Published November 2022

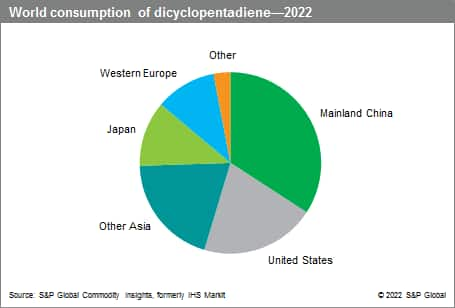

Cyclopentadiene and its dimer, dicyclopentadiene (DCPD), are obtained as by-products of the steam cracking of hydrocarbons. Production and consumption had been concentrated in the United States, Western Europe, and Japan, but the rise of mainland Chinese demand in traditional dicyclopentadiene markets has made mainland China the largest consumer. Especially in Asia, the growth of the construction, automotive, and electronics industries has increased the consumption of dicyclopentadiene. Growth in DCPD consumption for hydrocarbon resins has launched Singapore and Taiwan as major Asian consumers.

The following pie chart shows world consumption of dicyclopentadiene:

The majority of DCPD end-use applications are for well-established markets. In 2022, the largest global DCPD markets were unsaturated polyester resins, hydrocarbon (petroleum) resins, and EPDM elastomers (mostly as ethylidene norbornene). Other more specialized DCPD markets include poly-DCPD, COC/COP (cyclo-olefin copolymers or cyclo-olefin polymers), flame retardants, pesticides, antioxidants, and flavors/fragrances (some of these markets consume higher-purity DCPD).

Important factors influencing the global DCPD market are the following: (1) the shift of global production centers to mainland China and Other Asia; (2) the effect of changing feedstocks for ethylene production, especially in the United States; (3) changing trade flows (especially shipments from mainland China and Taiwan to North America and Europe); and (4) the dramatic Asian growth for hydrocarbon resins.

In 2022, the United States, mainland China, Western Europe, and Japan are the largest consuming regions, followed closely by Singapore and South Korea. Global consumption is forecast to continue growing moderately during 2022–27; most end-use markets are expected to grow at GDP levels. Strong drivers for market growth are the hydrocarbon resin expansions in mainland China, Singapore, and Taiwan and continued steady growth in unsaturated polyester resins. Hydrocarbon resins are widely consumed in hot-melt adhesives used for diapers and other nonwovens, packaging, and woodworking. World DCPD consumption will grow fastest in Taiwan and mainland China during 2022–27.

Mainland Chinese consumption of DCPD will continue to grow strongly during 2022–27, followed by the United States and Europe. Consumption in Taiwan will experience rapid growth during the forecast period.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Cyclopentadiene-Dicyclopentadiene is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key Benefits

S&P Global’s Chemical Economics Handbook – Cyclopentadiene-Dicyclopentadiene has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability