Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 10, 2019

Can Ethane go Global?

With the rise in US natural gas and oil production US ethane availability has increased significantly. US natural gas production is projected to grow by more than 50%, from approximately 80 billion cubic feet per day (Bcf/d) in 2017 to 123 Bcf/d by 2040, propelled by the development of unconventional oil and natural gas plays and basins upstream activity.

The US is the world's largest exporter of natural gas liquids (NGL) in total, including ethane and propane and butane. The US exports NGL internationally through pipeline interconnections and over water via ships/vessels. During the past few years, the rapid increase in NGL available for recovery in the US drove NGL prices down including ethane. Lower prices in the case of ethane caused ethylene/propylene producers both domestically and abroad to take notice of an attractive petrochemical feedstock option even after accounting for logistics costs associated with natural gas gathering, natural gas processing, NGL fractionation in to purity ethane, and ethane storage and pipeline transportation.

Available ethane is significant and more than US ethane demand and the only demand sink for purity ethane is as a petrochemical feedstock. Total annual US ethane exports to international destinations via pipeline and waterborne vessels is currently approximately 0.28 million barrels per day (b/d) and is expected to reach 0.58 million b/d by 2030. Will availability of US ethane for international markets alone mean ethane will become a global commodity? Let's investigate this hypothesis and conclude.

An opinion and conclusion in relation to ethane becoming a globally traded commodity and global market is bounded by and can be answered by addressing the following questions:

- Will US ethane be readily available and tradeable (waterborne trade) over long distances and economically advantaged over a long-term basis?

- Similarly, will ethane be a fungible good/product, and will this lead to US ethane price to become a global benchmark price?

- Will US ethane prices become interconnected and interrelated to other petrochemical feedstocks from an onshore, regional and global perspectives?

- Is there or will there be enough US ethane market liquidity (volume and pricing) to support the free trade of ethane while at the same time allow for the buyers and sellers to effectively manage price risk?

- Will there be or is there enough transportation and logistics capacity to support global ethane trade?

- Will the transportation costs and logistics costs be discoverable and therefore further support ethane becoming a fungible good/product?

- Will or can the US ethane market price evolve and become a global benchmark price?

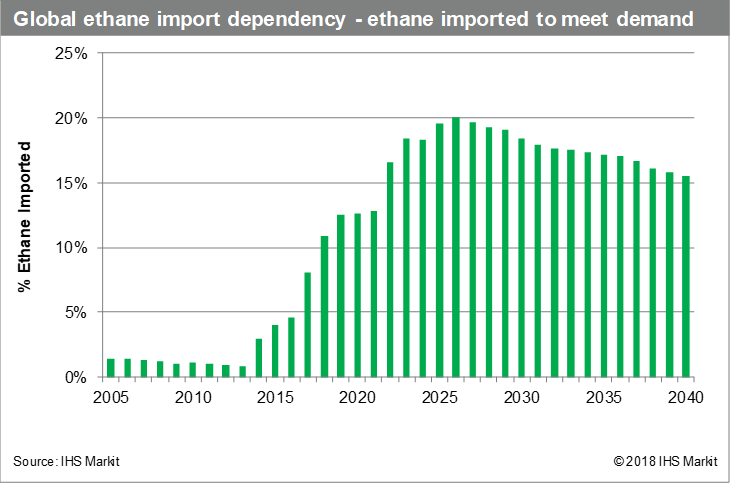

US ethane is readily available but will not be able to support the world's appetite for competitively priced US ethane versus naphtha and/or propane over the long term. As shown in the graph below US ethane has a limit, reflected by "global ethane import dependency". This is a measure of ethane exported (currently from only the US) to meet total global demand. Over time US ethane will not be sufficient to meet growing demand and therefore an international market and traded commodity market for ethane will not emerge. US ethane exports to international markets to meet growing demand is expected to peak in 2026, reaching a global import dependency measure of 20%. The global ethane import dependency reflects the volume of US ethane production consumed as a proportion of total ethane consumed as a petrochemical feedstock on a global basis. US ethane exports increase and make up approximately 20% of global ethane supplied by 2026 and after 2026 global ethane demand continues to rise and is supplied by in-country supplies. For example, Saudi Arabia demand for ethane as a petrochemical feedstock increases and the increasing demand is met by Saudi Arabia's own domestic production. The situation is the same in other countries and correspondingly global ethane demand becomes less dependent on US ethane supplies.

IHS Markit Midstream & NGL market experts are available to address your long-term NGL supply, demand, trade, pricing, and midstream related cost questions. The question posed here and many more can be addressed via our NGL Markets Annual Strategic Workbooks.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-ethane-go-global.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-ethane-go-global.html&text=Can+Ethane+go+Global%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-ethane-go-global.html","enabled":true},{"name":"email","url":"?subject=Can Ethane go Global? | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-ethane-go-global.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Can+Ethane+go+Global%3f+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-ethane-go-global.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}