Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 29, 2014

Caveat Emptor: Take the conventional approach when acquiring unconventional resources

“Caveat Emptor”—Let the Buyer Beware. Those considering acquisitions in unconventional resource basins would be wise to follow this conventional rule of thumb for M&A buyers, and “do the due”, as in due diligence.

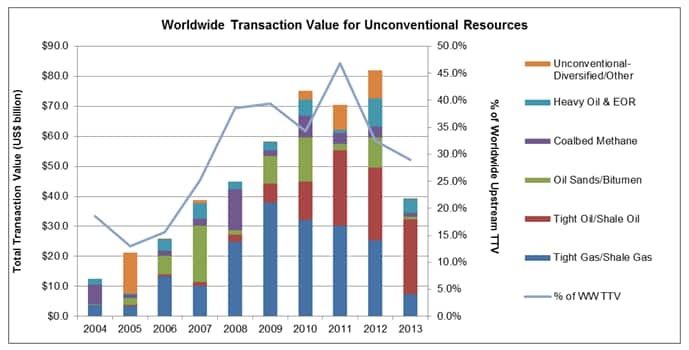

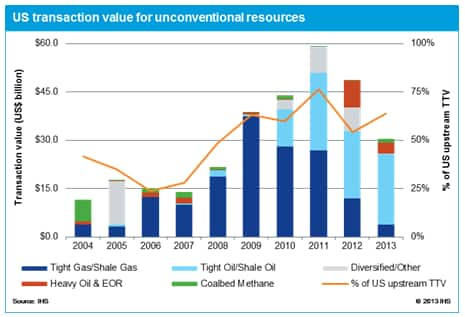

Unconventional resources have become a prime target for upstream M&A buyers--many that needed to establish entry into this sector and supplement modest organic conventional growth profiles. During the past decade, there have been more than $450 billion worth of acquisitions of unconventional resources, including more than $300 billion during a buying frenzy from 2008-2012, with 90% of it targeting North America. While it is true that global unconventional resource M&A spending did decline by half to around $40 billion during 2013, did this indicate that buyers were exercising more caution? Not necessarily, as M&A spending on global unconventional resources declined in conjunction with the overall slowdown in activity in the worldwide upstream M&A market in 2013 where transaction value also fell by nearly half to approximately $135 billion. In other words, M&A spending on unconventional resources remained around 30% of total global upstream M&A deal value in 2013, close to the same market share as during the record spending year on unconventional resources of 2012. In the US, moreover, unconventional market share actually increased during 2013 to nearly two-thirds of US upstream transaction value.

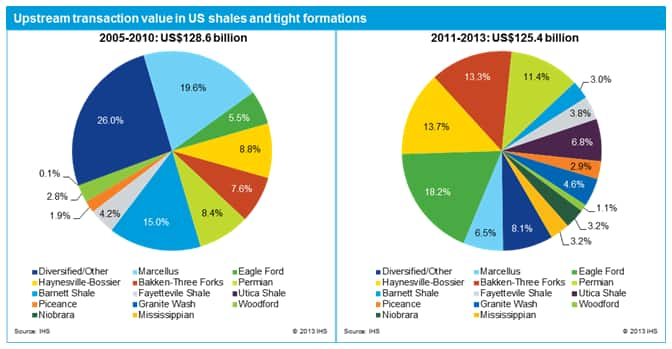

Since the advent of the shale gas and tight oil revolutions, many buyers and investors have viewed the unconventional resource market as a homogenous entity. However, it is critical to be aware that extremely varied drilling and financial return results between and within a multitude of unconventional resource basins (and even within the same counties within particular US basins), has debunked this notion and is demonstrating that good old fashioned due diligence to understand operational assets and acreage is more important than ever when considering acquisitions of unconventional resources.

So what cautionary tales do recent acquisitions tell? They indicate that now more than ever, buyers need to do stringent due diligence when considering acquisitions in unconventional resource basins.

BHP’s $15 billion corporate acquisition of Petrohawk Energy in mid-2011 (all-cash offer at a 65% premium), and its subsequent multi-billion dollar financial writedowns of US unconventional resource assets, highlight the old adage that timing is (mostly) everything, in addition to what type of assets are acquired. A hindsight lesson is that at the height of domestic E&Ps seeking well-heeled overseas buyers desperately seeking entry into North American unconventional resources--do not rush to buy unconventional natural gas-weighted assets when natural gas prices are over $4.50 per Mcfe at the time of acquisition, only to see them fall to around $3.25 per Mcfe a year later and remain below $4.00 two years later.

Even strategic planning master ExxonMobil has been the victim of poor M&A timing given the continued weakness in US natural gas prices since its largest corporate upstream acquisition after the merger of Exxon and Mobil. ExxonMobil’s $40 billion takeover of XTO Energy in late 2009 was announced when natural gas prices were over $5.50 per Mcfe, a level that had been sinking enough since mid-2008 to convince the management of XTO Energy that it was the right time to sell.. What lessons do the BHP and ExxonMobil’s acquisitions teach us? For one, if you do make a forecasting mistake on near term direction commodity prices, it helps, as in ExxonMobil’s case, to have a 30 year time horizon for your acquisition play on the growth of domestic natural gas usage (and it sure doesn’t hurt to have diverse global integrated energy operations spewing tens of billions of dollars of cash flow rather than core exposure to a struggling mining commodity industry like BHP).

While both of these huge corporate acquisitions included massive strategic entry into both dry natural gas plays and plays with oil & liquids upside potential when natural gas prices were stronger, one buyer was better served in its due diligence by considering its overall ability to withstand the impact of a near term hit from commodity prices that are inherently volatile. The bottom line? Despite poor timing on both scores, BHP’s share price is down about 25% since the Petrohawk takeover while ExxonMobil’s is up around 25% since the XTO deal.

While North America has accounted for around 90% of global unconventional resource transaction value since 2008, recent deals by cross-border buyers into emerging international unconventional resource basins (Bowland Shale in the UK and the Vaca Muerta Shale in Argentina) also highlight that the due diligence of monitoring quickly shifting political conditions can also be critical. Buyers need to often move fast as political and regulatory winds shift, such as with the UK lifting its ban on fracking and the Argentine government welcoming and incentivizing foreign investment into a new basin (after previously recently expropriating Repsol’s YPF Argentine holdings). Regardless of the due diligence spent on political considerations, at the end of the day in the M&A market, from a financial perspective, profiting (for you and your shareholders) from the assets you are acquiring should be the ultimate goal as you undertake your due diligence.

Uneven drilling results highlight that due diligence for the actual assets and operations will remain paramount. Even in the top performing Eagle Ford play, buyers need to be diligent in understanding the location and performance of the assets under evaluation. Devon Energy likely engaged in lengthy due diligence to identify the best acquisition candidate for the $6 billion it recently spent acquiring assets from one of the top performing operators there, GeoSouthern Energy.

In M&A, optimistic buyers believe that someone else’s trash can be someone’s treasure. With massive volumes of unconventional resources beckoning and many companies facing tepid organic growth, M&A buyers should not lose sight of the conventional M&A rules of buyer beware and undertaking required due diligence. Like Mike Brady of the Brady Bunch seeking to preach “Caveat Emptor” to his son Greg when he considered spending $100 on a used car, there certainly is wisdom in taking this conventional “buyer beware” approach when considering spending $100 million, or $100 billion for that matter, on acquiring unconventional resources!

Posted 29 January 2014

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcaveat-emptor-take-the-conventional-approach-when-acquiring-unconventional-resources.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcaveat-emptor-take-the-conventional-approach-when-acquiring-unconventional-resources.html&text=Caveat+Emptor%3a+Take+the+conventional+approach+when+acquiring+unconventional+resources","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcaveat-emptor-take-the-conventional-approach-when-acquiring-unconventional-resources.html","enabled":true},{"name":"email","url":"?subject=Caveat Emptor: Take the conventional approach when acquiring unconventional resources&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcaveat-emptor-take-the-conventional-approach-when-acquiring-unconventional-resources.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Caveat+Emptor%3a+Take+the+conventional+approach+when+acquiring+unconventional+resources http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcaveat-emptor-take-the-conventional-approach-when-acquiring-unconventional-resources.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}