Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 19, 2022

Asia Pacific Regional Integrated Energy Service research highlights, Q2 2022

In the second quarter of 2022, 24 new insight papers have been published in the S&P Global Commodity Insights (formerly IHS Markit) Asia Pacific Integrated service, apart from the regular updated reports. This research highlight summarizes the key impact papers and provides an overview the market signposts in Q2. Link to a select set of reports summaries is provided below.

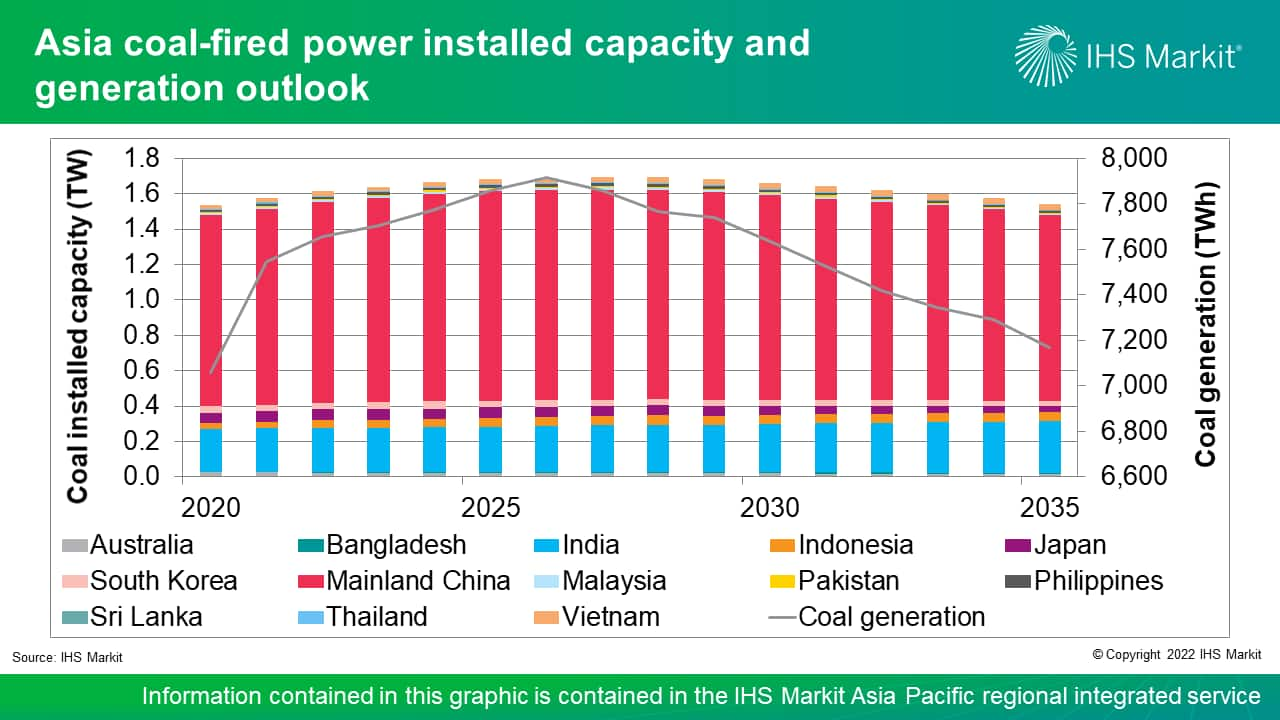

The graphic of the quarter is selected from "Peak coal in Asia by 2027 as energy transition begins: Two sides of the coin", showing peak coal-fired power capacity in Asia at 1,697 GW in 2027.

Peak coal in Asia by 2027 as energy transition begins: Two sides of the coin

The Asia Pacific region accounted for 62% of total global power sector carbon emissions in 2020, out of which 90% was contributed by coal-fired power generation alone, as it is the most affordable source of baseload power in the region. Therefore, the future of coal-fired power in energy-transitioning Asia is facing pressure from the global call for decarbonization. Although only a handful of Asian economies signed the Global Coal to Clean Power Transition Statement at the 2021 United Nations Climate Change Conference (COP26), many, if not all, have responded to the global climate ambition via their respective national energy master planning.

Asia is pivoting away from coal-fired power, expecting both installed capacity and generation by coal fleet to peak around 2027. Based on IHS Markit tracking, more than 47 GW of planned coal-fired power projects have been canceled owing to the country's self-driven energy agenda or investment moratorium from financiers. While most of the developing countries in Asia are trying to put the brakes on, or slow down new coal capacity buildout, accelerating coal-fired power fleet retirement has been the main approach adopted by most OECD Asian countries to meet their carbon commitments.

Aggressive newbuild of renewables and growth of natural gas will be the main supply drivers to meet Asia's growing demand with coal phasing out. Aggressive new build of renewables, estimated to quadruple installed capacity over next three decades, may help decarbonize 80% of Asia's incremental power demand growth toward 2050. Gas-fired generation is expected to double, playing a critical "bridging" role in lowering emissions with the immediate effect of replacing coal and providing system flexibility in the long run.

Coal will still play a role in Asia's power mix in 2050 while each market is exploring a bespoke way for its energy transition away from coal. Alternative low-carbon fuels, co-firing with zero-carbon fuels, and carbon capture are heavily counted on in offsetting last-mile emissions from coal for Asia's climate commitment.

China refines dual-control scheme: Tilting the balance toward economic growth

On 24 January 2022, the State Council issued the Comprehensive Work Plan on Energy Conservation and Emissions Mitigation in the 14th Five-Year-Plan (FYP) Period (《"十四五"节能减排综合方案》). The work plan will serve as the guiding document on energy conservation under China's "1+N" climate policy framework, in addition to being part of the regular policy streams of China's FYPs. Furthermore, on 5 March, Premier Li Keqiang's State of Nation Report excluded energy-intensity reduction from mainland China's annual targets, which is a mandatory target in FYPs and usually assessed every year if not more frequently, reconfirming the adjusted policy stance.

The recent policies signal modest relaxation in the implementation of the energy consumption "dual-control" scheme during the 14th FYP. Mainland China has set no binding energy-intensity reduction target for 2022, nor non-binding national cap on total energy consumption for the 14th FYP. This will give provinces more room to set and adjust their own targets to better accommodate local development needs.

The work plan designed several new mechanisms to refine the dual-control scheme, to ensure that energy consumption control will not come at the expense of sacrificing economic growth. The general principle is to continue prioritizing energy-intensity reduction while allowing total energy consumption targets to be reasonably relaxed upon low-carbon energy use.

- Incremental renewable power consumption will be exempted from the assessment of total energy consumption

- Energy used as feedstocks will be exempted from the assessment of both energy intensity reduction and total energy consumption targets.

Mainland China will continue to tighten its efficiency control over the energy-intensive industries as part of the key efforts to achieve carbon pledges. Mainland China will facilitate energy-efficiency improvement of key energy-intensive industries towards world leading levels, while retrofitting or retiring inefficient capacities.

Call for market reforms sparks as commodity price hike raises power prices to new highs — A dive into responses seen in Australia, Japan, and Singapore

Australia, Japan, and Singapore are the few markets within Asia Pacific that have achieved full liberalization of their power markets. With a wholesale power market in place, smaller power retailers have been able to compete with the incumbent power retailers that have traditionally enjoyed dominance through its vertically integrated structure. With the commodity price hike in the past year, these markets are also experiencing power price increases to levels never seen before. However, the effects are diverse as differences in their power market structure and power tariff structure translate to different sensitivities to commodity prices, resulting in different government responses in addressing the issue at hand.

Wholesale power prices surge: Wholesale power prices in the three markets have increased by 112% to 281% year on year (y/y). Singapore, with the highest share of thermal capacity within its power mix, has been hit the hardest, followed by Australia where thermal generation maintains a majority share. In both markets, wholesale makes up 100% of power retail while the exposure in Japan is only 35%.

Incumbent power retailers return to the spotlight as the power price surge drives small retailers out of business: High prices have negatively affected the revenue margins driving a number of smaller retailers out of business. The market share of these retailers is small; however, this may mark the beginning of future impacts should current conditions continue. Larger retailers have also not been left unscathed, resulting in a call for market reforms.

Government measures: Measures announced by governments range from ensuring security of fuel and supply and protecting businesses through short-term fixed price contracts to launching a full independent investigation to holistically reevaluate the power sector. Long-term measures are still needed to ensure market resilience among future commodity price volatility.

China's energy markets during latest COVID-19 lockdown: Coal and gas plummet while renewables flourish

The Omicron outbreak in China since the beginning of 2022 has led to stringent restriction measures that severely disrupted economic activities and energy demand. However, our analysis of the latest data show that the scale of the demand impact did not match that of early 2020 at the onset of COVID-19. The weakness in fossil fuel demand is in contrast with the continued robust growth of renewables.

Power demand declined by 1.3% year on year (y/y) in April, bringing full-year growth in 2022 down to 4.1%, compared with 3.1% in 2020. Both the services and manufacturing sectors contributed significantly to the power demand drop in April. The industrial sector is expected to lead the rebound in the rest of 2022, but a rapid recovery in 2020-21 is unlikely to reemerge.

Coal and gas are impacted the most in power generation owing to demand weakness as well as tight fuel markets while renewables continue booming. Generation from coal and gas plants declined by 11% and 29% in April, respectively. Meanwhile, wind and solar generation increased 15% and 25%, respectively, with record capacity additions expected this year—as a result of high coal and gas prices as well as strengthened climate policies.

Almost-flat demand growth is expected in the oil market in 2022. In April, China's oil demand decreased by 9.8% y/y amid weak traffic volumes and supply chain disruptions associated with movement restrictions on people and goods. We expect the oil demand to rebound slightly in May as lockdown measures are marginally eased, although downside risks remain in place with new sporadic cases being reported.

On the other hand, Chinese gas demand growth in 2022 will be much weaker than the 2020 levels. Apparent demand dropped 5.8% in April, the largest decline since May 2015. Full-year demand growth is expected to be 4.1%, just half of the December 2021 outlook. We expect high prices to curb gas demand growth rest of 2022 and in 2023.

China's gas demand and LNG imports in 2022: Evident response to record-high prices

In the first quarter of 2022, mainland China's apparent gas demand growth declined to just 2% and LNG imports fell by 12%. Growth of gas demand and LNG imports was previously expected to moderate in 2022, but new factors emerging in early 2022 have dampened this year's growth prospect even more.

Decelerating economic growth, relentlessly high commodity prices, and higher coal reliance will constrain mainland China's gas and LNG demand. Recent events including COVID-19 outbreaks and measures to control them and the implications of the Russia-Ukraine conflict on the global energy market will put further downward pressure on mainland China's gas market.

LNG imports will decline by about 3 million metric tons (MMt) year on year in 2022. Oil-linked term contracts, both LNG and pipeline imports, will be more expensive under the high oil price environment, driving up mainland China's average portfolio supply cost, with larger and more immediate impact on LNG imports. The current spot price is way above mainland China's affordability level, although some spot purchases can be blended into the portfolio.

Economic and noneconomic levers will curtail gas demand growth. Cost pass-through in the deregulated gas market segments will send strong price signals to curb demand. In addition, regional governments and players are making plans to identify the order and magnitude of supply cuts to guarantee supply to prioritized sectors. The industrial, power and heat generation, and transport sectors will be most adversely affected.

Various domestic and global factors will bring an unprecedented level of uncertainty to mainland China's gas supply mix and demand growth in 2022. These factors include measures to maintain energy supply security and contain COVID-19 outbreaks in the domestic market and market sentiments on the potential disruption of Russian gas supply to Europe and LNG demand in the global market.

How sensitive is South Asian LNG demand to price shifts?

During the period of LNG oversupply, South Asia was considered a potential sink for surplus LNG cargoes. In today's tight market, the question is whether Europe—in its pursuit to diversify from Russian gas as quickly as possible—will outbid South Asia for spot LNG.

South Asia's spot LNG demand is inversely proportional to spot LNG prices. Import trends suggest that spot purchasing decreases sharply once prices exceed $10/MMBtu.

The outliers are recent spot LNG purchases by Pakistan and Bangladesh. With prices coming down to $20/MMBtu, the relative affordability has spurred emerging markets to procure more volumes to ease power curtailments and gas shortages.

Absolute price levels are the primary driver of purchase decisions. There is minimal evidence that the oil-to-LNG price differential drives demand or willingness to pay.

China's LNG Imports: Procurement strategy and infrastructure outlook

In 2021, mainland China surpassed Japan to become the world's largest LNG importer with 78.9 MMt, according to China Customs data. Driven by cold weather in the 2020/21 winter, the early heat wave in the 2021 summer, economic recovery, local coal-to-gas switching policies, and limited hydro and coal-fired power generation, LNG imports grew 17.6% year on year (y/y) to fill the gap between strong gas demand and supplies from domestic production and pipeline imports. Gas demand growth was particularly strong in southern coastal mainland China, as reflected in the LNG import growth in mainland China's northern, central, and southern coastal regions of 1%, 21%, and 38%, respectively, in 2021.

Mainland China's national oil companies (NOCs) still dominate LNG imports activities but with a declining supply share of 84% in 2021 compared with 87% in 2020. The NOCs' LNG import volumes rose 13.5% y/y to reach 66.4 MMt in 2021. China National Offshore Oil Corporation (CNOOC), China Petrochemical Corporation (Sinopec), and China National Petroleum Corporation (CNPC) all imported more LNG year on year to meet rapid gas growth in 2021. As contracted volumes were flat year on year at 43 MMt, the NOCs ratcheted up spot and short-term purchases. Spot or short-term purchases by the NOCs were estimated to be 23 MMt, accounting for about 70% of mainland China's total spot and short-term LNG purchases in 2021. Imports by the non-NOCs reached 12.0 MMt in 2021, growing 39.0% y/y, enabled by rising non-NOC terminal capacity and improved third-party access to terminals by the NOCs and the national pipeline company, China Oil and Gas Pipeline Network Corporation (PipeChina). However, spiking spot LNG prices hampered spot purchases in the second half of 2021.

Contracting activities rebounded with a record level of nearly 30 million metric tons per annum (MMtpa) new term contracts signed in 2021 under the combined effect of high spot prices, supply security pressure, and the tightening global balance in the next few years. Of the new contracts, 19 MMtpa were by the NOCs and 10 MMtpa were by non-NOCs, with supply from portfolio suppliers or projects in the United States, Qatar, and Russia.

China's total LNG receiving capacity reached 102 MMtpa at the end of 2021. During 2021, mainland China commissioned 13.0 MMtpa of new receiving capacity, all from brownfield expansion at existing terminals. The northern region still had the most LNG regasification capacity, with 30.5 MMtpa, 29.3 MMtpa, and 28.2 MMtpa in the northern, central, and southern coastal regions, respectively. The southern region previously had most spare capacity, but its utilization has been catching up, reaching 84% in 2021 under strong imports. Mainland China's national average terminal utilization rose 1 percentage point to 85% in 2021.

Mainland China's LNG receiving capacity buildout will outpace import growth, alleviating infrastructure bottleneck and reducing utilization rates. After the 2017/18 winter gas supply shortage, new capacity development accelerated to bring additional capacity online, especially in northern and central mainland China. Of the 72 MMtpa capacity under construction, 19 MMtpa are on schedule to start operation in 2022. IHS Markit expects capacity to continue to grow rapidly to reach 188 MMtpa in 2025 and 267 MMtpa in 2030. On the other hand, high oil and spot LNG prices owing to geopolitical risks and tight global LNG supply in the next few years will restrict mainland China's LNG import growth.

Demand responses to high and volatile gas prices in Southeast Asia

Each Southeast Asian gas market has responded differently to the unprecedented high levels and volatility of international gas and coal prices. Oil prices, which were a laggard throughout most of 2021, have now caught up with gas and coal prices. The surge in oil price is increasing the price of oil-indexed gas—the typical gas contract in Southeast Asia—and that hurts affordability even in markets with minimal exposure to spot LNG.

Many of the current measures were done in response to the energy market dynamics in the second half of 2021 and have yet to incorporate the impact of the Russia-Ukraine war.

In the near term, a persistent high energy price environment would test governments' ability to limit the impact on consumer prices to avoid derailing economic recovery. An increase in subsidies is inevitable as countries attempt to limit the impact of inflation on low-income families.

For the moment, the long-term trend toward sustainability and liberalization is still on track. However, should prices stay high over the next two years, governments may be forced to reassess the situation, moving back to cheaper power options and reverting to market consolidation and increased government intervention.

Pakistan returns to the spot market, but can it pay?

Despite record-high LNG prices, deteriorating foreign exchange reserves, and an unstable political milieu, Pakistan LNG Limited has issued spot tenders seeking seven cargoes for delivery during May and June.

Pakistan has turned to the spot market owing to declining domestic gas production, higher cooling demand driven by heatwaves across the country, and supply disruptions by its term suppliers Eni and Gunvor.

The high cost of spot cargoes raises the question of Pakistan's ability to pay. However, its ongoing financing program with various multilateral funds and bilateral loans from countries, including mainland China and Saudi Arabia, will continue to buy time to support Pakistan's import needs.

Looming energy crisis in South Asia: Global energy crisis and economic/political discord adding to the woes

An unprecedented acute energy crisis looms over the South Asian countries. The crisis is triggered by the economic and political emergency, and global fuel price upheaval, due to Russia's invasion of Ukraine. Power cuts of more than 12 hours in Sri Lanka and Pakistan; rationing of coal and natural gas to industries in India, Pakistan, and Bangladesh; and price spikes and supply shortages of petrol/diesel and compressed natural gas/piped natural gas haunt transport and household sectors alike across the South Asian markets.

With South Asia vulnerable to global fuel markets, the situation is likely to worsen in the short term with the expected price increase. As a net importer of energy with more than 60% import dependence in oil and gas, South Asia remains exposed to the global fuel price shocks. The rising challenge of persistently high commodity prices has contributed to inflation, rising fiscal deficits, depreciating currency, dwindling foreign exchange reserves, higher subsidy support, and rising political instability, particularly in Pakistan and Sri Lanka. Even India, with its traditional reliance on domestic coal, is feeling the pinch of shortages in reserve stocks at thermal plants, having to resort to imported coal on an emergency basis. No respite is expected in the short term as costs and supply deficits in electricity are likely to exacerbate in the summer.

The current power crisis in South Asia is a result of the legacy issues of policy-induced operational inefficiencies, worsened by the prolonged tightness in the global fuel market. Institutional and regulatory practices oriented toward dominant government ownership, regulated pricing, subsidies, and cross-subsidies coupled with weak governance have resulted in operational inefficiencies across the electricity supply chain, leading to financially weak utilities and poor infrastructure. While recent price spikes in fuel markets expose the economic vulnerability of these nations, they also threaten the transition to efficient and low-carbon energy systems.

Energy security, along with the sustainability agenda, is a tight ropewalk for South Asia to meet the long-term targets. Amid growing concern for climate change and actions to mitigate rising emissions, the South Asian countries pledged for no new additional coal (other than the under-construction projects) and emphasized clean energy sources—renewables and natural gas. However, faced with an uneven recovery from the pandemic and aggravated economic influence of the recent war, the subcontinent is confronted with hard choices and veritable trade-offs in pursuing the sustainability and reform agenda.

Additional Insights and Strategic Reports published in Q2 2022:

- A big step toward net-zero in Taiwan

- India unveils the first phase of its green hydrogen policy: A good start but needs to tighten the loose ends to achieve 2030 production targets

- In the race to global net zero, what are the lessons for India's carbon market?

- India's domestic gas prices to continue their upward momentum

- New rules for offshore wind resources' competitive allocation gradually unveiled in China

- China issued its first policy on re-gas fee setting mechanism

- China's gas-fired power: Aggressive build-out ahead despite short-term headwinds

- Climate change efforts in Southeast Asia continue to propel natural gas use

- Decarbonizing while growing: Energy transition in Southeast Asia's power sector

- Federal elections to redefine Australia's energy policy

- Australian electricity market suspension provides a signal to project developers

Learn more about our energy research in Asia Pacific.

Logan Reese, is an associate director on the Asia Pacific Regional Integrated team at S&P Global Commodity Insights, focusing on Australia power and gas markets.

Ankita Chauhan is a senior renewable analyst on the Gas, Power, and Climate Solutions team at S&P Global Commodity Insights, covering research and analysis for Indian and South Asian markets.

Posted 19 July 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fasia-pacific-regional-integrated-energy-service-research.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fasia-pacific-regional-integrated-energy-service-research.html&text=Asia+Pacific+Regional+Integrated+Energy+Service+research+highlights%2c+Q2+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fasia-pacific-regional-integrated-energy-service-research.html","enabled":true},{"name":"email","url":"?subject=Asia Pacific Regional Integrated Energy Service research highlights, Q2 2022 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fasia-pacific-regional-integrated-energy-service-research.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asia+Pacific+Regional+Integrated+Energy+Service+research+highlights%2c+Q2+2022+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fasia-pacific-regional-integrated-energy-service-research.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}