Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 16, 2020

Carbon prices: Taxes and carbon markets increasing to drive company behavior

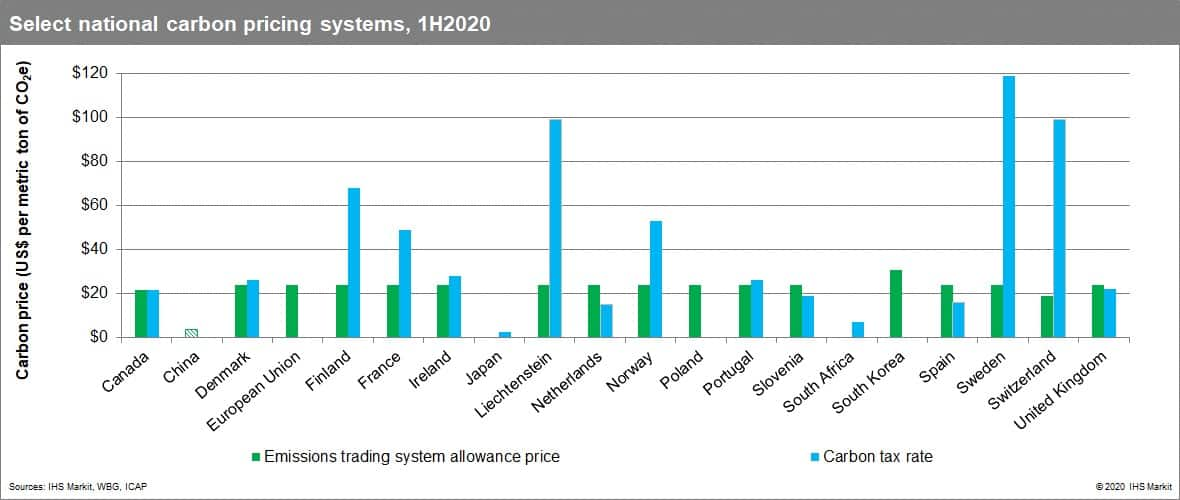

Carbon pricing mechanisms—emissions trading systems (ETSs) and carbon taxes—continue to increase globally, with a number of countries having both. IHS Markit monitors carbon prices on an ongoing basis and recently reviewed 30 jurisdictions to assess national and sector level systems. While the United States has significant regional markets in California and on the east coast, there is no national system, and so is excluded. China is in the process of rolling out a national pricing mechanism, and therefore included.

Key implications from our recent reporting include:

- Ten of the 20 largest national GHG emitters have some form of carbon price in place, with more policies under discussion or in development.

- Twenty-six of the 30 jurisdictions surveyed implemented carbon taxes.

- Carbon taxes averaged (simple not weighted) nearly 24% higher than averaged carbon market prices, reflecting the complexity of combining regulated allowance levels and emissions with participant decisions and other factors.

- The power sector and energy-intensive industries are subject to carbon pricing in 29 of the 30 markets. Although vehicle fuels are only covered in 17 of the markets, they are priced higher.

There is an extremely wide range of pricing across countries as indicated, with a number still at levels so low they risk having little impact. However, with the number of net zero targets increasing, including the September announcement from China, the use of carbon pricing and the level of prices will rise.

To learn more about our executive news for the climate and cleantech sectors, visit our page for Executive Briefings: Climate and Cleantech.

Posted on 16 November 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcarbon-prices-taxes-and-carbon-markets-increasing-to-drive-com.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcarbon-prices-taxes-and-carbon-markets-increasing-to-drive-com.html&text=Carbon+prices%3a+Taxes+and+carbon+markets+increasing+to+drive+company+behavior++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcarbon-prices-taxes-and-carbon-markets-increasing-to-drive-com.html","enabled":true},{"name":"email","url":"?subject=Carbon prices: Taxes and carbon markets increasing to drive company behavior | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcarbon-prices-taxes-and-carbon-markets-increasing-to-drive-com.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Carbon+prices%3a+Taxes+and+carbon+markets+increasing+to+drive+company+behavior++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcarbon-prices-taxes-and-carbon-markets-increasing-to-drive-com.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}