Published June 2022

Ethylbenzene (EB) is a highly flammable, colorless liquid that has a sweet aroma similar to that of gasoline. Nearly all ethylbenzene produced in the world is used in the manufacture of styrene; therefore, ethylbenzene demand is determined primarily by styrene production. Styrene is used mostly in polymer production for polystyrene, acrylonitrile-butadiene-styrene (ABS) and styrene-acrylonitrile (SAN) resins, styrene-butadiene elastomers and latexes, and unsaturated polyester resins. The major styrene industry markets include packaging, electrical/electronic/appliances, construction, and consumer products. Consumption of ethylbenzene for uses other than the production of styrene is estimated to be less than 2%. These applications include use as a solvent and, on occasion, the production of diethylbenzene, acetophenone, and ethyl anthraquinone.

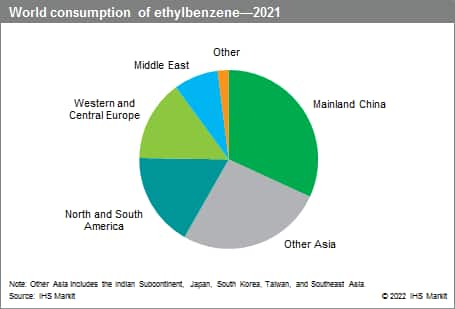

The following pie chart shows world consumption of ethylbenzene:

Northeast Asia is the dominant player in the ethylbenzene industry, representing for over half of global capacity and consumption. Mainland China is the main driver in Northeast Asia, accounting for about two thirds of regional capacity and nearly 60% of regional demand as of 2021. Mainland China will also be the fastest-growing market for ethylbenzene over the next five years. Global ethylbenzene demand is projected to grow at 2–3% per year during the forecast period.

Over the last decade, global styrene demand (and likewise ethylbenzene) has been driven primarily by the production of polystyrene (PS), which accounted for about one-third of global styrene demand in 2021. The other main end uses for styrene and their shares in 2021 include expandable polystyrene (22%), ABS resins (19%), unsaturated polyester resins (6%), SB latex (4%), and SB rubber (3%).

The top 15 producers represented more than half of the total capacity in 2021. Royal Dutch/Shell, INEOS Styrolution, and SINOPEC are the largest producers, together accounting for nearly 20% of global capacity in 2021.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Ethylbenzene is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key Benefits

S&P Global’s Chemical Economics Handbook – Ethylbenzene has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability