Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 06, 2021

Announced wind turbine orders exceeding 48 GW tracked globally in 2020

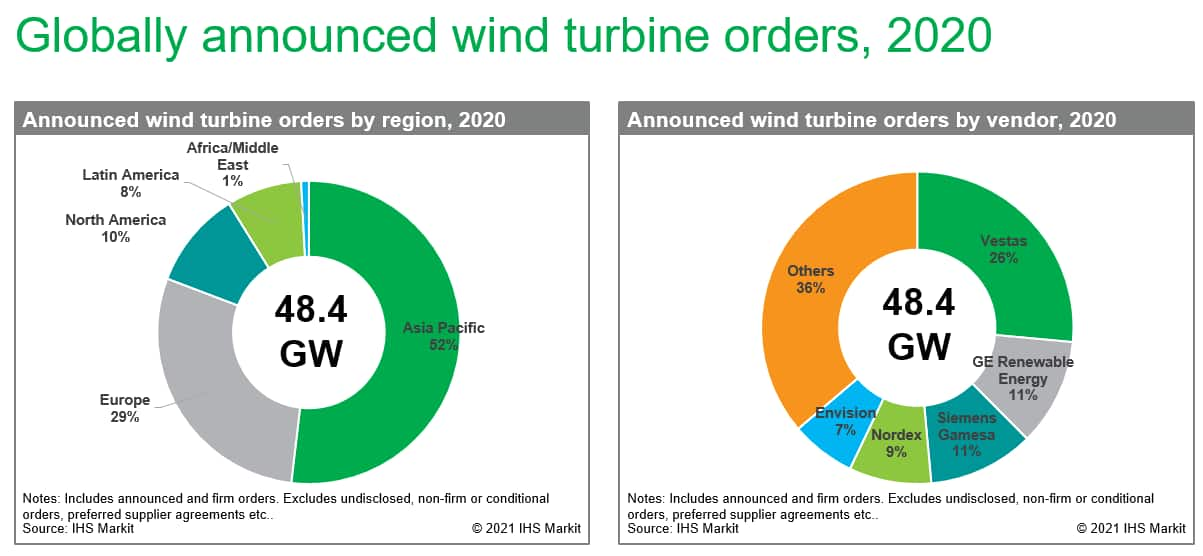

In 2020, IHS Markit tracked wind turbine orders totaling 48.4 GW from 23 vendors globally. This 22% contraction in orders compared to 2019 was brought about by the combined effects of the COVID-19 pandemic and lower onshore activity in the United States and mainland China where most orders for the 2020 installation race had been locked in beforehand. Despite this, offshore contracting activity grew by over 10%, accounting for one-fourth of the total announced orders in 2020.

Even as wind turbine contracting activity in 2020 continued to be driven by the United States and mainland China, their share in total announced orders fell from 65% in 2019 to 50% last year. In Europe, the United Kingdom and Nordic markets drove offshore and onshore orderbooks respectively. A recovering Indian market and continued momentum in Vietnam bolstered order intake from the Asia Pacific, while a strong demand surge was observed from Latin America in second half 2020, driven by Brazil and Colombia.

The four largest western OEMs, Vestas, SGRE, GE, and Nordex together announced orders totaling nearly 28 GW in 2020 to be installed across 38 markets. Including leading mainland Chinese vendors Goldwind, Envision, and Ming Yang into the mix, the seven largest vendors consolidated three-fourths of all announced orders last year. However, mainland China's 2020 installation rush severely pressure its wind supply chain and resulted in a sharp uptick in orders for local tier 2 vendors. Even western vendors including Vestas and GE benefited from this by leveraging their local supply presence to secure contracts exceeding 1 GW each with tight execution deadlines.

Turbine vendors have restructured their product and supply chain strategies to return to profitability. As part of this, OEMs have refocused sales efforts for their latest modular platform turbines. For instance, in 2020, Nordex's Delta4000 turbines accounted for three-fourths of its announced order intake. Other western OEMs have similarly secured over 1 GW in contracts each for their latest 4 - 6 MW turbine platforms. While these turbines are targeting a global customer base, vendors have also launched customized models to solidify presence in select high growth markets. This was observed with Vestas and SGRE's India focused turbine launches last year.

While the emphasis has been on boost customizability and site optimization in onshore, turbine size is defining success in the offshore space. In 2020, SGRE's latest 11 MW and 14 MW turbines raked in over 8 MW of non-firm supply commitments. Similarly, GE firmed its contract for the first two phases of the Dogger Bank project totaling 2.5 GW after being first-to-market in the >10 MW space with its Haliade-X turbine. The vendor also secured preferred supplier status for the Vineyard Wind project in the U.S., which had originally gone to MHI Vestas Offshore Wind (MVOW). In a bid to accelerate product innovation and regain offshore market share, Vestas completed its takeover of MVOW in December 2020 and has since announced a 15 MW turbine model with a 236-meter rotor.

IHS Markit closely tracks wind turbine orders globally and publishes data and key insights in its Global Announced Wind Turbine Order Tracker report on a half-yearly basis.

For more information on recorded orders please visit our Clean Energy Technology page.

IIndrayuth Mukherjee is a senior research analyst at IHS Markit that specializes in renewable power markets globally with a special focus on wind energy.

*Note: An announced order refers only to a publicly announced supply agreement for a quantity of wind turbines between a wind project developer/owner and a turbine manufacturer. Firm orders include confirmed project orders, framework agreements, and repowering orders. Non-firm contracts include loosely defined letters of intent (LOIs), memorandums of understanding (MOUs), conditional orders or preferred supplier agreements, and supply from previously accounted for framework agreements.

Posted on 06 May 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fannounced-wind-turbine-orders-exceeding-48-gw-tracked-globally.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fannounced-wind-turbine-orders-exceeding-48-gw-tracked-globally.html&text=Announced+wind+turbine+orders+exceeding+48+GW+tracked+globally+in+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fannounced-wind-turbine-orders-exceeding-48-gw-tracked-globally.html","enabled":true},{"name":"email","url":"?subject=Announced wind turbine orders exceeding 48 GW tracked globally in 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fannounced-wind-turbine-orders-exceeding-48-gw-tracked-globally.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Announced+wind+turbine+orders+exceeding+48+GW+tracked+globally+in+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fannounced-wind-turbine-orders-exceeding-48-gw-tracked-globally.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}