Published January 2024

Nonwovens are generally categorized by their use in either disposable (medical/surgical products such as face masks, hygiene products such as baby diapers, adult incontinence products and feminine hygiene products, as well as use in wipes, filtration products and other uses such as industrial garments) or durable (geotextiles, building/construction, automotive parts, flooring/furnishings/bedding and other uses such as apparel interlinings) applications. Disposable applications (led by medical/surgical and hygiene products, and wipes) account for the majority of nonwovens use with 60% of the total; durable applications (led by geotextiles/construction, automotive parts and flooring/furnishings/bedding) make up 40% of total nonwovens consumption.

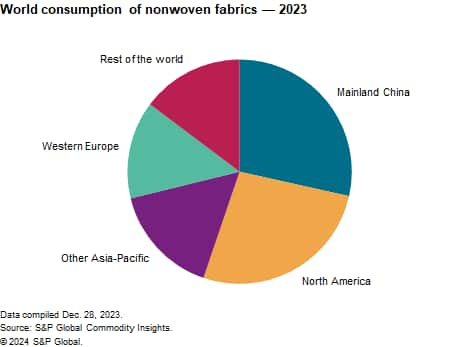

The following pie chart shows world consumption of nonwoven fabrics:

This report discusses fiber consumption in nonwovens by fiber (acrylic, cotton, rayon/lyocell, nylon, polyester, polyethylene and polypropylene) and by end use. Wood pulp, glass fiber and high-performance aramid fibers are excluded from these discussions, as are conventional fiberfill stuffing and batting applications.

In 2020, the global COVID-19 pandemic had a major impact on the nonwovens market. For disposable nonwovens, markets increased significantly throughout the world. Production and consumption increased as nonwovens were heavily used in applications to combat the virus. For example, medical/surgical uses such as face masks, hospital gowns and medical apparel were in high demand during the crisis. This led to a surge in mainland China for medical/surgical applications for both export and domestic use.

In contrast, the COVID-19 pandemic led to a negative effect on the nonwovens market in durable applications. In 2020, the pandemic led to declines in the global economy, as major industries such as construction, transportation (including automotive) and industrial applications were impacted.

As the pandemic began to subside, nonwovens production and consumption has also returned to lower levels. For example, nonwovens use for face masks has significantly been reduced as mask restrictions have been lifted worldwide. There has also been a decline in other nonwoven medical uses and applications as the number of pandemic related cases have dropped. For durable goods, such as in the automotive or construction industries, there was a slight recovery in nonwovens use in 2021. However, with the global economic slowdown in late 2022 and in 2023, growth in these industries has been limited.

Overall, the nonwovens market has adjusted from its unprecedented levels in 2020. During the next few years, global nonwovens consumption is expected to grow at an average annual rate of about 3%. Growth will be supported by increases in disposable applications such as medical/surgical uses, filtration and other uses. There will also be continued growth in disposable areas such as hygiene markets, wipes, industrial garments and food packaging. In general, the expected recovery of the global economy (and industries such as construction and automotive) will contribute to growth in durable nonwoven applications such as those found in geotextiles/building, and in construction and automotive production. Growth will also continue for other durable goods such as electronics, landscaping, agriculture and others.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook –Nonwoven Fabrics is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook –Nonwoven Fabrics has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability