Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

Dec 04, 2023

Between Profit and Policy: The Panna & Mutka Asset's Journey Amidst India's Windfall Tax Changes

In July 2022, India made a significant fiscal policy shift by introducing a Special Additional Excise Duty (SAED) or windfall tax on crude oil producers, signalling a response to the surging global oil prices. This tax was accompanied by an extension of levies on exports of gasoline, diesel, and aviation turbine fuel (ATF) to counter the profit-seeking endeavours in overseas markets.

The windfall tax is designed to activate when international crude prices exceed the $75/b threshold. To balance its impact, Exemptions are granted to producers with annual production in previous year below 2 million barrels (MMb) and on quantities exceeding the previous year's production. Notably, this tax is applied uniformly, regardless of crude quality.

The announcement of the windfall tax in India was unexpected, causing ripples throughout the upstream sector, particularly among private players unaccustomed to direct levies on their crude oil earnings. Projected to contribute billions to government revenue, the windfall tax's full economic implications hinge on awaited implementation directives, making it a subject of intense surveillance and debate in India's evolving energy landscape.

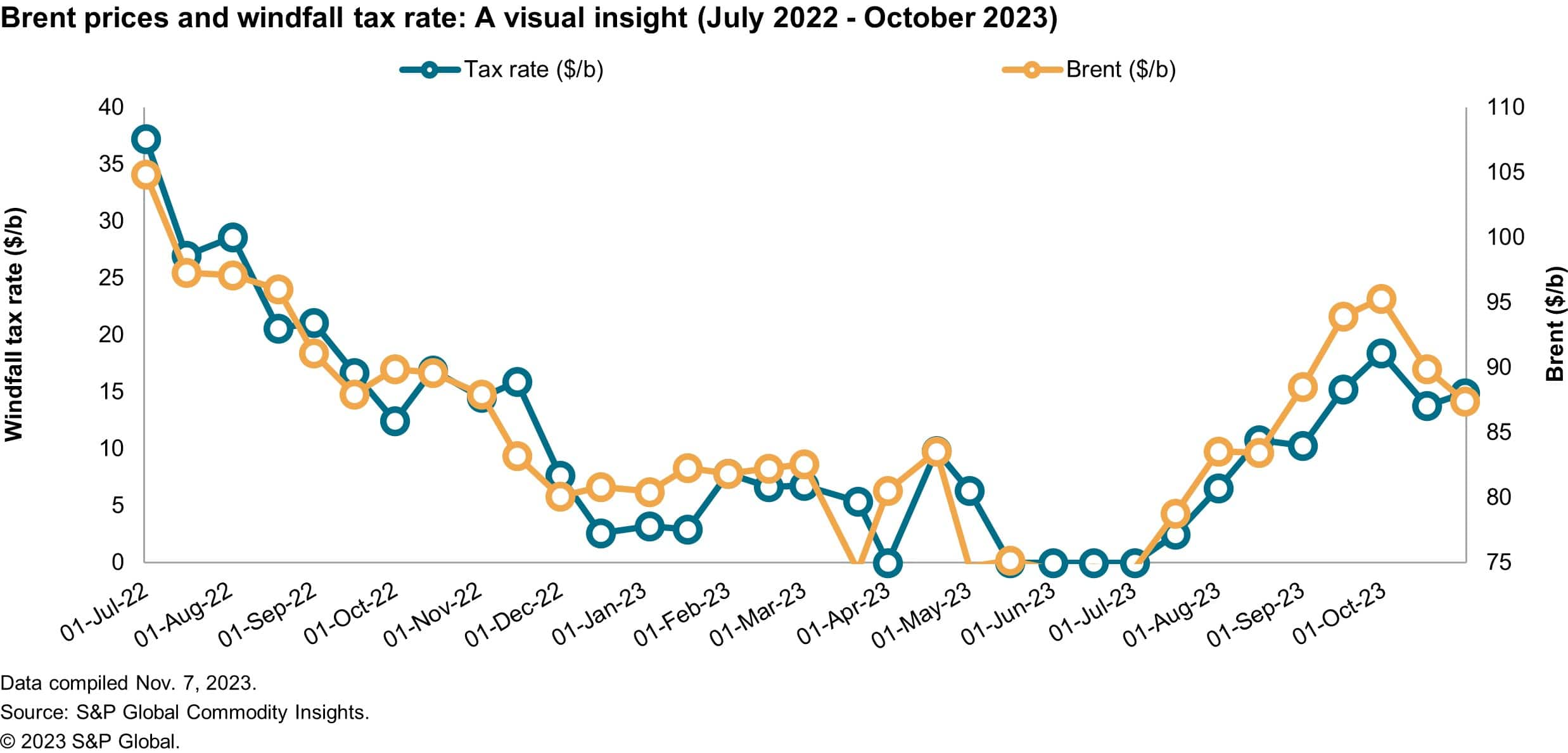

This discretionary nature, subject to government review every 15 days based on the global crude price, adds a unique layer of volatility to the already unpredictable environment of the upstream sector, with a range between 1,600 Indian rupees (INR)/per metric ton (~$2.5/b) and INR 23,250/t (~$37.3/b), since its implementation in July 2022.

Notably, the tax's responsiveness to the price of Brent indicates a direct correlation — higher Brent price leads to a higher windfall tax rate. However, between May and July 2023, as the oil price experienced a drop, the windfall tax was not applied, showcasing the tax's adaptability to market conditions.

To visualize this correlation, the chart below shows the monthly Brent price and the corresponding windfall tax rate from July 2022 to October 2023.

Economic impact on the Panna and Mutka asset:

To assess the specific economic implications of India's windfall tax, we examine its effects on the Panna and Mutka asset, notable for its approximately 93.5 million barrels of oil equivalent in economically recoverable reserves. This asset falls under the Indian Production Sharing Agreements fiscal regime and is fully operated by Oil & Natural Gas Corp Ltd (ONGC). It provides a valuable case study, shedding light on how this tax policy influences the asset's economic attractiveness, ONGC and the Indian government.

Various sensitivities scenarios will be shown, in order to assess the impact of the windfall tax, using the After-tax Net Present Value (AT NPV) @10% nominal discount rate as the main economic metric used for comparison. The economic viability was determined using S&P Global Commodity Insight's Vantage Economic Model considering India's PSA fiscal system, an oil price scenario of $84/b and a gas price scenario of $6.7/Mcf, both oil and gas prices are base 2023, inflated by 2% thereafter, and a 12-month windfall tax rate average (November 2022 to October 2023) of $100/t, depending on the sensitivity.

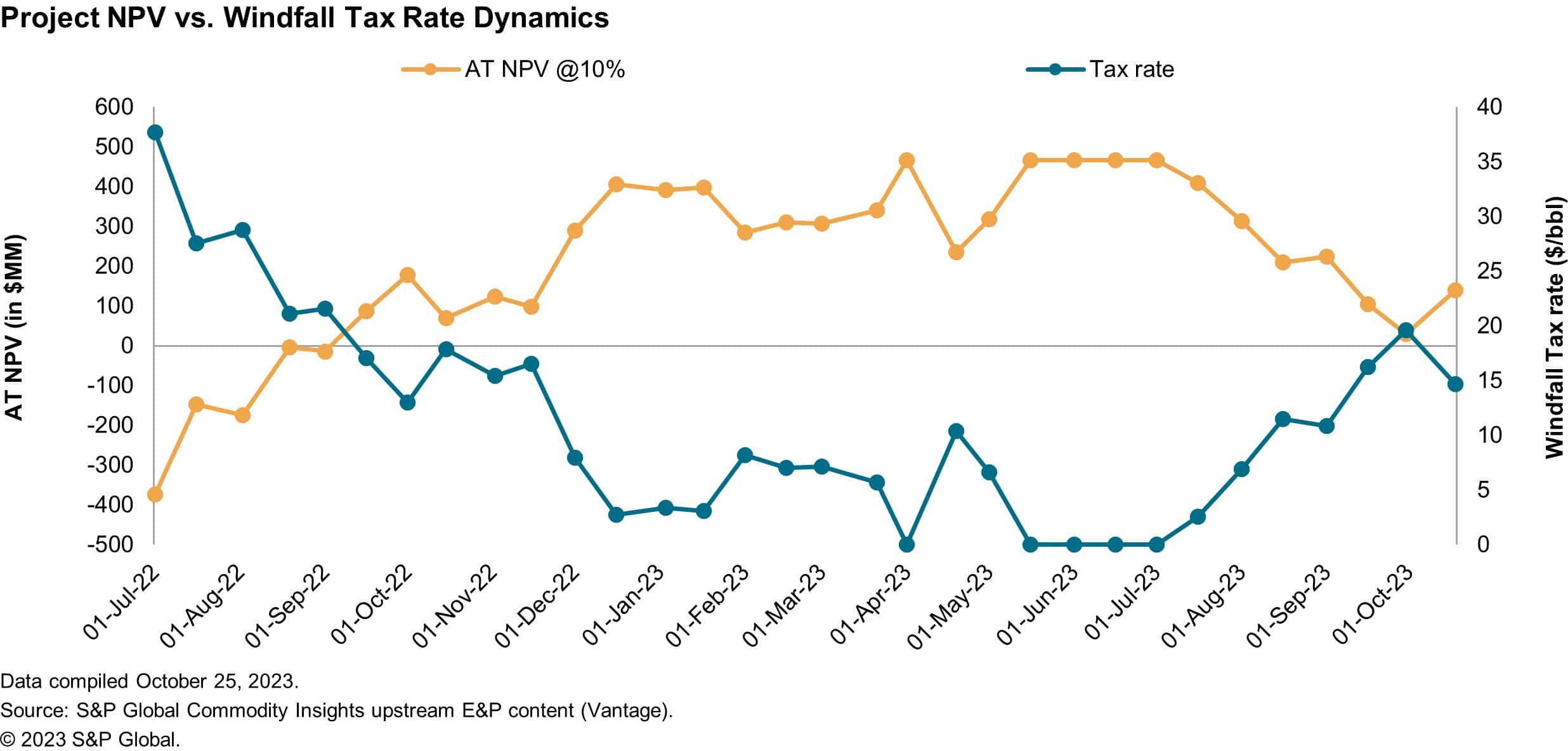

The analysis also relies on government-announced bi-weekly rates. To provide a broader view, Vantage extrapolates these rates from monthly to yearly, offering a comprehensive understanding of the windfall tax's implications over a longer period.

The windfall tax had a significant impact on the project's finances, causing fluctuations in its profitability. Initially, high tax rates led to losses, but as tax rates decreased, the project became profitable. Notably, for the project to be profitable, the tax rate needed to stay around $165/t (~$21/b) or lower, showing how tax rates played a crucial role in the profitability of Panna & Mutka project.

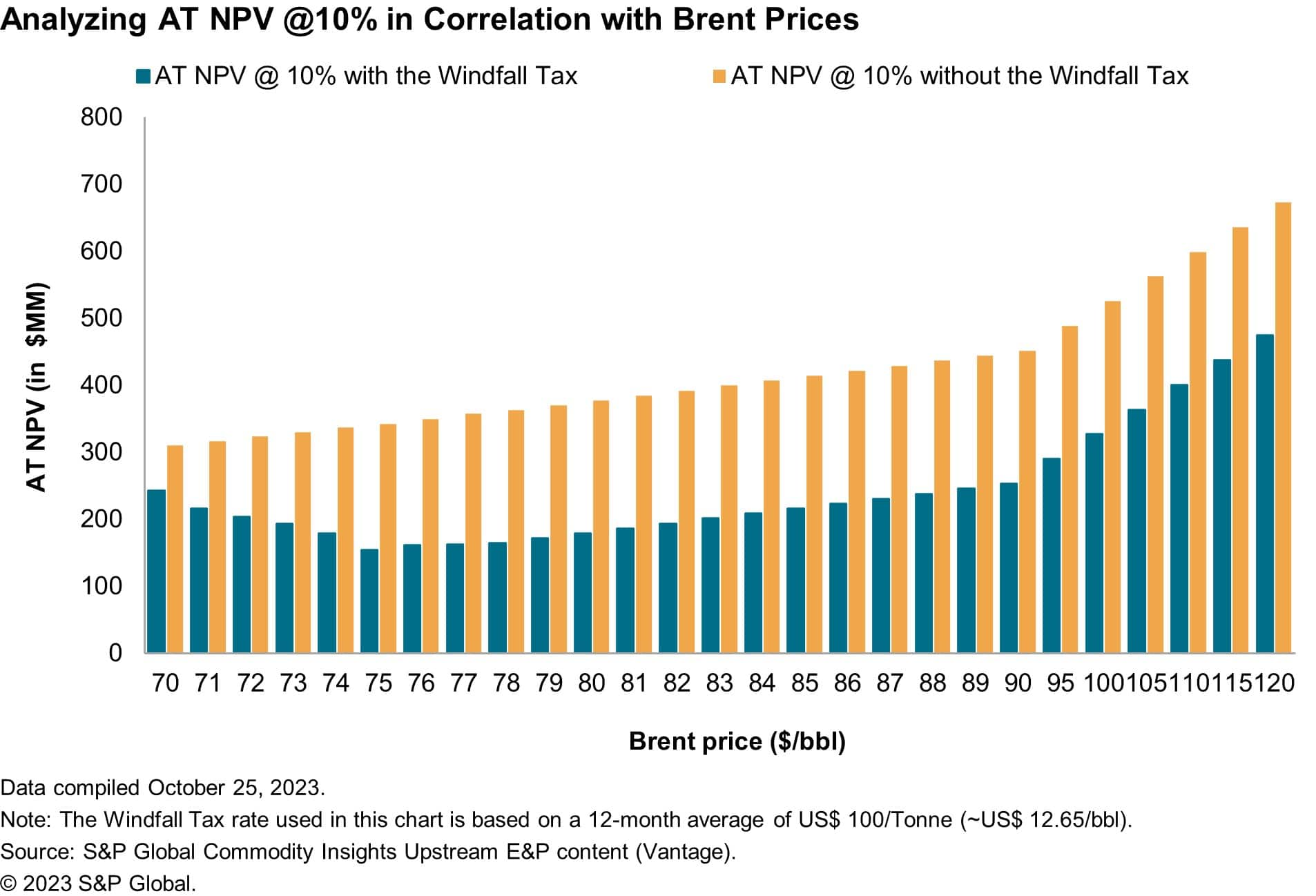

The drop in AT NPV when Brent reaches $75/b is a significant observation, primarily explained by the triggering of India's windfall tax at this price point, which exerts a notable impact on the project's profitability.

It is important to note that the decrease in AT NPV when Brent is below $75/b can be attributed to our Vantage models' assumption of a 2% annual price inflation. This inflation factor accelerates the project's attainment of the $75 threshold, causing the windfall tax to come into effect sooner. Consequently, this results in a higher discounting factor, which adversely affects the AT NPV before reaching the tax-triggering threshold.

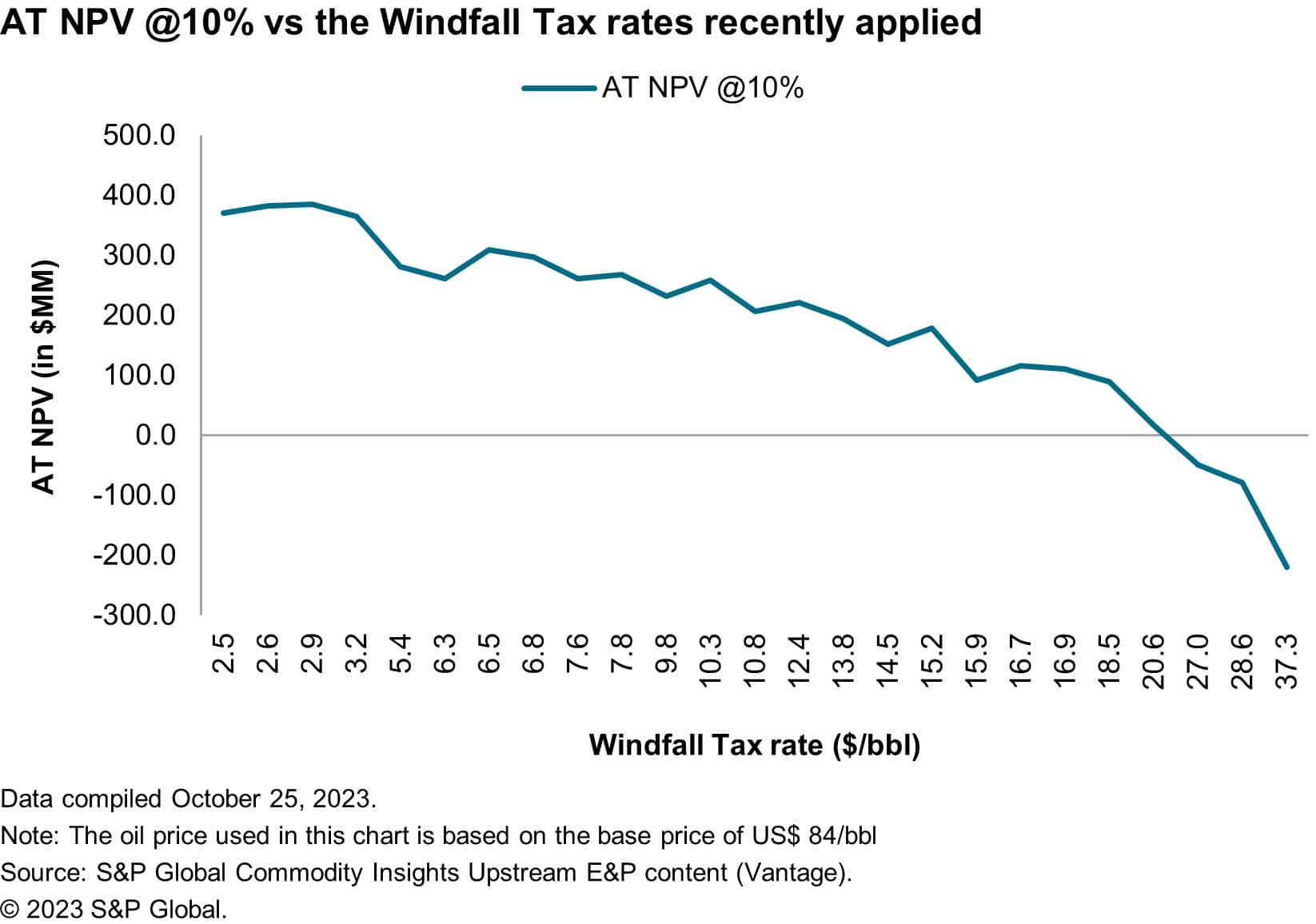

The chart illustrates the negative correlation between ascending windfall tax rates and the project's AT NPV. It showcases a descending trend in AT NPV as tax rates increase, with a distinct turning point where AT NPV transitions from positive to negative, aligning with the project's windfall break-even rate of $165.5/t. It highlights the project's sensitivity to tax rate changes, revealing how higher rates could notably impact the project's profitability.

India's windfall tax and its echoes in the energy sector

India's introduction of the windfall tax, reactive to the global oil price exceeding $75/b, has exerted significant financial pressure on upstream projects, evidenced by the Panna and Mutka asset, as its profitability hinged on careful tax rate calibrations.

On one side, the government is looking to increase domestic oil production to cut rising import bills but on the other side implementing the tax is disincentivizing upstream producers by limiting their profit margins for up to $75/b Brent price. Fiscal stability will remain a key focus to attract foreign investors. As global oil prices fluctuate, the market and industry stakeholders remain vigilant, awaiting further governmental policy shifts.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbetween-profit-and-policy-the-panna-mutka-assets-journey-amids.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbetween-profit-and-policy-the-panna-mutka-assets-journey-amids.html&text=Between+Profit+and+Policy%3a+The+Panna+%26+Mutka+Asset%27s+Journey+Amidst+India%27s+Windfall+Tax+Changes+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbetween-profit-and-policy-the-panna-mutka-assets-journey-amids.html","enabled":true},{"name":"email","url":"?subject=Between Profit and Policy: The Panna & Mutka Asset's Journey Amidst India's Windfall Tax Changes | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbetween-profit-and-policy-the-panna-mutka-assets-journey-amids.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Between+Profit+and+Policy%3a+The+Panna+%26+Mutka+Asset%27s+Journey+Amidst+India%27s+Windfall+Tax+Changes+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbetween-profit-and-policy-the-panna-mutka-assets-journey-amids.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}