Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 15, 2022

2022 exploration drilling review and 2023 High Impact well (HIW) drilling outlook

2022 exploration drilling delivers 18.7 Bboe

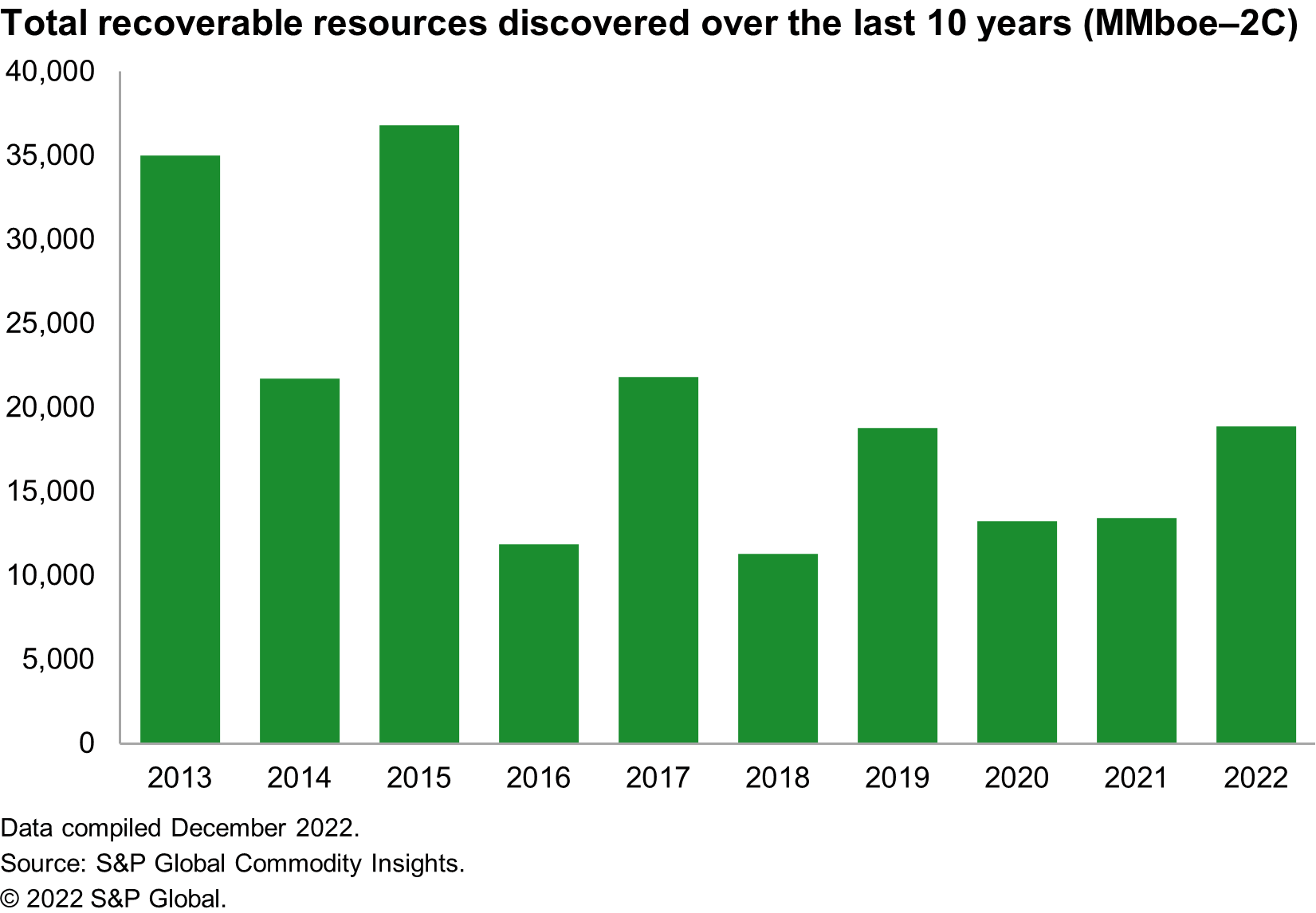

By the end of November 2022, a total of 178 discoveries had been made globally from new-field wildcat (NFW) drilling equating to just over 18.7 billion barrels of oil equivalent (Bboe) recoverable (conventional). To put this in perspective and once a full year of results is realised, it could surpass 2019 and be the most discovered recoverable resources from exploration drilling across the last five years outside of North America (L48). To date 2022 has delivered some big discoveries, within some new plays and countries, likely as a result of work undertaken by operators on portfolio high-grading which took place during the pandemic, or potentially before that, when companies began to adapt their portfolios for the energy transition. In addition, the industry continues its resurgence following the coronavirus disease 2019 (COVID19), which combined with the tailwinds of the high oil price all add to an impressive year in exploration.

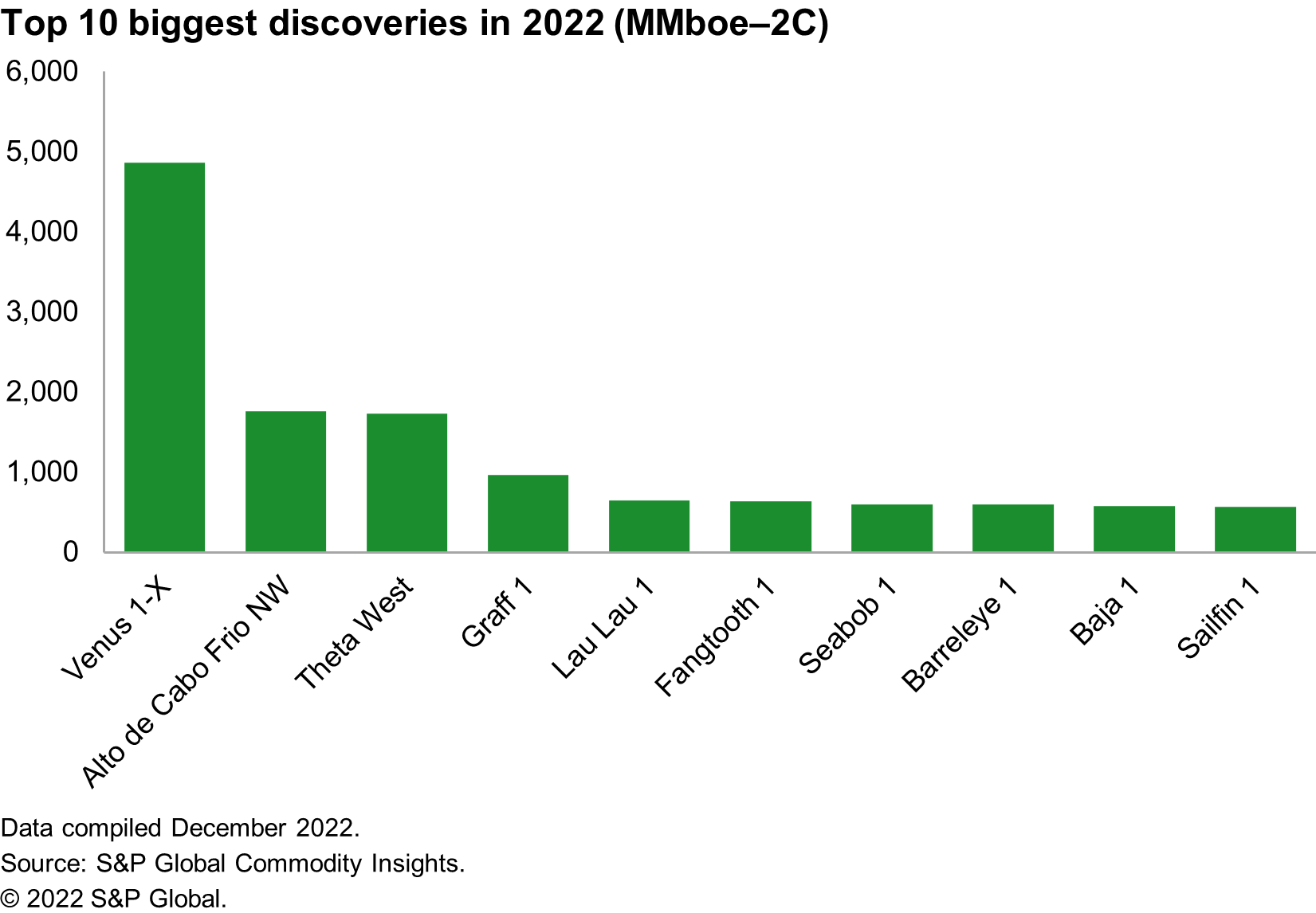

There have been some huge discoveries this year, a summary of the top 10 is outlined below. In Namibia, within the Orange Sub-basin, TotalEnergies and Shell discovered the Venus and Graff discoveries respectively. These were the first discoveries in Namibia since 1974, when Chevron discovered the Kudu field, which remained the only discovery in the country until this year. Venus is a 600 sq km basin floor fan, with partners in the group comparing the discovery to the Marlim field in the Campos Basin, offshore Brazil, which has Aptian aged reservoirs. There is some debate over the size of the discoveries and therefore further appraisal drilling is expected beginning late 2022 (Graff) / early 2023 (Venus) to refine just how large these discoveries are. Based on these two discoveries alone, Namibia could go from a non-producing country to becoming one of Africa's top oil producers within the next 10 years.

In Latin America the Guyana Basin continues to deliver, with ExxonMobil making several big discoveries in the top 10 in 2022 (Lau Lau, Fangtooth, Seabob, Barreleye and Sailfin) but the operator also made discoveries such as Yarrow, Kiru Kiru, Lukanani and Patwa. These wells were all part of a drilling campaign which could see 30+ wells being drilled, with 12-15 wells in the prolific Starbroek Area and 15 within the Canje block. These discoveries have all been found within the New Amsterdam Formation, part of the north-south trending turbiditic channel complex where the sands are sealed by intraformational shales. Fangtooth is already under appraisal with drilling commencing in October 2022 to the southeast of the discovery.

Across the border in Suriname, Apache has been successful with its Baja discovery in Block 53. The discovery is the first in this block with the well encountering 34 m of net oil pay in high quality New Amsterdam Formation reservoirs.

Staying in Latin America we have witnessed a big discovery in Brazil named Alto de Cabo Frio NW by Petrobras. The pre-salt discovery is located within the East Campos Sub-basin in a water depths of over 1,800 m. A depth structural map of the base salt (pre-drill) shows a mega structural closure of 2,700 sq km covering almost the whole block. Prior to drilling it was thought that the structure may be compartmentalised. The well encountered a thick interval of pre-salt carbonate reservoirs and confirmed good productivity index.

Moving northeast 13,250 km to Alaska, Pantheon Resources had success with a high impact well (HIW) targeting its Theta West prospect. The well encountered just over 350 m of hydrocarbon bearing reservoir across the Brookian aged Upper Basin Floor Fan and Lower Basin Floor Fan horizons. Unfortunately testing operations were hampered by extremely cold weather but following plugging and abandonment the company stated it had acquired sufficient information to determine that movable hydrocarbons were present. This discovery follows the 2021 Talitha discovery whereby 183 m of oil-bearing sand was encountered within the same play. In 2023 it is expected that an appraisal well (or potentially two) will be drilled between Theta West and Talitha. Pantheon announced that the Lower Basin Floor Fan play could hold in-place resources of 17.8 Bbo.

HIWs responsible for 66% of discovered resources

Of the 178 discoveries made to date in 2022, a total of 17 were from HIWs with 12.3 Bboe of recoverable resource being discovered in total from the 17 discoveries. HIW drilling is a risky business and while there have been some significant successes there were also several dry holes. From HIWs spudded in 2022, a total of nine wells were reported as P&A, dry. Two of these were in Australia with Cervantes and Sasanof, four were in Brazil, three of which were drilled in the Campos Basin and the other located within the Sergipe-Alagoas Basin. In NW Europe the Norwegian Copernicus gas prospect was confirmed a dry hole after no reservoir was encountered, and the UK/Norway cross-border Edinburgh high pressure high temperature prospect was also dry even though Jurassic sands were encountered. Finally, in Kenya, the Milma HIW was also classed as a dry hole. There were two other HIWs of note, Mersing in Malaysia and Karasu in Turkey of which the results remain unreported.

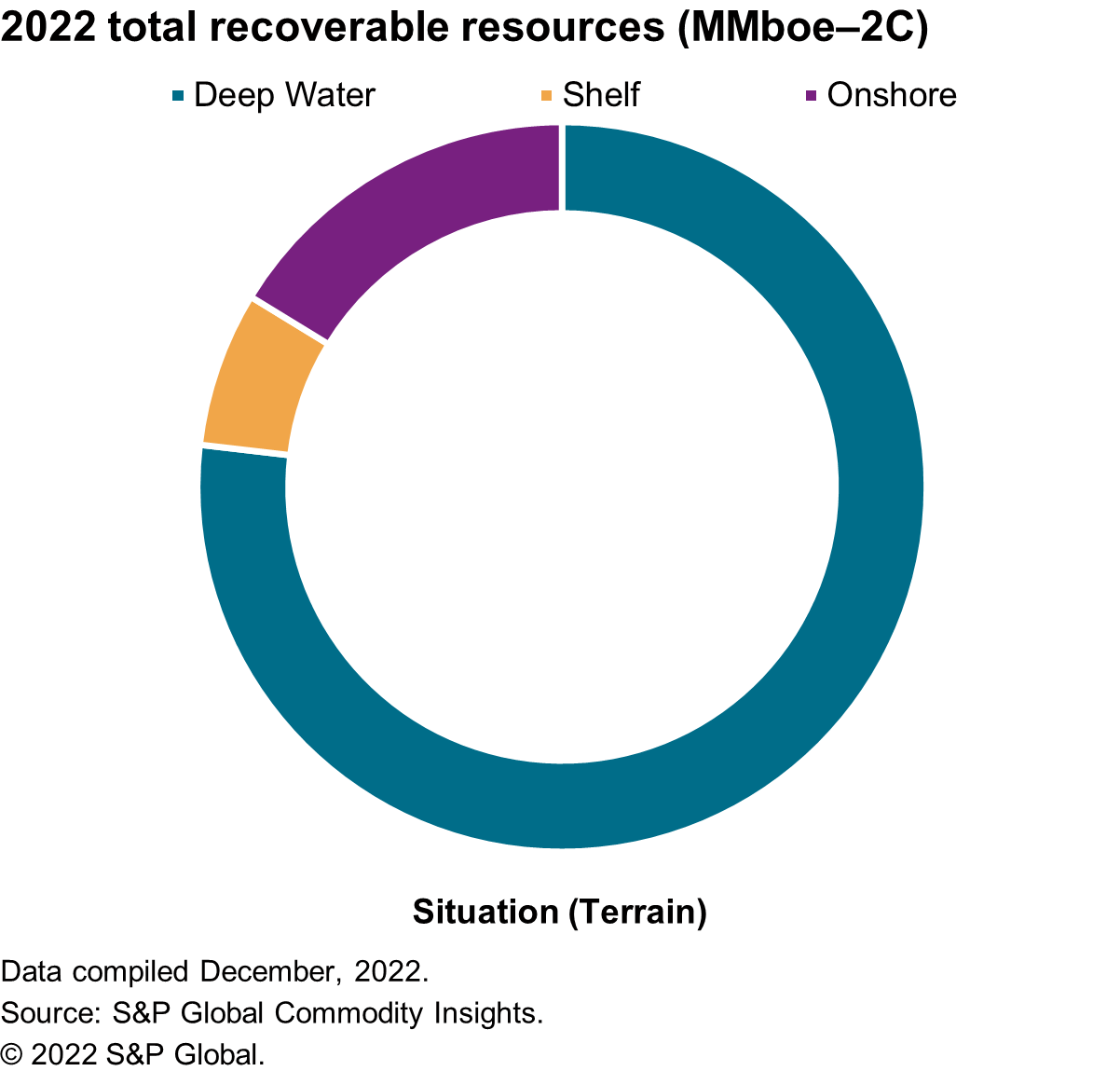

Of the globally discovered resources 77% is situated in deepwater (>200m)

One common theme for 2022 is that these large discoveries, Theta West aside, are all located offshore in deep waters. In fact, when reviewing all the 2022 discoveries (all 178) 77% of the discovered recoverable resources are in deepwater, 16% onshore and 7% located within the shelf setting.

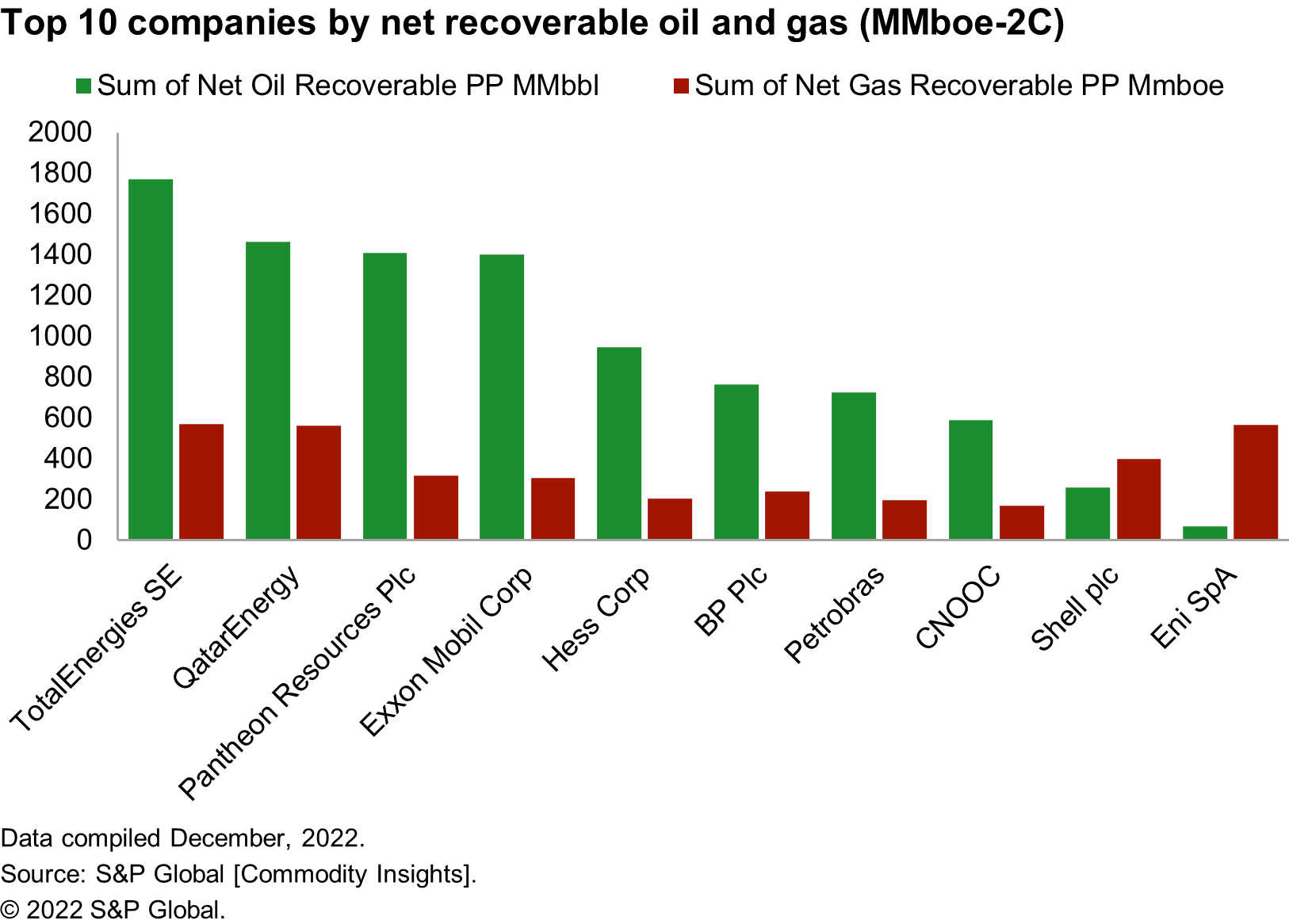

Blend of company types making the biggest discoveries

There is a mix of operator persona's when looking at the most successful 'finders' from exploration drilling in 2022, from the Global Integrated Oil Companies (GIOCs) to National Oil Companies (NOCs) and smaller independents. TotalEnergies leads the way by volumes encountered following its success in Namibia, however, further appraisal drilling of the Venus discovery will determine just how significant this 2022 discovery is. Another successful operator from the year has been ExxonMobil with its success in Guyana, where Hess has also performed well as a core partner. QatarEnergy has proven successful through its non-operated interest in some large exploration projects, as a result it has emerged as the second most successful explorer. This success has been built off a long-term plan by QatarEnergy to step-out from its predominantly domestic role and into the international arena through partnering companies like TotalEnergies and ExxonMobil. It could be that QatarEnergy will transition into being an operator of international exploration wells in the future. Another company to mention is BP, which has recently stated that it will no longer be looking to enter new countries for E&P activity. However, it still has ambitions within the countries in which it is incumbent, to look at frontier exploration opportunities such as the 2023 Cape Freels HIW in Eastern Canada's Orphan Basin. Shell and Eni are the two companies in the top 10 which have had greater success in discovering gas rather than oil during 2022. This may be a sign that these GIOC's are tackling the energy transition head on and looking to discover more gas as the key transition resource. From an NOC perspective both Petrobras and CNOOC have been successful in 2022. As mentioned, Petrobras was operator of the second biggest discovery of the year. Finally, Pantheon Resources is a notable smaller independent which makes it into the top 10 following its success in the Alaska North Slope Basin.

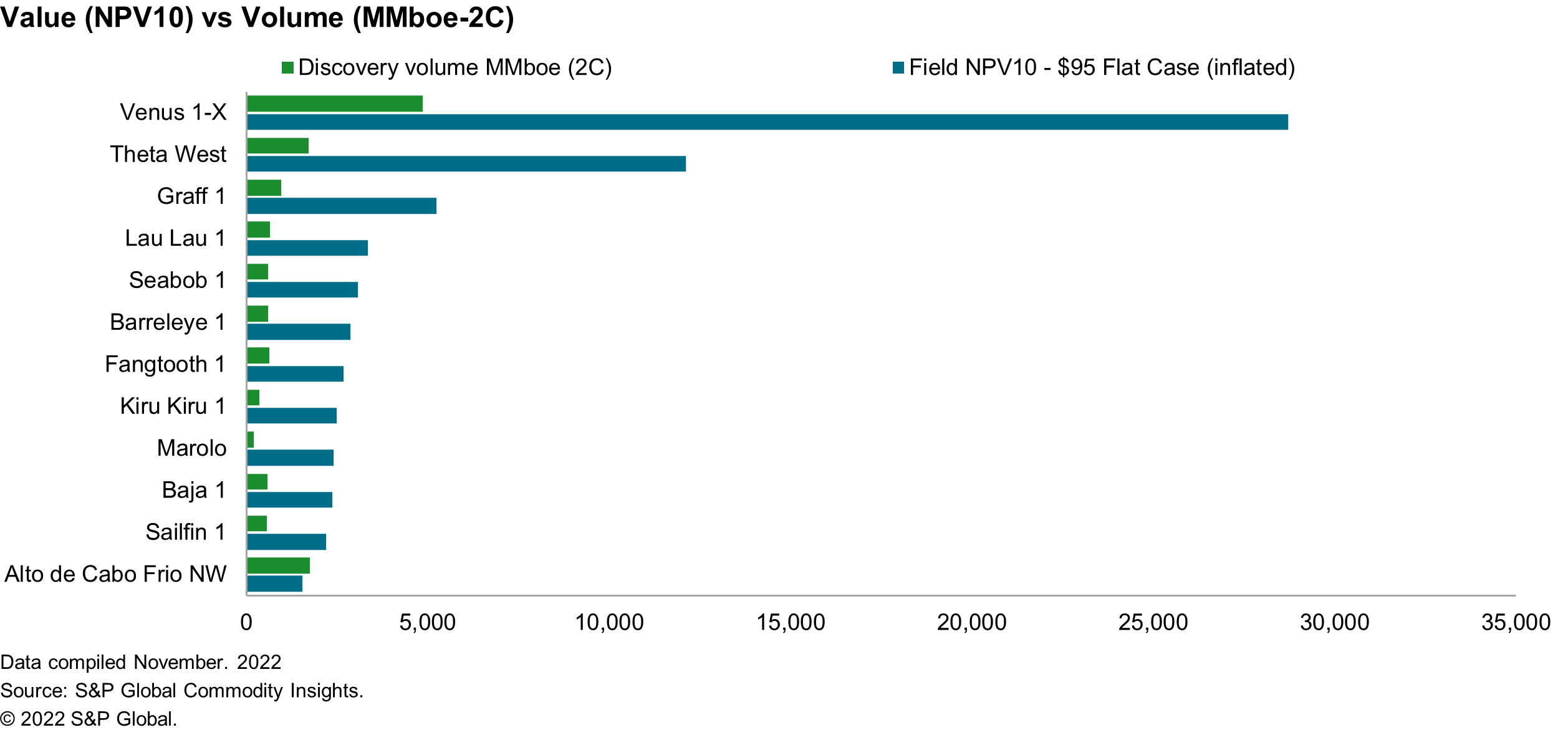

Whilst volume is an important metric, it is the value of discoveries that is the main driver for operators. The chart below details exactly that, plotting the volume of the discovery's vs their interpreted value. In general, the value follows the volume but there are some exceptions. The second biggest discovery in terms of volume from 2022 is Petrobras's Alto de Cabo Frio, yet this is the 12th most valuable discovery due to the high government take (just over 90%).

Between 25 and 30+ HIWs planned for 2023

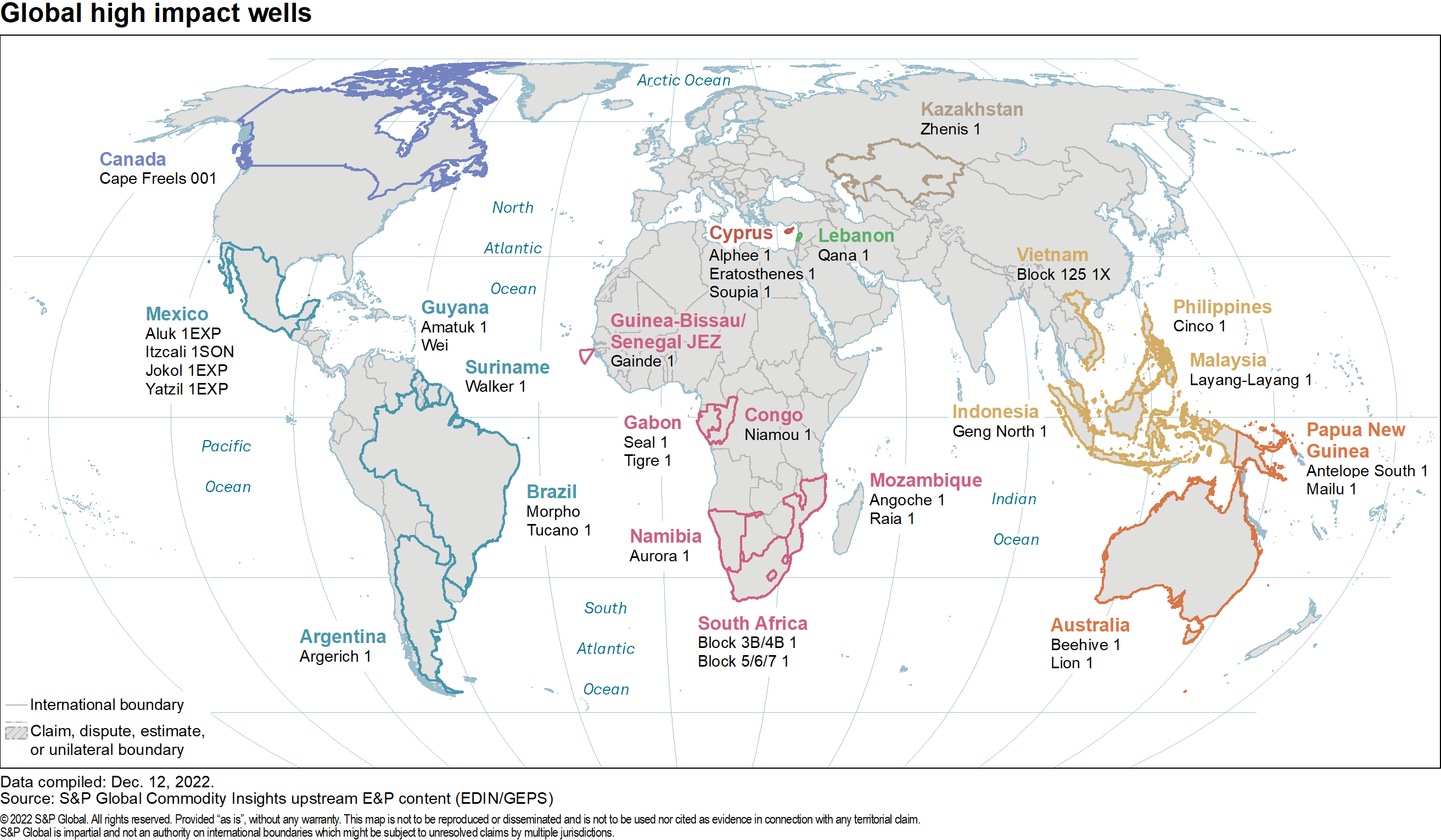

Following the successes of 2022, we will likely see companies revisiting certain projects for appraisal drilling such as Venus, Graff, Fangtooth and Alto de Cabo Frio which may result in resource revisions and further information around commerciality. But how will 2023 shape up from a HIW perspective? With a few weeks to go before the end of the year, we still expect to see some HIWs spud. For 2023 it appears that HIW drilling will mainly be focused upon the Latin America, Africa, and the Asia Pacific regions, with fewer wells planned in Europe, CIS, Frontier North America, and the Middle East.

In Latin America we envisage HIWs to spud in Mexico (Yatzil, Itzcali and Jokol), Brazil (Tucano and Morpho), Argentina (Argerich) Suriname (Walker) and Guyana (Amatuk and Wei). With the success of Guyana in recent years and plans announced by operators such as ExxonMobil, we are aware that additional HIWs could spud in Guyana in 2023, ExxonMobil has also indicated potential to explore within the Kaieteur block in 2023. In addition to ExxonMobil's exploration efforts, with its fields such as Liza (producing), Payara (due onstream in 2023) and Yellowtail (due onstream in 2025), the company expects Guyana's oil production capacity to be more than 1 MMbo/d by the end of the decade.

In Africa there are two wells planned in Gabon (Seal and Tigre), two wells in Mozambique (Angoche and Raia) and two wells in South Africa. We also expect to see HIWs in Republic of the Congo (Niamou), Guinea-Bissau/Senegal JEZ (Gainde) and further drilling in Namibia with the Aurora well.

For Asia Pacific there are wells planned in Australia (Beehive and Lion) and Papua New Guinea (Antelope South and Mailu) along with wells in Indonesia (Geng North), Malaysia (Layang-Layang), Philippines (Cinco) and Vietnam.

In Europe we may see further drilling in Cyprus. Last year Eni discovered Cronos which is the fifth discovery in the area to date. There are potentially three wells planned for 2023, these are Soupia, Alphee and Eratosthenes.

In the Middle East we may see the Qana 1 well in Lebanon be drilled within the Levantine Basin. In Kazakhstan the Zhenis well is planned which was due to spud during December 2022. Finally in Frontier North America, the Cape Freels well might be given the go ahead in the Orphan Basin.

Based on current information we expect between 25 and 30+ HIWs to be drilled in 2023. There are some exciting exploration targets being drilled in the coming year and the map below details those wells. Exploration is a high risk and high reward business, and plans are subject to change, an unsteady state amplified by the ever-changing environment in which we find ourselves in relation to rebound from the COVID-19 pandemic and energy transition pressures. Up to date details on all the wells mentioned above can be found in the relevant country within our Global Exploration & Production Service (GEPS) product.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2022-exploration-drilling-review-and-2023-high-impact-well-hiw.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2022-exploration-drilling-review-and-2023-high-impact-well-hiw.html&text=2022+exploration+drilling+review+and+2023+High+Impact+well+(HIW)+drilling+outlook++%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2022-exploration-drilling-review-and-2023-high-impact-well-hiw.html","enabled":true},{"name":"email","url":"?subject=2022 exploration drilling review and 2023 High Impact well (HIW) drilling outlook | S&P Global&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2022-exploration-drilling-review-and-2023-high-impact-well-hiw.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=2022+exploration+drilling+review+and+2023+High+Impact+well+(HIW)+drilling+outlook++%7c+S%26P+Global http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2022-exploration-drilling-review-and-2023-high-impact-well-hiw.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}