration is changing and there's renewed interest in getting back into the offshore. There is a southward shift of exploration risk capital from out of the Deepwater U.S. GoM into Mexico and Brazil, and we expect to see that as being sustained for the next five to ten years. This is due to materiality of discovery size and these areas offering more running room south of the boarder.

- Evolving competitive landscape dynamics- The U.S. D.W. GoM will see an increasingly more concentrated competitive landscape while Mexico and Brazil's offshore will continue to see diversification as Global IOCs and Independents look to explore for billion-barrel discoveries and by-passed resource

- Risk dichotomy- External factors such as price environment cyclicality, fiscal and political stability play an increasingly greater part in operator portfolio choices in LATAM compared to internal factors (such as technology capabilities and capital allocation) which rank higher for the D.W. GoM. Sub-surface and resource potential risk is greater in the D.W. GoM but political stability is not a risk factor- the opposite exists for Mexico and Brazil. Cycle time, a combination of both internal and external factors can be achieved through both offshore resource type selection and overall corporate strategy pertaining to a particular basin.

- So that's essentially our risking that we can apply to our portfolio and depending on what geography or what basin you're looking at, you'll apply different weighting to these various factors.

- Offshore offers optionality, and not just in longer cycle capital intensive projects that offer no flexibility. Shallow water is available and with various openings in Mexico, Brazil and other parts of LATAM, we can see an evolution of how the offshore landscape in the Americas will play out for the next five to ten years.

View the entire presentation along with graphics and case study.

Kareemah Mohamed is an Associate Director on the Plays and Basins team at IHS Markit.

Posted 30 November 2018

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeepwater-americas-new-offshore-timelines-risk-driving-capital.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeepwater-americas-new-offshore-timelines-risk-driving-capital.html&text=Deepwater+Americas%3a+New+offshore+timelines+%26+risk+driving+capital+flow+%26+activity+levels+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeepwater-americas-new-offshore-timelines-risk-driving-capital.html","enabled":true},{"name":"email","url":"?subject=Deepwater Americas: New offshore timelines & risk driving capital flow & activity levels | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeepwater-americas-new-offshore-timelines-risk-driving-capital.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Deepwater+Americas%3a+New+offshore+timelines+%26+risk+driving+capital+flow+%26+activity+levels+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeepwater-americas-new-offshore-timelines-risk-driving-capital.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}