Published June 2022

Polyurethanes are based on the exothermic reaction of polyisocyanates and polyol molecules. Many different types of polyurethane materials are produced from a few types of isocyanates and a range of polyols with different functionality and molecular weights. Some of the diversity of functionality depends on whether the polyols are based on polyethers or polyesters. Most polyether polyols are produced for polyurethane applications; however, other end uses range from synthetic lubricants and functional fluids to surface-active agents. This report focuses on urethane applications.

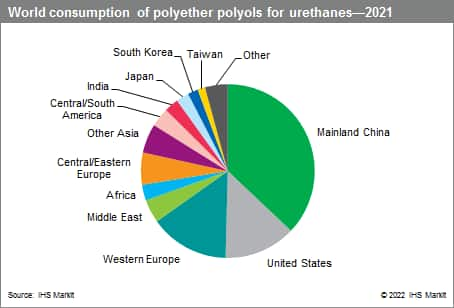

The following pie chart shows world consumption of polyether polyols for urethanes in 2021:

The polyether polyol business is global and fairly concentrated, with the top-four producers accounting for more than 40% of global capacity. Dow Chemical is the largest worldwide producer of polyether polyols, with the largest number of both plants and capacities in the greatest number of countries. Shell has become the second-largest producer, following the expansion of the joint venture plant in mainland China in 2021. Covestro (formerly operating as Bayer MaterialScience) is the third-largest producer, with plants in the United States, Europe, Latin America, and Asia. BASF rounds out the top four, with plants located in the United States and Western Europe, and smaller plants in Latin America and South Korea.

Consumption of polyether polyols is highly influenced by the polyurethane foam markets. Flexible foams are used in automotive seating, furniture, and bedding, while rigid foams are used in construction and appliances. Nonfoam uses include urethane adhesives and sealants and urethane surface coatings. With the impact of the COVID-19 pandemic in 2020, the global economy and major downstream industries (automotive, construction, manufacturing) were severely impacted, and the global polyether polyols market dropped. As the pandemic started receding in 2021, the polyurethane and polyols markets have also started recovering.

Consumption of polyether polyols in global markets will grow at an average annual rate of around 4.0% during 2021-26; the greatest growth will take place in Asia (excluding Japan, South Korea, and Taiwan). Mainland China and India will show high growth rates for 2021–26.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook –Polyether Polyols is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key Benefits

S&P Global’s Chemical Economics Handbook –Polyurethane Foams has been compiled using primary interviews with key suppliers, organizations and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence, expert insights into industry dynamics, trade and economics.

This report can help you:

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability