Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 02, 2020

Assessing the impact of a second coronavirus wave on fuel demand

Over the course of three weeks in March, the SARS-CoV-2 pandemic cut US gasoline demand by nearly 50% and effectively brought commercial air travel to a halt. Since then, the government lockdown measures, corporate work from home policies, and social distancing enthusiasm that underpinned this demand destruction have all been rolled back. This has led to a steady increase in refined product demand but also, distressingly, a surge in new cases of COVID-19. So far, the country has not experienced a corresponding uptick in deaths, but the current progression of the virus has proved troubling enough that several states have paused or even reversed their "reopening" program.

Clearly, the risk of a dangerous resurgence is rising. Whether or not that risk transforms into a full blown "second wave" is unknowable at the moment. However, <span/>IHS Markit has developed an alternative scenario to our base case outlook for the United States. This "resurgence scenario" includes the following assumptions:

- Widespread reopening of the economy and a recovery in

employment results in a higher virus transmission rate. The virus

transmission will occur primarily in urban areas.

- Limited state-level response to increased COVID-19 case counts.

Most states, particularly the ones that reopened early, will rely

on individuals making prudent choices to reduce the spread of the

virus.

- The general population has social-distancing fatigue and will

be less conservative in their behavior and activities during the

resurgence.

- Those states that do reimpose lockdowns and individuals who

choose to return to a shelter-in-place lifestyle will be much

slower to return to business-as-usual than they were the first

time. The recovery will be less swift than that experienced during

the summer.

- Diesel demand recovery, then destruction, will lag the gasoline

demand recovery and destruction. Diesel demand is primarily driven

by consumer spending. As individuals return to shelter-in-place,

consumer spending will fall again and lead to diesel demand

destruction.

- Jet fuel demand will be even slower to recover with consumers being more reluctant to risk air travel and with international borders remaining closed well into 2021.

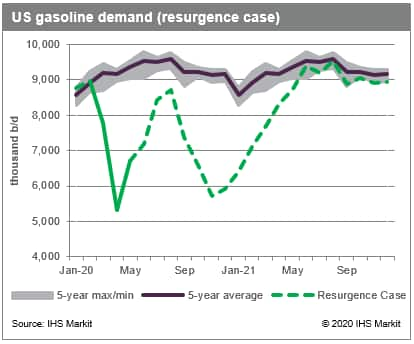

IHS Markit further assumes that the second wave will crest in November, the traditional onset of flu season. Of course, the second wave could arrive earlier depending on how swiftly - and severely - the virus proliferates. Regardless, this scenario would generate a characteristic "w-shaped" curve for most demand indicators. The second "v" of the "w" would not be as deep as the first, but it is expected that the recovery would be slower, based on the assumption that governments and society will have learned the lessons of returning too swiftly to business as usual the first time around.

Figure 1: US gasoline demand (resurgence case)

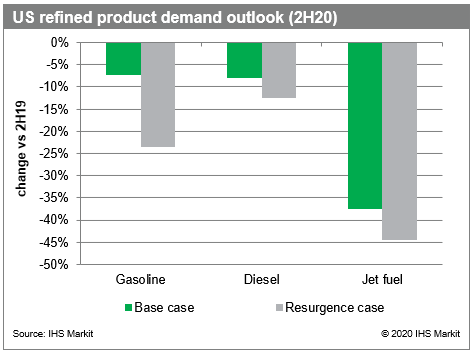

Overall, this resurgence scenario would see US gasoline demand averaging 7.1 million b/d for the second half of the year, down nearly 25% from 2H19. Diesel consumption would be down 12% year-on-year and jet fuel demand will be nearly 45% below the same period in 2019. As shown in the graph below, demand for all three products would be lower than in our base case outlook, but the gap is particularly wide for gasoline. Moreover, owing to the slower recovery the second time around, product demand in this alternate scenario will remain significantly below average for most of 2021.

Figure 2: US refined product demand outlook (2H20)

Understand changing dynamics in the oil refining and marketing value chain around the world with IHS Markit energy refining and marketing outlooks, data and analysis: Learn more.

Susan Bell is a principal research analyst at IHS Markit.

Posted 02 June 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fassessing-the-impact-of-a-second-coronavirus-wave-on-fuel-demand.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fassessing-the-impact-of-a-second-coronavirus-wave-on-fuel-demand.html&text=Assessing+the+impact+of+a+second+coronavirus+wave+on+fuel+demand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fassessing-the-impact-of-a-second-coronavirus-wave-on-fuel-demand.html","enabled":true},{"name":"email","url":"?subject=Assessing the impact of a second coronavirus wave on fuel demand | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fassessing-the-impact-of-a-second-coronavirus-wave-on-fuel-demand.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Assessing+the+impact+of+a+second+coronavirus+wave+on+fuel+demand+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fassessing-the-impact-of-a-second-coronavirus-wave-on-fuel-demand.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}