Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 18, 2023

Competitive tenders drive the deployment of renewables in Africa and the Middle East

Overview of renewables tenders in Africa and the Middle East

Competitive tenders are one of the preferred policy mechanisms to accelerate the implementation of large-scale solar and wind projects in Africa and the Middle East. They provide a common framework that aims to mitigate the risk associated with some of the less developed local markets and stakeholders in the sector. Ambitious renewables targets and commitment to an energy transition path have ramped up procurement and accelerated competitive tenders' timelines. However, the success rate differs across markets. S&P Global Commodity Insights recently analyzed the tender landscape across the region and published a report on the topic within its Global Power and Renewables service.

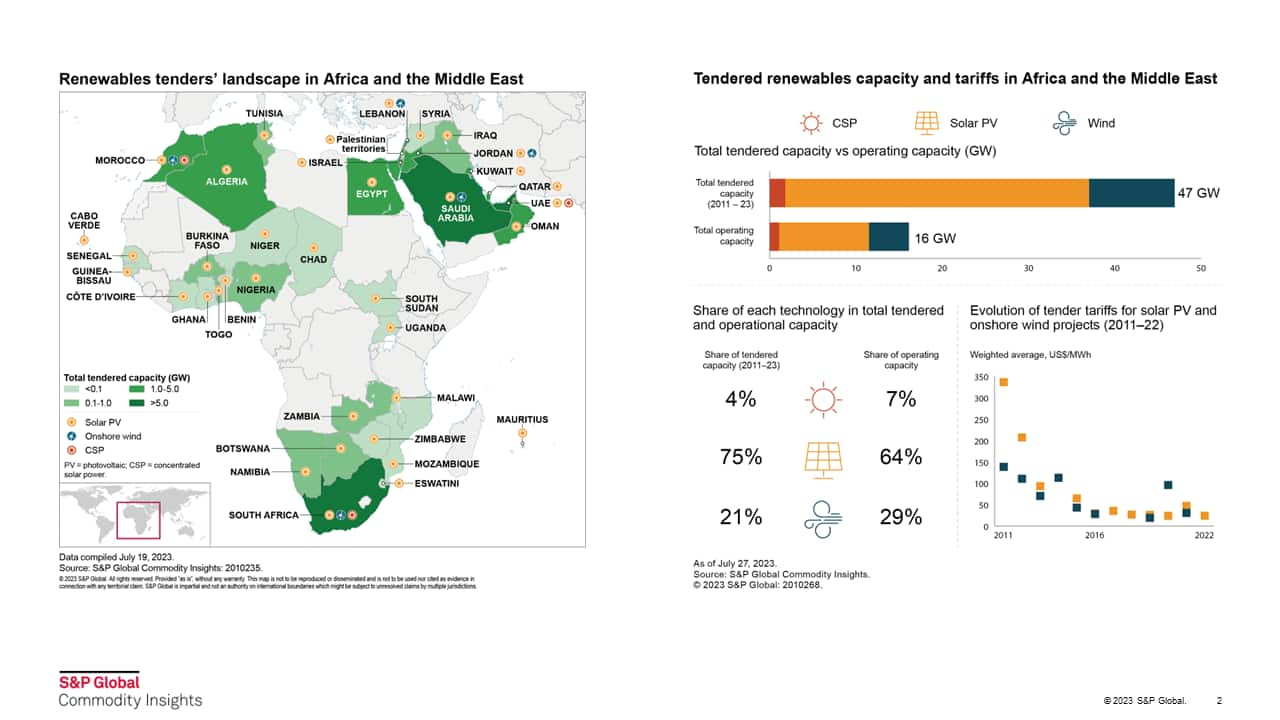

The region has auctioned nearly 50 GW of renewable energy capacity in the past decade, most of which being solar photovoltaics (PV), followed by onshore wind and concentrated solar power (CSP). However, only one-third of that capacity is currently online, mostly owing to long lead times to bring projects from the award date to commercial operation.

Markets in Africa and the Middle East differ widely by size, resources, maturity and risk, but generally, utility-scale projects are largely driving the build-out in the Middle East and North Africa, whereas distributed solar systems are more prevalent across Sub-Saharan Africa to support rural electrification programs. Within the region, South Africa, the UAE and Saudi Arabia are leading the way in tendered volumes, with the latter also achieving the lowest prices.

Exceptionally good sites and conditions for solar PV in particular, alongside generous government support and long duration power purchase agreements (PPAs), have contributed to record-low tender tariffs across several Middle Eastern markets, pushing average price for solar PV tenders below US$20/MWh. The UAE and Saudi Arabia have recently ramped up their renewable energy deployment with mostly GW-scale solar PV projects developed by well-established IPPs. This prevalence of solar PV as an abundant, low-cost and fast-to-deploy technology has overshadowed wind potential in the Middle East. However, GW-scale tenders are being planned, particularly in Saudi Arabia, where the government seeks to procure 16 GW by 2030.

In Africa, the dependence on equipment imports and high exposure to global prices are reflected in the bid prices submitted over time in large-scale auctions. Tariffs have declined in the past decade as costs have dropped globally, particularly for solar PV components. Onshore wind tariffs have reached low levels in North African markets such as Morocco and Egypt, where exceptionally high wind speeds have supported the deployment of projects from the early 2000s. Meanwhile, the involvement of multilateral institutions such as the World Bank in regional renewables tenders is important to provide guarantees in unknown and developing markets and ensure transparency at competitive conditions.

Local and international developers have played an important role in the region's renewables build-out, particularly in Sub-Saharan Africa. Experience with solar and wind projects and the competitiveness of specialized players has allowed the sector to take off in markets with no track record and facilitated a convergence of local tender tariffs with global prices. The participation of IPPs in the renewables sector was in some cases an exception to local market structures, where vertically integrated, state-owned utilities have controlled generation assets. Currently, international renewables companies and IPPs hold most awarded capacity in the region's renewables auctions, with public authorities and local utilities keeping a marginal but important role, particularly in North African and Middle Eastern markets where their involvement - through allocation of land for renewable tender projects and/or participation in asset ownership - has allowed project companies to bid at lower tariffs.

As renewable energy penetration grows in these markets and more complex regulatory mechanisms are developed, tender requirements may change going forward as shown by some procurement rounds with more sophisticated terms. Tenders mandating some form of energy storage have started appearing in the region, alongside dedicated storage projects and high capacity-factor requirements. Renewables tenders targeting corporate offtakers are also limited in the region, due to a lack of or early-stage regulation for wheeling power through a utility or for direct contracts limit growth in this space, but there is high market potential driven by reliability challenges, high energy costs and commitment to decarbonization.

Learn more about our research in our Global Power and Renewables and Clean Energy Procurement offerings.

Miguel Barros Brito is an analyst at S&P Global Commodity Insights and is part of the Low Carbon Electricity team.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcompetitive-tenders-drive-the-deployment-of-renewables.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcompetitive-tenders-drive-the-deployment-of-renewables.html&text=Competitive+tenders+drive+the+deployment+of+renewables+in+Africa+and+the+Middle+East+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcompetitive-tenders-drive-the-deployment-of-renewables.html","enabled":true},{"name":"email","url":"?subject=Competitive tenders drive the deployment of renewables in Africa and the Middle East | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcompetitive-tenders-drive-the-deployment-of-renewables.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Competitive+tenders+drive+the+deployment+of+renewables+in+Africa+and+the+Middle+East+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcompetitive-tenders-drive-the-deployment-of-renewables.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}