Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 20, 2021

Can Tanzania revive its LNG export prospects?

A push by the Tanzanian government to reinvigorate a stalled LNG export project led by Equinor and Shell must overcome longstanding uncertainties around commercial terms and global market dynamics. For LNG and the hydrocarbon sector more broadly, Tanzania will likely have to make improvements to fiscal terms and contract sanctity if proposed developments are to be revived and new exploration encouraged.

Incoming president renews pursuit of LNG

Tanzania's new head of state, Samia Hassan, in April called on the

energy ministry and international oil company (IOC) operators

Equinor and Shell to expedite a stalled plan to monetise 35 Tcf of

gas discoveries via a USD20-billion onshore liquefaction plant.

Hassan also called on the ministry to find new investors if a

development agreement can't be reached with Equinor and Shell.

Dash for gas hampered by commercial, fiscal and

contractual hurdles

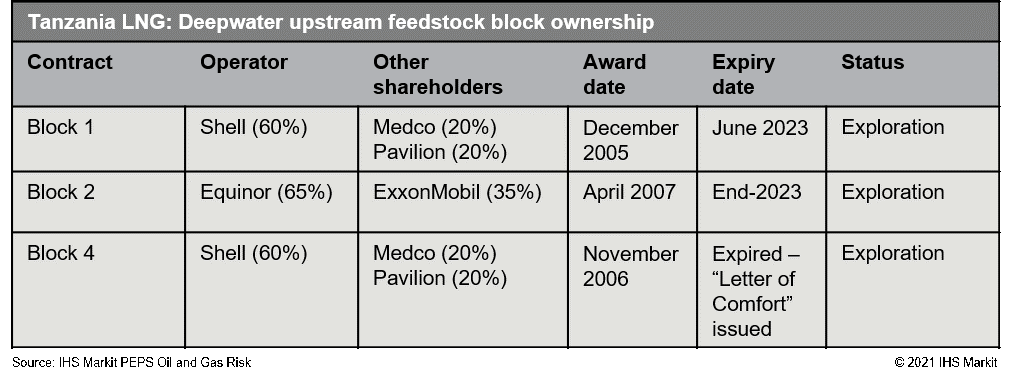

Tanzania's deepwater gas resources - discovered between 2010 and

2018 - remain untapped despite their huge economic potential.

Equinor and Shell had originally envisaged the start-up of the

proposed two-train, 10 million tons per annum (MMtpa) onshore

Tanzania LNG plant this year, but start-up now looks unlikely until

after 2030 at the earliest - if at all.

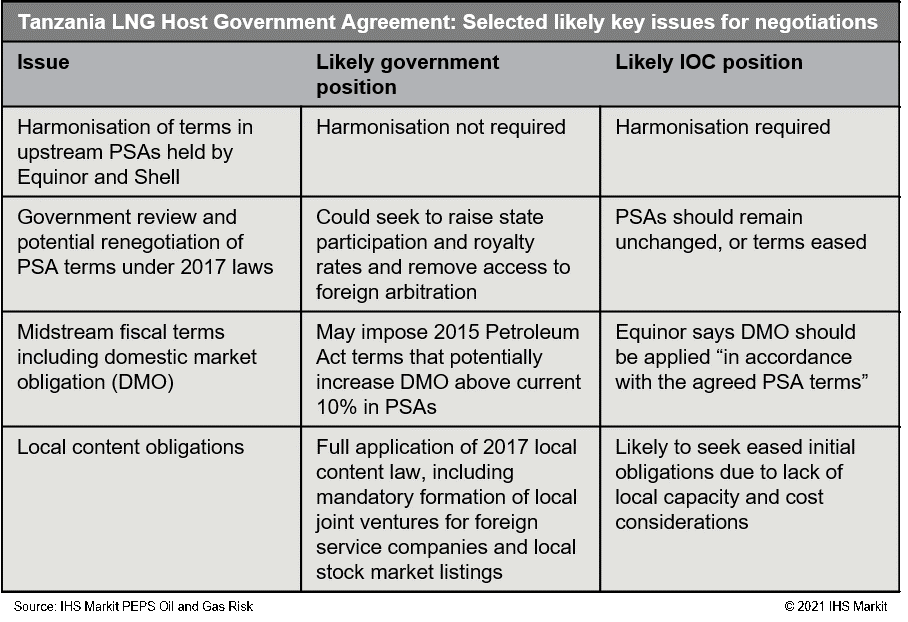

A final investment decision (FID) on the plant is contingent on the signing of a Host Government Agreement (HGA) between the state and the IOCs, which would establish the investment framework including commercial terms. High and fluctuating costs and a shifting global gas market make the economics of the project tenuous, and they were further undermined by toughened tax and contractual terms introduced by Tanzania's 2015 Petroleum Act, 2016 Finance Act and, in particular, three 2017 natural resources laws championed by previous president John Magufuli. Those laws enabled the authorities to renegotiate production sharing agreements (PSAs) signed by previous governments in which terms are deemed "unconscionable". In any renegotiation, the government would likely seek to increase tax take and state participation, as it has successfully done in the mining sector.

Battle lines drawn, but compromises

needed

Although Hassan's desire to reinvigorate the LNG project seems

positive - at least relative to Magufuli's approach - the

government will need to examine the barriers created by its own

policies. Equinor has repeatedly stated that contract sanctity and

stability are "necessary elements for the success of LNG

development". Equinor and Shell both agree that HGA talks should

resume this year and be concluded quickly, pointing to a shrinking

window of opportunity to monetise the gas resources due to climate

concerns.

Despite agreement between government and IOCs on the need to expedite and conclude HGA talks, reaching the necessary compromises may be challenging. Fiscal terms relating to upstream and midstream elements and local content obligations are probably still the main sticking points between the parties. Should compromises not be reached on key issues based on the current two-train onshore concept, Equinor and Shell could seek to redesign the project, or walk away if the economics remain uncompetitive.

Meanwhile, Hassan's stated intent to find other, more willing

investors if talks aren't fruitful is probably unrealistic. Should

HGA talks fail to progress, in theory the government could reach an

agreement with the IOCs under which they relinquish the blocks, but

there are few technically competent replacements that could

monetise the deepwater gas for both export and domestic use. Other

majors are either focused on LNG investments elsewhere and/or are

reducing future spending commitments. International national oil

companies (NOCs) such as Petronas could perhaps step in for an FLNG

solution, but fundamentally the government's options to monetise

the gas are very limited.

Window for LNG may be shut, but eased policy can still

boost hydrocarbon sector

Years of wrangling and inertia over Tanzania LNG shows that the

government and IOCs are still struggling to overcome internal

hurdles. Yet the project may already be compromised by the

exogenous forces of global LNG market supply and demand combined

with energy transition considerations. Even if HGA terms are

agreed, Tanzania LNG may struggle to attract buyers and financing

amid an anticipated market oversupply until the end of the 2020s,

which is unlikely to ease sufficiently even if neighbouring

Mozambique's LNG programme is delayed.

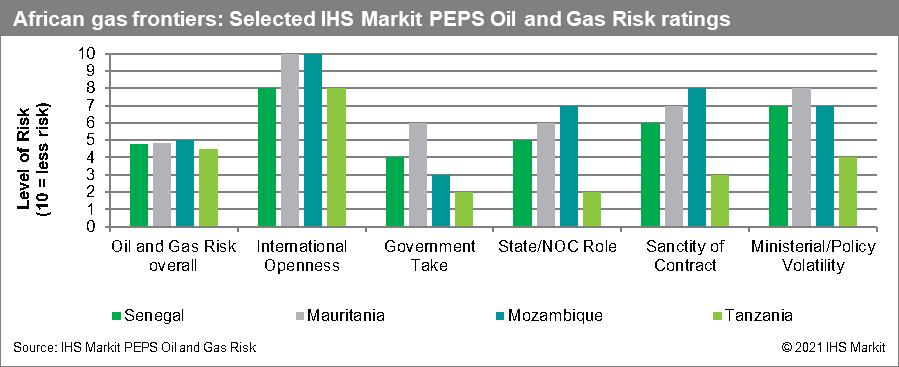

That said, Hassan's apparent desire to accelerate LNG development may be a positive indicator for broader exploration and production activity in the country. Much will depend on Hassan's ability to tighten her grip on sector decision-making and follow through on stated aims. Her decisions on whether to renegotiate PSAs following the sector-wide contract reviews, and her approach to Tanzania's currently uncompetitive fiscal terms in light of planned new licensing will be particularly important. Tangible improvements are needed on fiscal terms and contract sanctity if proposed developments and new exploration are to be revived at scale.

Screen upstream opportunities and above-ground risk with

PEPS from IHS Markit.

The full report, Government and IOC warning shots complicate Tanzanian LNG revival, is available to PEPS subscribers.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-tanzania-revive-its-lng-export-prospects-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-tanzania-revive-its-lng-export-prospects-.html&text=Can+Tanzania+revive+its+LNG+export+prospects%3f++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-tanzania-revive-its-lng-export-prospects-.html","enabled":true},{"name":"email","url":"?subject=Can Tanzania revive its LNG export prospects? | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-tanzania-revive-its-lng-export-prospects-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Can+Tanzania+revive+its+LNG+export+prospects%3f++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-tanzania-revive-its-lng-export-prospects-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}