Published April 2022

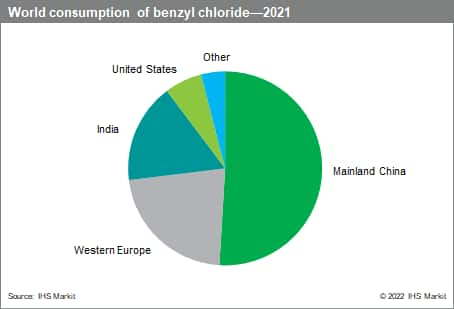

Benzyl chloride is consumed in the production of benzyl alcohol (accounting for about 55% of total benzyl chloride consumption), benzyl quaternary ammonium compounds (17%), benzyl cyanide (13%), and benzyl esters (5%), with the remainder consumed for benzyl phthalates and other products. The benzyl chloride market has been affected by low demand from derivatives products during the COVID-19 pandemic. However, recovery of demand is expected. Consumption in mainland China and India accounted for 68% of global demand in 2021. Consumption in these two markets will continue to grow the fastest over the next five years. The market for benzyl chloride is mature in Western Europe and North America. In North America, benzyl chloride consumption is expected to increase at an average rate of 2.7% per year. Other Asian demand is expected to grow at about 7.2% per year during the forecast period, while demand in the rest of the world is expected to grow moderately.

The following pie chart shows world consumption of benzyl chloride:

Benzyl chloride consumption for the production of benzyl alcohol has increased and will continue to increase strongly in mainland China and India. In mainland China, benzyl alcohol is used increasingly in a variety of applications including as an epoxy resin diluent, and in perfumes, flavors, personal care, and pharmaceutical products, as well as solvents. In India, benzyl alcohol accounts for the largest benzyl chloride market and is exported primarily to Western Europe, the United States, Japan, and South Korea. It is also consumed domestically for pharmaceuticals, fragrances, and other uses. In Western Europe, benzyl chloride consumption for benzyl alcohol production is the largest market. Slow growth is expected for this market in such areas as solvents, ballpoint pen inks, and chemical intermediates. There is no benzyl alcohol production from benzyl chloride in the United States or Japan.

Benzyl chloride use for benzyl quaternary ammonium compounds (benzyl quats) is another major global market. In the United States, benzyl quats are expected to grow as a result of increasing use in biocides, oil and gas applications, personal care, and other product areas. Mainland China will continue to see strong growth in the water treatment and biocides markets. Benzyl quats use in Western Europe will grow because of the water treatment and pharmaceutical industries. Other regions, such as India, Central and South America, Central and Eastern Europe, and the Middle East and Africa, will also consume benzyl chloride in benzyl quats production.

Benzyl chloride for benzyl cyanide production occurs primarily in mainland China. Consumption is expected to increase only modestly. Benzyl cyanide is a precursor to the manufacture of penicillin G; it is also used in minor amounts for pesticides, flavors, and fragrances. Moreover, benzyl cyanide is listed as drug precursor chemical in mainland China. Therefore, the production, selling, and transportation of benzyl cyanide in mainland China is strictly controlled.

Benzyl chloride consumption for benzyl esters will continue to grow. In mainland China, demand for benzyl esters will increase because of demand for fragrances. US demand for esters will grow because of perfume and cosmetics applications. Other regions such as India and Central and South America will also have growth.

Future demand for benzyl chloride in the manufacture of phthalates is moderate because market participants are developing new phthalate products that are safer for the market. It is unclear what impact this will have on demand, and the scope of regulatory scrutiny is still difficult to evaluate. Stricter regulations are affecting the use of benzyl chloride in this application in Europe, and other regions could follow.

Stricter environmental standards in mainland China will continue to cause periodic shortages of benzyl chloride in the next few years. However, the supply shortage situation will improve as more producers refit their plants to comply with stricter environmental standards.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Benzyl Chloride is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook – Benzyl Chloride has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability