Published October 2024

Linear alkylbenzene sulfonic acid (LABSA) is prepared commercially by sulfonating linear alkylbenzene (LAB). Linear alkylbenzene sulfonate (LAS), the world’s largest-volume synthetic surfactant, which includes the various salts of sulfonated alkylbenzenes, is widely used in household detergents as well as in numerous industrial applications. The LABSA market is driven by the markets for LAS, primarily household detergents. Linear alkylbenzene sulfonate was developed as a biodegradable replacement for nonlinear (branched) alkylbenzene sulfonate (BAS) and has largely replaced BAS in household detergents throughout the world.

The pattern of LAS consumption demonstrates the overwhelming preference by consumers for liquid laundry detergents in North America, whereas powders continue to be the dominant products in Western Europe, mainland China, Japan and Other Eastern Asia (South Korea and Taiwan). Comparable and reliable data in other world regions are generally unavailable, but in these less-developed world areas, LAS is essentially used only in laundry powders (particularly in India and Indonesia) and hand dishwashing liquids. The latter are often used as general-purpose cleaners.

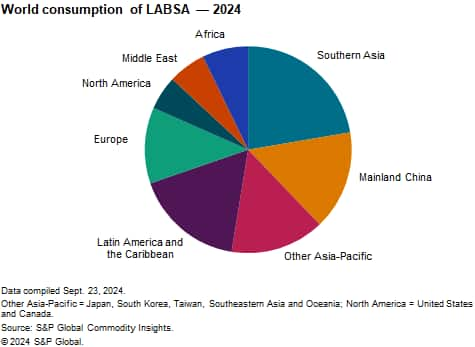

The following pie chart shows world consumption of LABSA:

Industrial, institutional and commercial cleaners account for most of the other applications, but LAS is also used as an emulsifier (e.g., for agricultural herbicides and in emulsion polymerization) and as a wetting agent. Very small volumes are also used in personal care applications.

Although consumption of LAS will likely remain stable in the highly developed regions, it will increase by 2.0%-4.0% per year in some less-developed regions or countries, such as the Middle East, Africa, Central and Eastern Europe, South America, Turkey, Southern Asia (particularly India) and South-eastern Asia, where powder detergents are still a very large part of the laundry detergent market. As a result of the rapid growth of LAS demand in Asia, demand in the region accounted for approximately half of global demand in 2024.

LABSA/LAS production is also impacted by the supply situation for competing products — mainly alcohol ether sulfates (AES). Shortages in AES supply or its high price has usually favored the use of LABSA/LAS. In the developing world, LAS competes with soaps. More recently, there has been some reformulation from alcohol ethoxylates/alcohol ether sulfates to linear alkylbenzene sulfonates due to 1,4-dioxane concerns. 1,4-Dioxane is a by-product of ethoxylation. Future LAS demand could benefit from 1,4-dioxane regulations, especially in Europe and the US, since LAS production does not produce 1,4-dioxane as a byproduct.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Linear Alkylbenzene Sulfonic Acid (LABSA)/Linear Alkylbenzene Sulfonate (LAS) is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook – Linear Alkylbenzene Sulfonic Acid (LABSA)/Linear Alkylbenzene Sulfonate (LAS) has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations and other factors on chemical profitability