Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

Dec 18, 2023

2023 International Exploration Review and 2024 HIW Outlook

2023 International Exploration Review

With the year not yet complete, any overview of global (excluding North America L48) exploration success for 2023 will be subject to change. However, with access to world leading E&P data and research, S&P Global Commodity Insights is positioned to draw initial conclusions. The purpose of this brief overview is to outline how 2023 (so far) compares in terms of exploration success across the last decade, highlight key 2023 exploration activity and look ahead to key high impact wells (HIWs) in 2024.

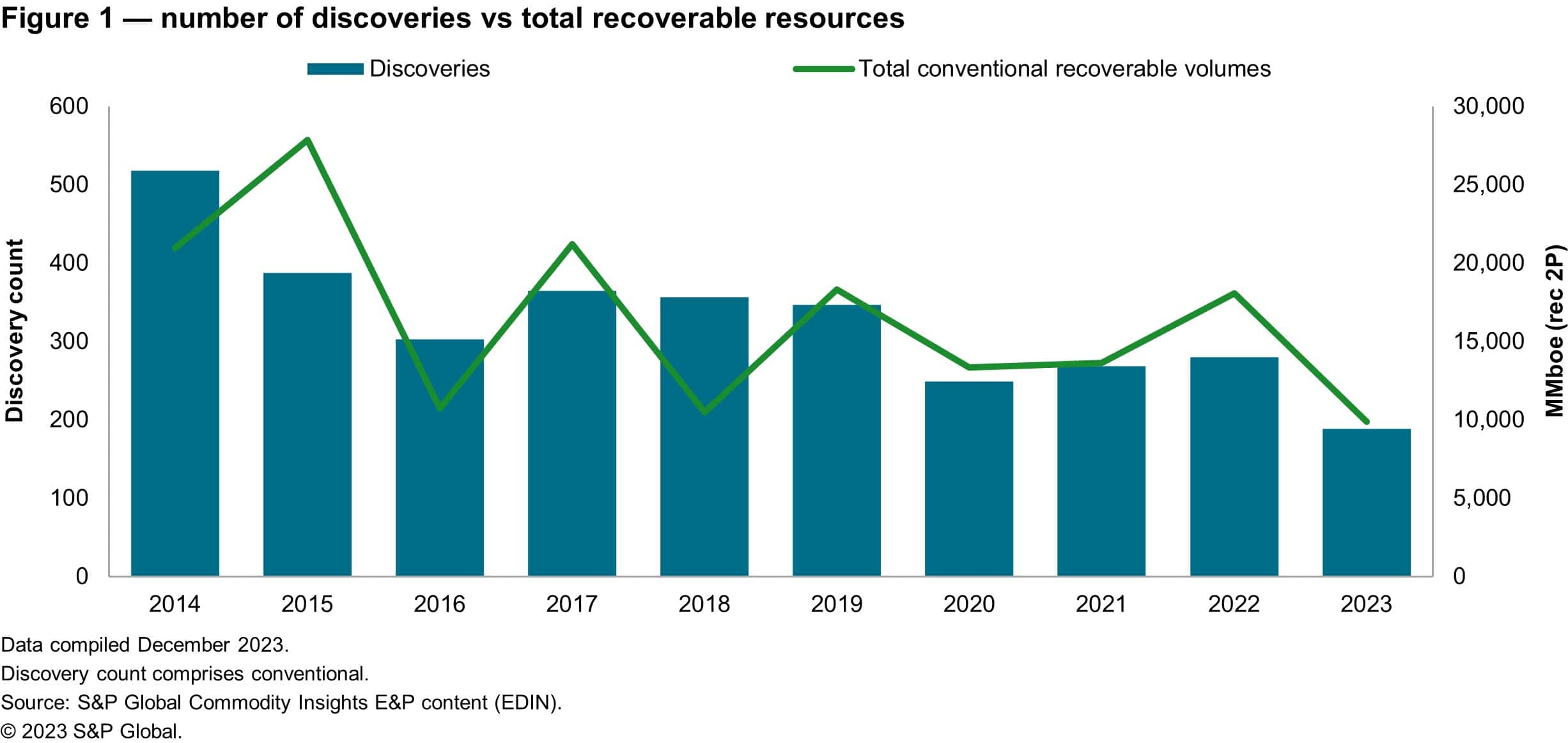

As of mid-December, we had a conventional discovery count of 189 for the year which have amassed 2P recoverable resources just short of 10 Bboe (billion barrels of oil equivalent — Figure 1). However, it is expected that this number will climb. The reasons behind this include the subsequent announcement of 'tight hole' results, the release of new company reports and ongoing topical research efforts across multiple geographies. For example, at the time of writing our analysis for 2022 (published mid-December 2022) we had recorded a total of 178 discoveries for the year, but if one was to extract the data in December 2023, the result would be a conventional discovery count of 280, a 57% increase.

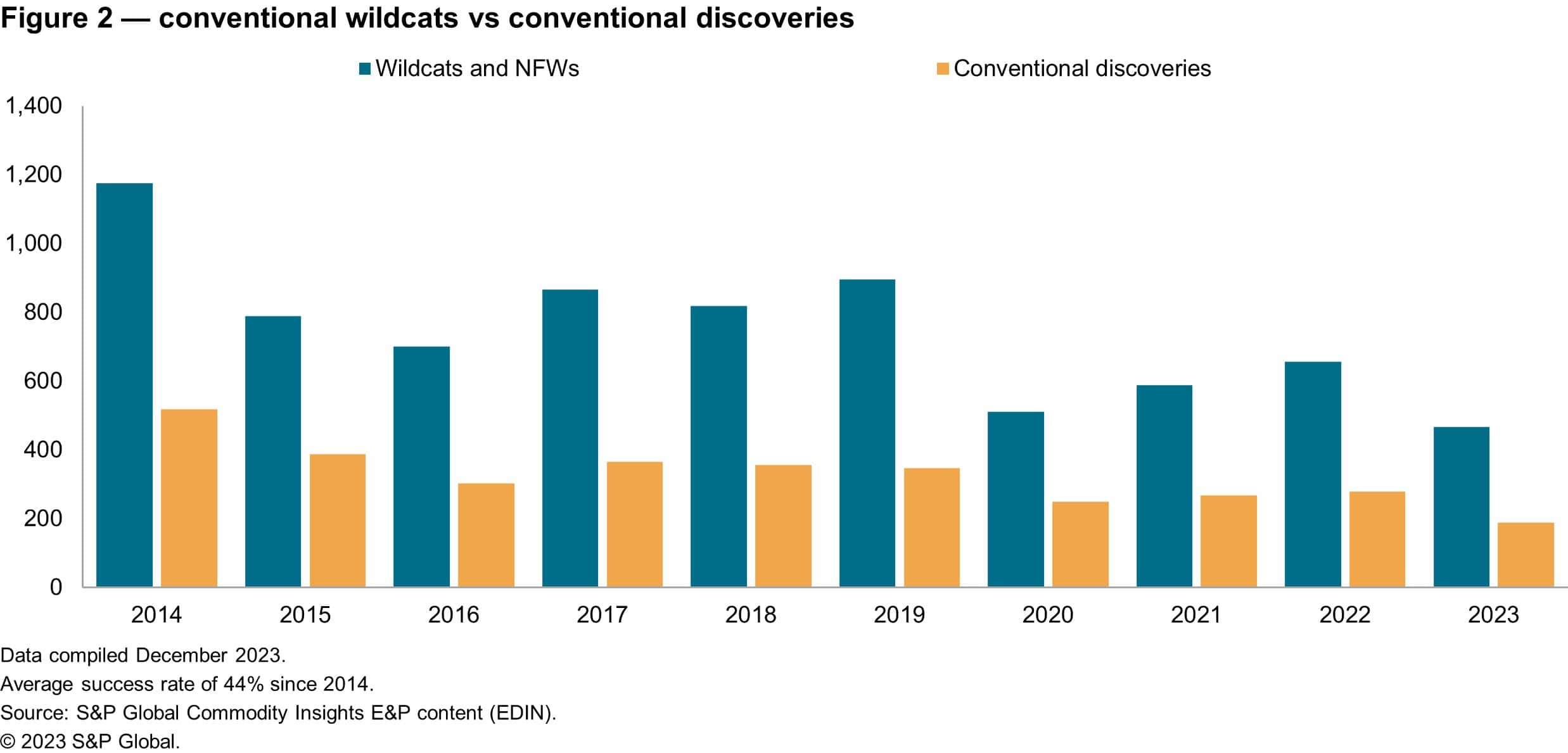

Based on the subsequent gathering of additional discoveries over time, we can review some of the variables and analyze what the numbers could potentially look like for 2023 in 12 months' time. In reviewing the number of conventional wildcats drilled since the COVID-19 related activity downturn of 2019, the average well count is ~557 per year (2020-2023). To date, we have a total of 468 wildcats for 2023 and therefore, we are 89 wells short of the last four-year average. If we then take the average technical success rate for wildcats of 44% (Figure 2), we could assume an additional number of discoveries in the region of 39. These new 39 (hypothetical) discoveries, multiplied by the average discovery size of the last four years, 55 MMboe, could add just over another 2.1 Bboe to the final resource accumulation for 2023 (all data pulled for analysis on Dec. 11, 2023).

2023 Regional Overview

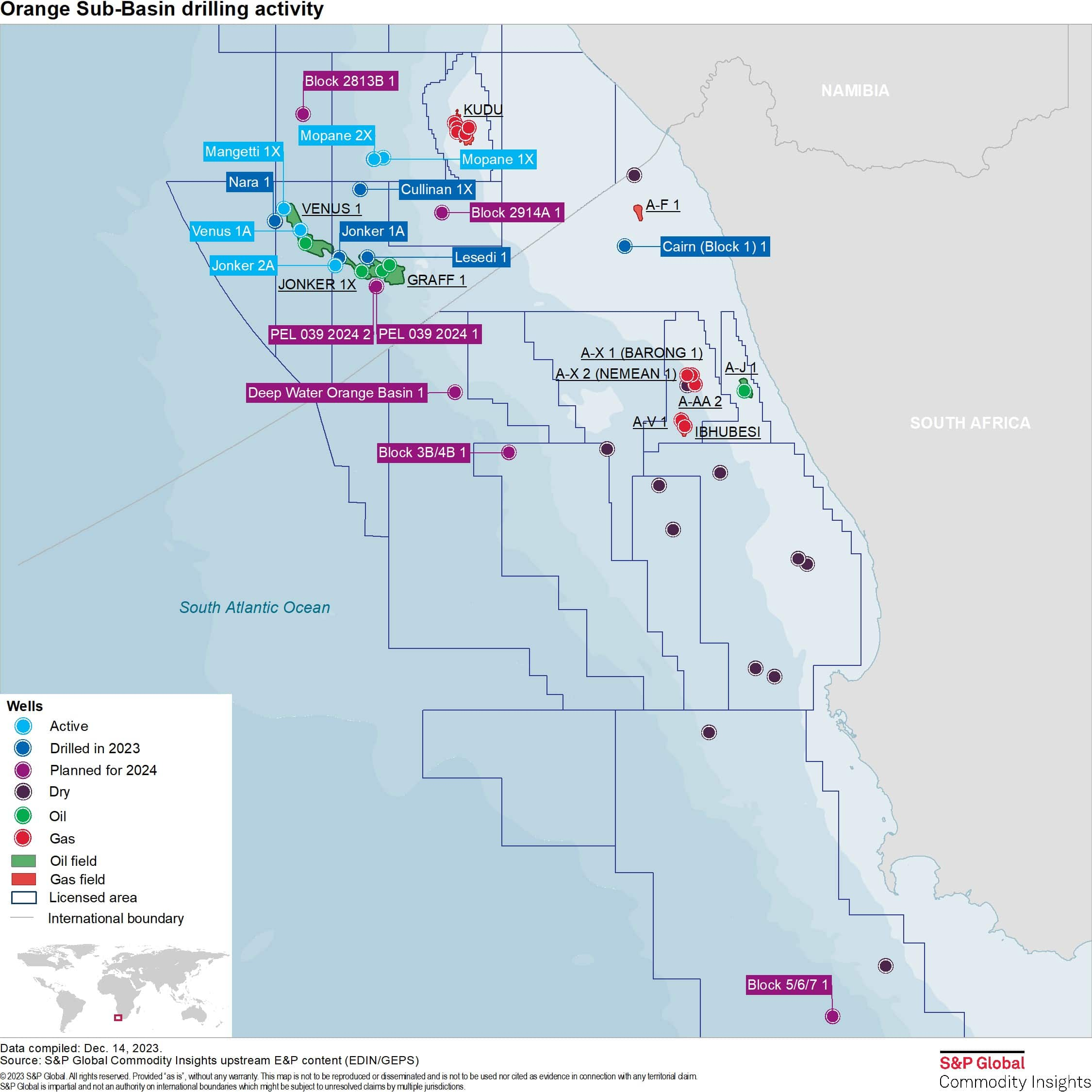

The year 2023 pales in comparison to 2022 which was a successful year for exploration, primarily due to the large offshore discoveries in the Orange Sub-basin, Namibia, and several large discoveries in Guyana. The buzz around Namibia drew comparisons with the success seen in recent years in Guyana and the two areas are likely to remain key exploration hotspots for the foreseeable future.

In Namibia both TotalEnergies (TE) and Shell have appraised their 2022 successes, and Shell built on its success with the Jonker discovery, but both have also drilled unsuccessful wells with Nara (TE) and Cullinan (Shell). TE is drilling ahead with its Mangetti 1 well which is testing a prospect north of Venus, while Shell is drilling a second appraisal well on Jonker. A third operator, Galp Energia, is drilling a well called Mopane 2 to the north of Shell's acreage. Further exploration is planned for 2024, with Galp potentially drilling the Mopane 1 well and additional wells planned by Chevron and Rhino Resources. We may also likely see a shift towards the South Africa portion of the basin where TE and Africa Oil Corp have drilling plans.

The offshore Guyana 2022 Licensing Round closed in 2023 with the Guyana government granting preliminary awards to each of the six groups of applicants who submitted a combined total of eight bids over deepwater (D1 and D2) and shallow water (S3, S4, S5, S7, and S8, and S10) offshore blocks. In July 2023, the government granted a one-year validity extension to ExxonMobil, Hess and CNOOC for the prolific Stabroek Area block due to a period of force majeure during the COVID-19 pandemic. Sticking to the Stabroek Area block, ExxonMobil had success with the Lancetfish discovery which was subsequently appraised during the year and the company is also, at the time of writing, drilling its Basher 1 well, located near its 2022 Fangtooth discovery. Another discovery during the year was CGX Energy's Wei-1 in the Corentyne Area, it was the second on the block after the 2022 Kawa-1 find. Approximately 3.4 Bboe was yielded from 2022 discoveries in Guyana, a figure that declined to just over 800 MMboe (Million barrels of oil equivalent) in 2023. Thoughts as to why 2023 has not resulted in similarly buoyant numbers are likely fewer wells drilled, a greater focus on appraisal drilling and some poor well results. However, it is known that ExxonMobil now has the environmental approval to drill 35 exploration and appraisal (E&A) wells on Stabroek through to the end of 2027. It has also applied for environmental clearance to drill 12 E&A wells in the Canje Block, for which it awaits approval. Across the border in Suriname Petronas had success with the Roystonea discovery in Block 52. It is thought that any potential development of Roystonea could also include the 2020 Sloanea discovery.

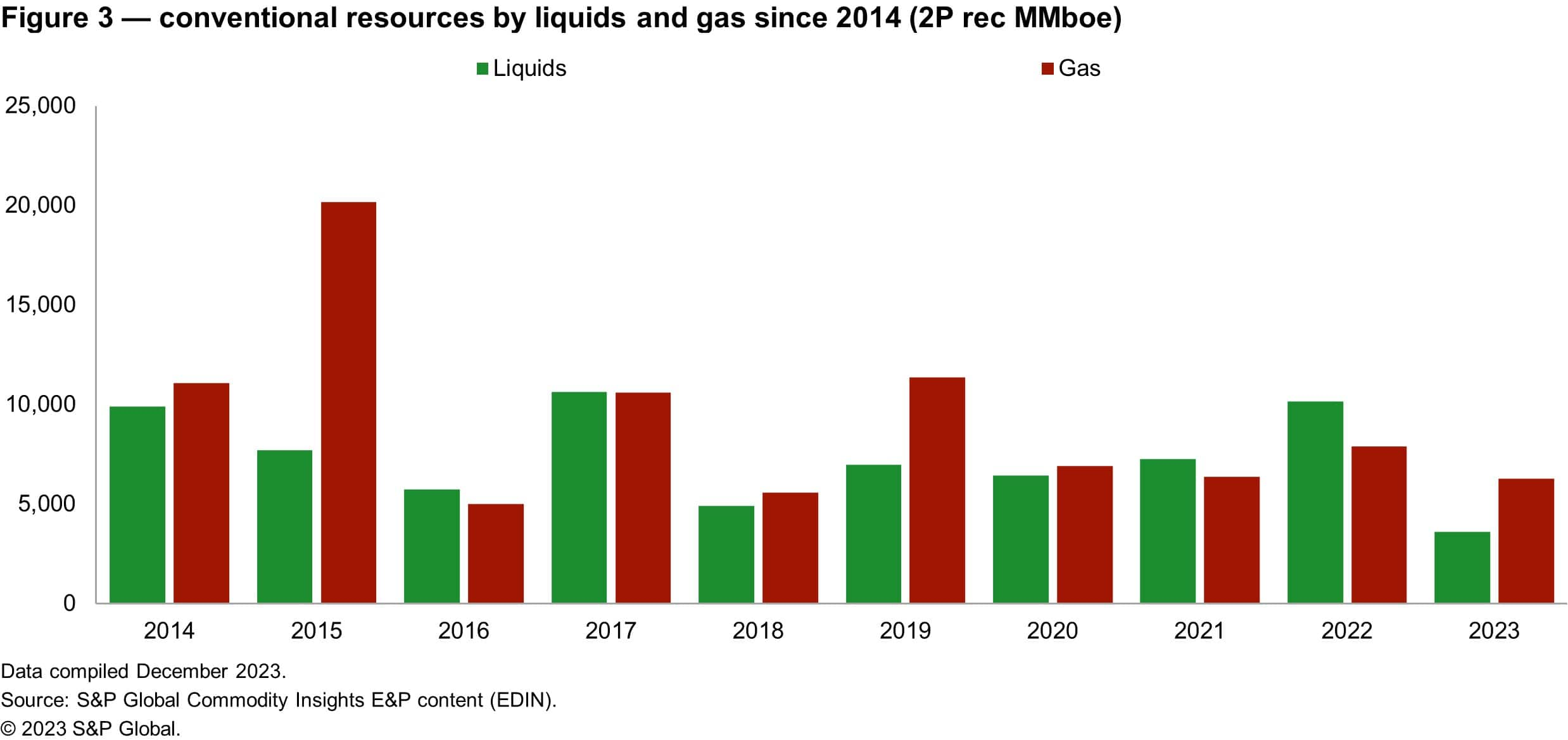

The two biggest discoveries of 2023 were both located in Iran. The largest of the two, Shahini, is in the Fars Province (Zagros Fold Belt) and the second discovery, Cheshmeh Shoor, is in the Razavi Khorasan Province (Kopet Dagh Foredeep) which is contiguous to both Turkmenistan and Afghanistan. Little is known about the future of these discoveries, but along with other large gas discoveries such as Geng North, more gas has been discovered this year than liquids even though we have a higher number of liquids dominated discoveries for the year. In fact, as of mid-December the total volume of liquids discovered in 2023 could be the lowest in the last 10 years (Figure 3).

Moving to Asia-Pacific, Eni had success with the aforementioned Geng North discovery in the Kutei Basin, Indonesia. The well encountered a significant accumulation of gas in Miocene sands. Eni is pushing ahead with development plans for the discovery and is looking at a final investment decision in 2024, with a view to fast-tracking the development with an onstream date of 2027. There were several other smaller successes across Indonesia during the year, while in Malaysia over 1 Bboe of newly discovered resource was encountered. Some of these larger accumulations include Chenda 1, Babadon 1, Layang-Layang 1, Sinsing 1 and Dermawan along with several more discoveries which contribute to the 1 Bboe.

In Europe, discoveries in the North Sea, across both Norway and the UK, resulted in approximately 400 MMboe of net new conventional resource. Of note, in the UK, Shell had success with the Pensacola and Orlov discoveries. The company plans to appraise Pensacola in the fourth quarter of 2024, focused on proving up the quality of the reef top location in the Zechstein Hauptdolomit reservoir. In Norway there were 11 new discoveries equating to 260 MMboe. Equinor made a total of five discoveries, three of which — Carmen, Heisenberg and Mulder — are located in Quad 35. Also of note, DNO Norge had success with its Norma discovery in Quad 25.

2024 HIW Outlook

A total of 32 HIWs drilled in 2023 contributed 11 discoveries yielding 2.7 Bboe (2P recoverable). These HIW discoveries equate to just over a quarter of the newly discovered resources for 2023 from just roughly 6% of the total number of successful wildcat wells. As was proven in Namibia most recently, high impact drilling still has a significant role to play in exploration and the opening up of new areas. So, what lies ahead for HIW drilling in 2024?

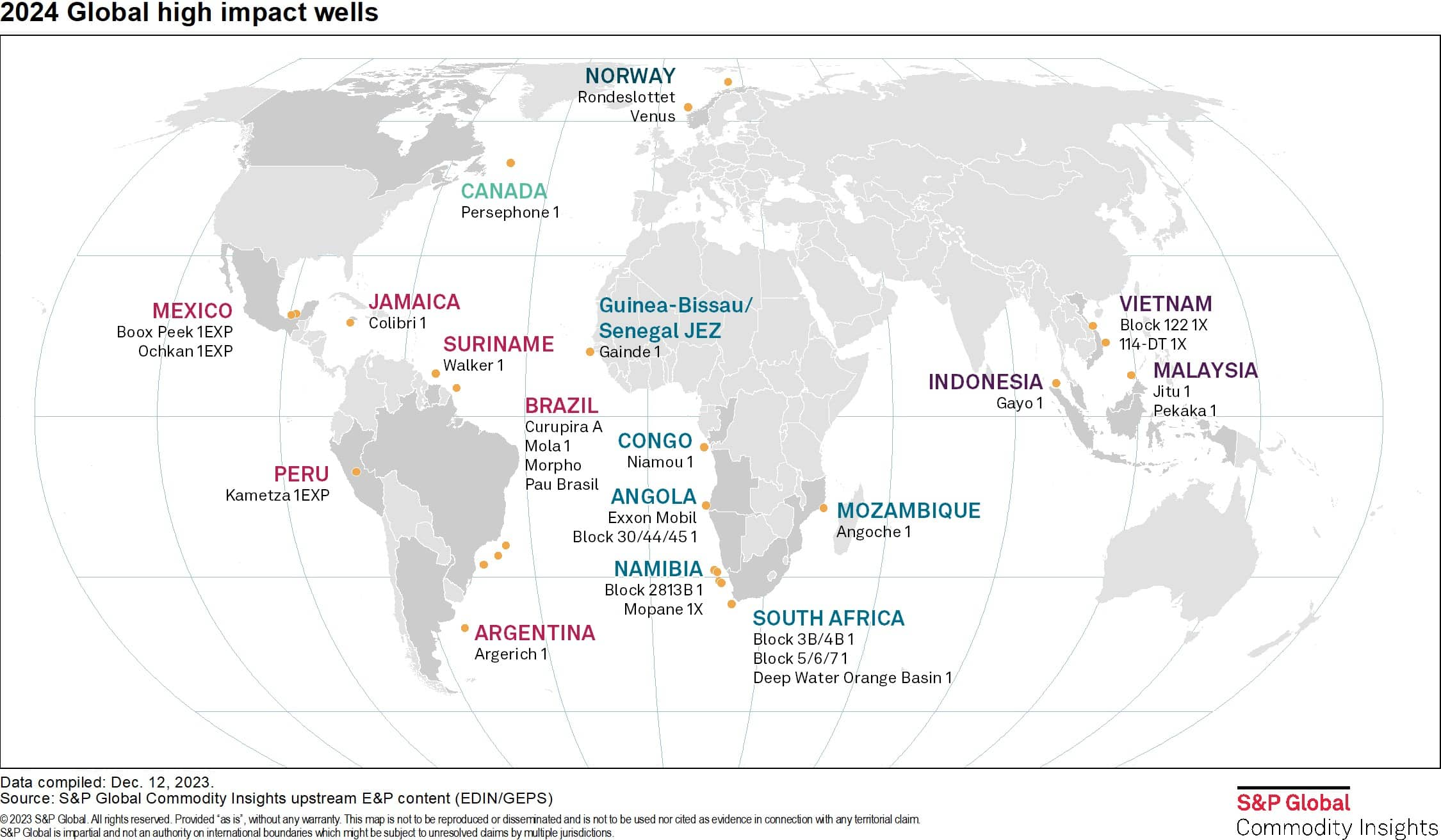

It is expected that the majority of HIWs will be drilled across Latin America and Africa. As mentioned above, exploration and appraisal activity will continue in the Orange Sub-basin in Namibia and extend south into South Africa. There are also interesting wells in Mozambique (Angoche), Angola, Republic of the Congo (Niamou) and Guinea (Gainde). In Latin America it is expected that exploration will continue across Guyana and Suriname (Walker), Brazil (Curupira, Mola, Pau Brasil and Morpho), Mexico (Boox Peek and Ochkan), Jamaica (Colibri), Peru (Kametza) and finally Argentina (Argerich). Argerich is being drilled by Equinor as a result of success on the other side of the Atlantic Margin in Namibia. In Asia-Pacific, we envisage two wells in Malaysia (Pekaka and Jitu), two wells in Vietnam (Block 122 and 114-DT) and one HIW in Indonesia (Gayo). In Norway there are two HIWs planned, one is in the Norwegian Sea (Rondeslottet) and the other in the Barents (Venus). Finally, ExxonMobil is planning a well in the Orphan Basin in Canada called Persephone located in ultra-deep water.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2023-international-exploration-review-and-2024-hiw-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2023-international-exploration-review-and-2024-hiw-outlook.html&text=2023+International+Exploration+Review+and+2024+HIW+Outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2023-international-exploration-review-and-2024-hiw-outlook.html","enabled":true},{"name":"email","url":"?subject=2023 International Exploration Review and 2024 HIW Outlook | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2023-international-exploration-review-and-2024-hiw-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=2023+International+Exploration+Review+and+2024+HIW+Outlook+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2023-international-exploration-review-and-2024-hiw-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}