Published September 2022

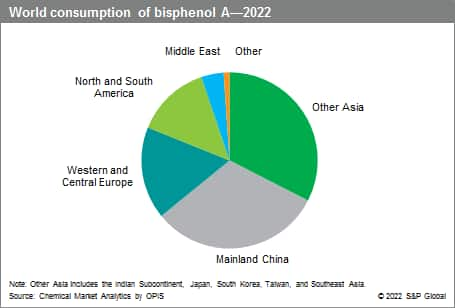

The overall health of the world economy will continue to play a major role in future demand for bisphenol A, as its derivatives’ major end-use markets include automotive, construction, and electrical/electronic applications. With more than half of the global demand, the Asian market will continue to expand, driven by growth in demand and capacity in mainland China.

The global bisphenol A (BPA) industry is led by demand for polycarbonate resins, which accounted for nearly two-thirds of BPA demand in 2020. Polycarbonate demand is mostly driven by the electronics, construction, and automotive industries. Epoxy resins are the second-largest application for bisphenol A, consumed mainly in surface coatings; other BPA uses include flame retardants, unsaturated polyester resins, polysulfone resins, polyetherimide resins, and polyarylate resins.

The following pie chart shows world consumption of bisphenol A:

There is a significant amount of controversy over the health effects of bisphenol A. The European Union and Canada have banned polycarbonate resins (which contain trace amounts of BPA) for baby bottles. Although there is no official ban in the United States, polycarbonate baby bottles have also been pulled from store shelves in response to consumer concerns about BPA health effects. For many years, research has shown BPA to be safe at current exposure levels. However, research continues to be conducted, because of the concern over potential endocrine disruption effects caused by exposure to BPA.

During the forecast period, brand owners will focus on the developing markets where there is demand from large groups of emerging middle-class consumers, including mainland China, India, Southeast Asia, and Brazil. In the electronics/electrical application, energy, solar, lighting, and security are some of the subsegments that will present opportunities for polycarbonate producers to offer the potential of innovative design and cost savings. Devices that will help overcome poor infrastructure in the developing world, such as mobile phones, will also see the most dramatic growth.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Bisphenol A is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key Benefits

S&P Global’s Chemical Economics Handbook – Bisphenol A has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability