Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 06, 2023

Corporate renewable procurement announcements dip in the first quarter with quick rebound expected later in 2023

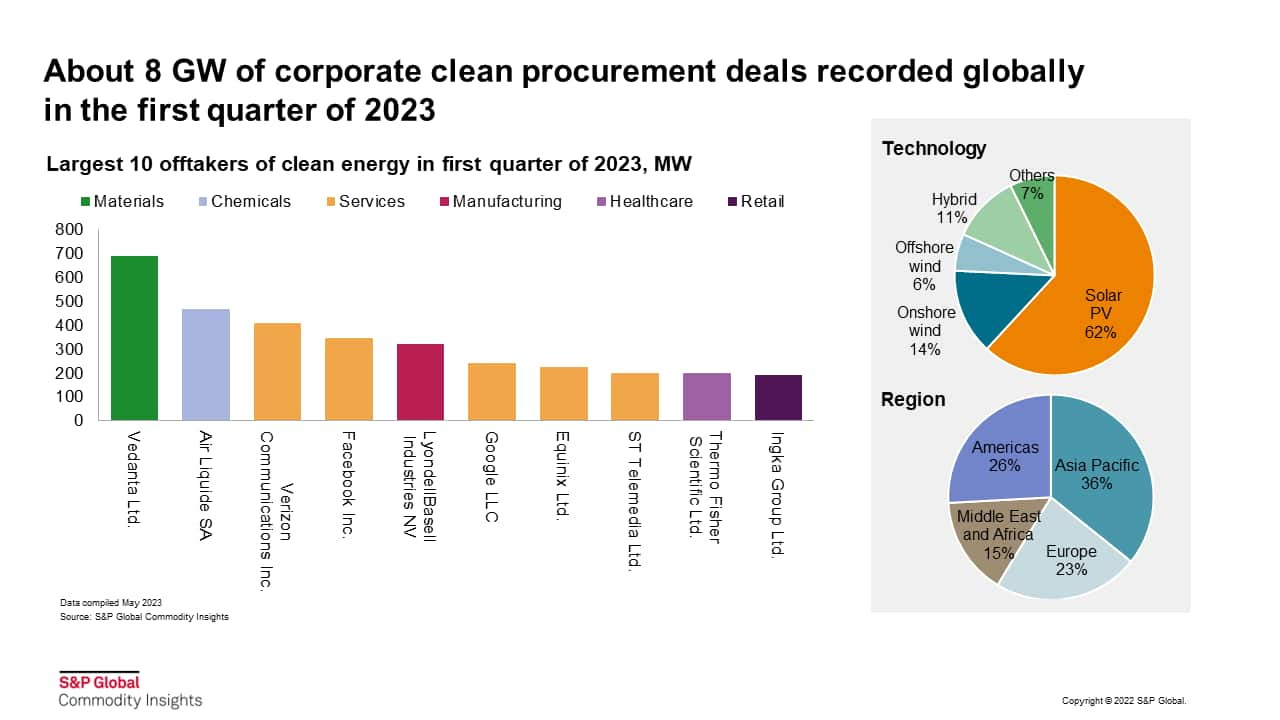

After a record announcement of more than 50 GW corporate renewable procurement deals in 2022, first quarter 2023 had a lukewarm start. S&P Global recorded about 300 clean energy procurement deals totaling about 8 GW in the first quarter of 2023 and registering a year-on-year decline of about 20% in deal numbers and 40% decline in the deal volumes. The slowed down can be attributed to various regional factors including high price volatility and preparation for higher renewable targets in Europe, and uncertainty due to Inflation Reduction Act's implementation in the United States.

Despite a slow start, the market activity is expected to pick up again as the corporate sustainability targets continue to grow, as shown by large increases in RE-100 members, and government policies around the world create increasing demand for emission reductions. While Europe prepares for an ambitious decarbonization strategy with "Fit for 55" regulation. European Union member states will be required to introduce measures such as state guarantees to reduce and manage counterparty credit risk, addressing the major hurdle limiting the growth of the PPA market.

In Asia-Pacific, the Australian government is targeting potential greenhouse gas emission reduction of more than 90% in key industries by 2050. Similarly, Indian government also pushing policy measures to revamp the renewable energy certificates mechanism and is in initial stages of designing a national carbon credit trading scheme.

Solar PV remains the preferred technology globally for corporates to go green, accounting for more than 60% of deals in the quarter. While in Europe offshore wind is the second largest technology procured after solar PV, and in Asia-Pacific hybrid wind-solar projects remains the second most populous choice. In Americas and Middle East and Africa, onshore wind is the second most preferred technology for corporate procurement.

As for offtakers, services companies are leading PPAs volumes in North America, materials and manufacturing sectors lead the renewable procurement in Asia-Pacific.

India-headquartered materials company Vedanta Ltd. emerged as the largest offtaker in Q1 2023 with 0.7 GW clean energy procurement announcement in Q1 2023 in the local market, followed by France-based chemicals company Air Liquide SA announcing 0.5 GW renewable procurement in South Africa. US-based telecom service provider Verizon Communications Inc. is the third largest offtaker of clean energy with 0.4 GW of procurement announcement in this quarter.

Deal type varies based on market with corporations choosing the best options available based on regulatory and market restrictions. Majority of markets in Asia-Pacific enter in self-generation contracts for renewables, while third-party and virtual PPAs are preferred in developed markets. Markets in Asia-Pacific region are undergoing several reforms to allow more market-based options including Mainland China's green power trading which show an increase in volume led by large state-owned enterprises procuring green energy to meet their commitments.

Apart from the direct procurement there is momentum in the environmental attributes market with issuance and redemption volumes increasing. In the first quarter of 2023, International renewable energy certificates (I-RECs) demand growth outpaced supply issuance and redemption grew by 33% and 66% respectively YoY and Brazil becomes the largest market. Among key markets, I-RECs prices made more significant moves in Turkey, due to rising preference for solar and wind technologies.

On the other hand, India's local REC mechanism undergoes change with inclusion of hydro projects and allowing for bilateral trading of green attributes in addition to trading on exchange. India also removed the regulated pricing bands for trading of RECs. These measures are expected to lead to market-based price determination for RECs in India and increase the demand from corporations with voluntary targets in addition to the compliance market.

Learn more about our offering for clean energy procurement.

Would you like a demo of our Clean Energy Procurement service? Contact us directly.

Ankita Chauhan is a principal research analyst for renewable energy in South Asia.

Posted on 6 June 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-announcements-dip-in-the-first.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-announcements-dip-in-the-first.html&text=Corporate+renewable+procurement+announcements+dip+in+the+first+quarter+with+quick+rebound+expected+later+in+2023++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-announcements-dip-in-the-first.html","enabled":true},{"name":"email","url":"?subject=Corporate renewable procurement announcements dip in the first quarter with quick rebound expected later in 2023 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-announcements-dip-in-the-first.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Corporate+renewable+procurement+announcements+dip+in+the+first+quarter+with+quick+rebound+expected+later+in+2023++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-announcements-dip-in-the-first.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}