Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 16, 2020

Biofuels and refining: Is decarbonization a joint opportunity?

The traditional refinery and biofuels sectors are at a point of convergence - one caused by falling demand for petroleum fuels, driven by decarbonization, and aided by food demand slowing to a rate below agriculture productivity growth. Traditionally competitive in the fuels sector, oil and agriculture are now confronted with shared short-term and strategic issues that, if acted on, will materially change the direction of each industry. However, a clear, stable policy and regulatory framework is needed to realize the full potential of oil/agdecarbonization options.

Policy evolution of biofuels: How did we get

here?

Policy support has been necessary for the development of biofuels.

The relative importance of supporting or enabling policies varies

by country and over time but generally biofuels are driven by three

major policy areas: agricultural support, energy security, and

environmental policies related to urban air quality and

decarbonization.

The table shows the current ranking of the three major biofuels policy drivers by country. Today, decarbonization is the major policy force in the Organization for Economic Cooperation and Development (OECD) countries. For the rest of the world (except China), agriculture and the local economy are the most important factors.

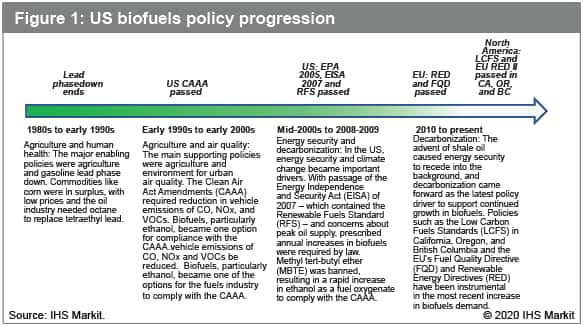

The US shows how the supporting policy for biofuels has changed over time. Figure 1 shows the US biofuels policy progression, from early emphasis on agricultural support to energy security to decarbonization. It also notes EU policy highlights.

The combined impacts of these policies, and many others - including vehicle effeciency standards and maturing demographics - are causing oil demand to fall in most developed countries. This pattern will continue in most countries over the next several years. Going forward, the growth of electric vehicles could accelerate the decline in oil demand.

Refinery and biofuel synergies: Can the two industries

come together at scale?

For the first 25 years of the biofuels industry, the refining and

marketing industries had almost no involvement in terms of

ownership of production. For the most part, these industries were

competitors - only coming together at the distribution terminal or

fuel outlet, when biofuels were blended with gasoline and diesel

fuel.Three key policy events changed the relationship between the

biofuels refining and marketing businesses:

- The 2005 US methyl tert-butyl ether (MTBE) ban as part of the Energy Policy Act resulted in ethanol being used as the oxygenate to meet the Clean Air Act Amendments (CAAA) requirements for reformulated gasoline. A few US refiners bought ethanol plants to ensure supply.

- The EU passage of the Renewable Energy Directive (RED) and the Fuel Quality Directive (FQD) in 2008 and 2009 supported the first renewable diesel plants built in EU countries and Singapore in 2010 and 2011.

- California's passage of the Low Carbon Fuels Standard (LCFS) in 2011 supported the start of the US renewable diesel industry with the first plant on stream in 2013.

The adoption of renewable diesel and jet fuel as a bio-product from conventional oil refineries could be considered the vanguard of continued convergence between the petroleum and bio-based transport fuels supply chain. To date, renewable diesel is the most compatible biofuel with existing refi nery processing. However, as decarbonization policies deepen and spread to other jurisdictions, processing expertise and technologies from the hydrocarbon processing industry could be critical factors for expanding biofuels production from biomass feedstocks.

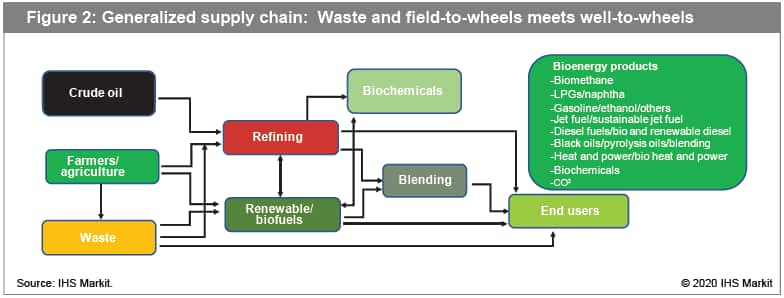

The energy density of bio-oils allowed refineries to directly enter the biofuels production business at scale. The next step in direct refinery production of biofuels will likely be different than renewable diesel and jet fuel. It also will be costlier, due to the low-energy density of other widely available and studied feedstocks. Future integration with the refining and marketing supply chain, particularly with existing refinery operations, will likely require some form of biomass densification. They may also require the use of refinery-based processing technologies and practices (which are much closer to the biomass supply) in existing refineries and biofuels plants (see Figure 2).

Agriculture: Is it a sustainable

solution?

Since the food chain can be a significant CO2 emitter, agriculture

is seen as part of the climate change problem. However, it also can

be part of the solution. Agriculture has the potential to adopt new

technologies, alter farming practices, and increase production

output in a more sustainable way. Linkages into the energy sector

through renewable and biofuels represent a large opportunity to

contribute to decarbonization.

To create carbon reduction pathways between agriculture and energy (and other sectors of the economy), clear policy and regulatory frameworks are needed to fully capitalize on agriculture's greenhouse gas (GHG) emission reduction potential. With these systems in place, farmers will be able to, in effect, "farm for carbon," which will facilitate decarbonization. These activities will initially focus on farming practices - such as more sustainable planting, crop protection, and harvesting techniques. But they could also include carbon sequestration in the soil, seed and crop selection and technology that rewards farmers for carbon reduction.

Based on current consumption trends, there is enough land in production to meet demand, since yield and productivity increases will be sufficient to match quantities needed. However, these projections do not include an increase in biofuels above what current policy mandates require. New policy initiatives would be additive. They also do not include transformative technologies that could increase productivity above baseline projections. These will be areas to monitor in the future.

Where do we go from here?

The separation between the refinery sector and traditional biofuels

is ending, and a new industry structure emerges. How far this goes

may depend on the policy and regulatory framework keeping pace with

technology and markets. The refining sector brings a "refinery

approach" to biofuels production that is underdeveloped. The

traditional agriculture-oriented biofuels industry will benefit

from R&D, technology, and marketing networks. The connection

between the traditional refinery sector and biofuels must be

supported by decarbonization actions, both in the public and

private sectors. Fears of a repeat "food-versus-fuel" debate are

tempered by an adequate productive base in agriculture - one that

can support a feedstock base for the future growth of biofuels

through increased productivity, potential new technologies, and

shifts in consumptive patterns. With these drivers in place, the

stage is set for an expansion in biofuels production, this time in

tandem with - and via active involvement from - the refinery

sector.

Biofuels Value Chain Service - Fundamentalsbased service delivers medium to long-term coverage of the supply chain, from feedstocks to refined products, and to supporting credit/ticket markets, including supply/demand and price forecasts to 2050. Find out more: ihsmarkit.com/biofuels-valuechain-service

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbiofuels-and-refining-is-decarbonization-a-joint-opportunity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbiofuels-and-refining-is-decarbonization-a-joint-opportunity.html&text=Biofuels+and+refining%3a+Is+decarbonization+a+joint+opportunity%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbiofuels-and-refining-is-decarbonization-a-joint-opportunity.html","enabled":true},{"name":"email","url":"?subject=Biofuels and refining: Is decarbonization a joint opportunity? | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbiofuels-and-refining-is-decarbonization-a-joint-opportunity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Biofuels+and+refining%3a+Is+decarbonization+a+joint+opportunity%3f+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbiofuels-and-refining-is-decarbonization-a-joint-opportunity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}