Published May 2022

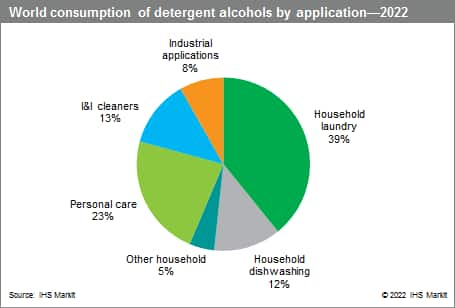

Global consumption of detergent alcohols will continue to grow at an average annual rate of 3.2% during the period 2022–27, driven primarily by the developing markets in Asia, particularly in India, mainland China, and Southeast Asia. Mainland China, the United States, and Western Europe consumed the majority of detergent alcohols in 2022. Derivatives of detergent alcohols are widely used as surfactants for laundry and dishwashing detergents, other household cleaners, personal care products, and various industrial applications. The demand for detergent alcohols and their associated surfactants will vary by region, based on the development of detergent formulations, washing technologies, legislation, and consumer preferences for liquid, powder, or single-dose products and their impact on sustainability.

The following chart shows consumption of detergent alcohols by major region:

The detergent alcohol industry had been in an overcapacity situation for several years, following the rapid buildup of capacity in 2011–16, mainly from producers of oleochemicals in Southeast Asia. Since 2019, there have been few capacity additions. In fact, the only significant addition was by Sasol in the United States in 2020. As consumption is expected to increase at a faster rate than capacity, utilization rates have improved and are expected to increase through the forecast period.

Corporate activity in the household detergents and surfactants industry (and subsequently the detergent alcohols market) remains dynamic, with numerous divestments, acquisitions, joint ventures, and investments announced since the last report was published in 2019, especially in the sustainability sector, as organizations try to meet the challenges of volatile feedstocks, emerging markets, new capacity expansions, and sustainability targets.

This report provides an excellent insight into the global market for detergent alcohols as well as their major surfactants. It has been compiled using primary industry research and brings together elements of other S&P Global reports in the Chemical Economics Handbook (CEH) and Specialty Chemicals Update Program (SCUP) suite of surfactant-related reports

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Detergent Alcohols is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key Benefits

S&P Global’s Chemical Economics Handbook – Detergent Alcohols has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability